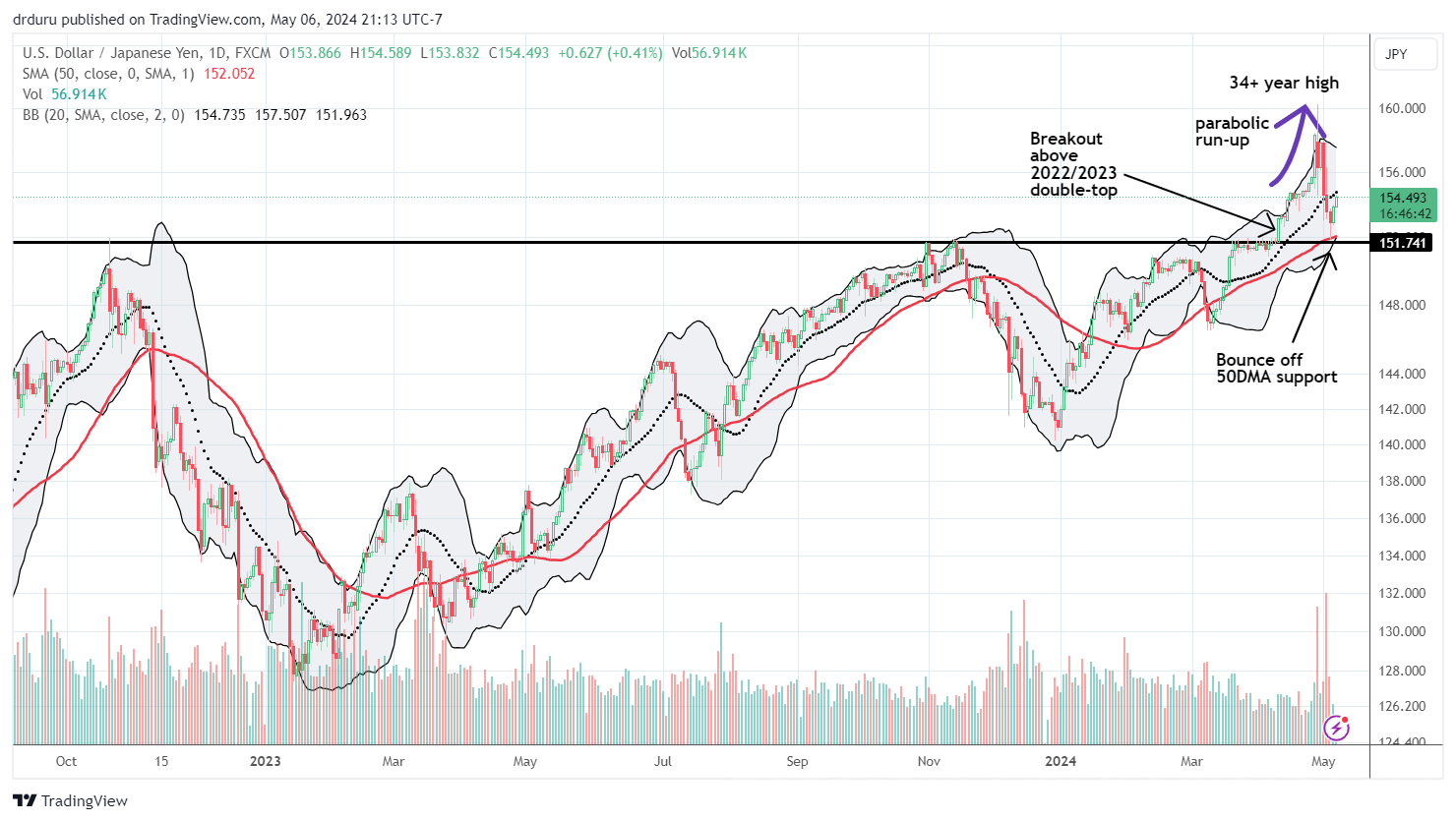

When I wrote about the Bank of Japan’s (BoJ) currency trap, the presumed intervention looked ineffective on balance. However, it appears the Bank of Japan has a multi-phased plan. Last week’s presumed intervention generated a fresh phase of weakness for USD/JPY (strength for the Japanese yen and Invesco CurrencyShares® Japanese Yen Trust ETF (FXY)). That weakness ended in poetic fashion right at technical support from the 50-day moving average (DMA) (the red line in the chart below) and a major breakout line. Buyers have remained in control of the currency battle ever since as USD/JPY now tests resistance at the 20DMA (the dashed line) at the time of writing.

The extended daily chart shows the technical battle the Bank of Japan is fighting to convince markets to respect its wishes to stop (or just slow?) yen weakness. The run-up that led to the parabolic move essentially started with a major breakout above the double-high from 2022 and 2023 (the long, black horizontal line in the above chart). That breakout worked like a major green light for traders. That line worked like a charm in reinforcing 50DMA support.

In other words, the Bank of Japan must break that major support line to truly prove its resolve.

The Trade on This Currency Battle

The trade strategy I outlined in the last piece has worked very well. It is well-designed for bouts of intervention. The related plunges have created plenty of space for stopping into positions and taking profits afterward. However, if the BoJ loses its battle with the technicals, for example an invalidation of the blow-off top formed by the parabolic move with USD/JPY over 160, then I will officially shift to the longer-term strategy of being net short the yen. This longer-term positioning stays in place as long as the BoJ maintains ultra-low interest rates and extreme monetary accommodation. At the time of writing, I am looking for a spot to take profits on my overlapping long USD/JPY while rebuilding a short in GBP/JPY. I have used the well-behaved technicals to determine entry and exit points.

Be careful out there!

Full disclosure: long USD/JPY (and FXY), short GBP/JPY