Almost a year ago, I claimed that investing in ARK Innovation ETF (ARKK) was little different than speculating on initial public offerings in the Renaissance IPO ETF (IPO). I was both right and wrong. On the way down, IPO far out-performed ARKK in 2021 and 2022. However, ARKK has benefited more than IPO in this year’s persistent rebound for the stock market. I was very right in calling out the irony of IPO offering a less volatile way to speculate than ARKK.

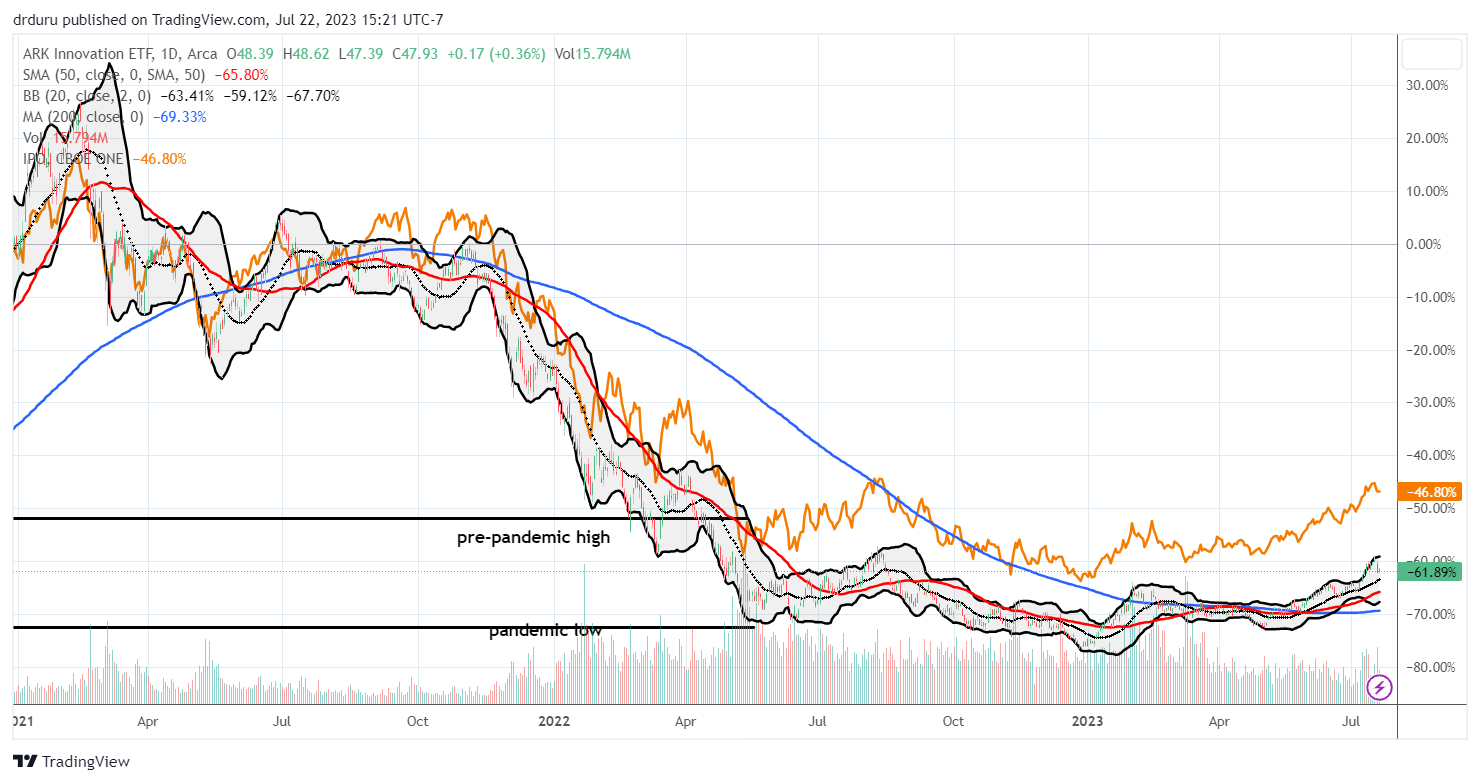

The following charts compare ARKK and IPO over three time periods. The candlestick chart, the volume, and the technical indicators all belong to ARKK. I overlayed the graph with IPO as an orange line. Neither ETF pays dividends.

The following table provides the approximate performance metrics where “since 20xx” refers to the ETF’s to-date performance since the beginning of the corresponding year.

| ETF | Since 2021 | Since 2022 | Since 2023 |

| Renaissance IPO ETF (IPO) | -46.8% | -39.7% | +43.4% |

| ARK Innovation ETF (ARKK) | -61.9% | -50.4% | +50.5% |

The Trade

So what to make of this variation in performance? Your assessment likely depends on what you think of the top constituents of these ETFs.

ARKK is dominated by large positions. One third of ARKK’s current holdings are in Tesla Inc (TSLA) at 11.7%, Coinbase (COIN) at 7.3%, Roku Inc (ROKU) at 7.1%, and Zoom Video Communications, Inc (ZM) at 7.1%. TSLA is probably the only stock in this group that will ever hit new all-time highs. If not for TSLA, the ARKK franchise may never have reached the fame it holds today. The active management of ARKK is a main reason for buying it instead of just going all-in with TSLA. Cathie Wood and team are notorious for loading up on losing positions over and over again so ARKK has huge upside potential on rebounds.

On the positive side, ARK loaded up on more Coinbase shares after an SEC lawsuit slammed the stock in early June. Last week, Wood sold TSLA and COIN shares to buy more shares in still beaten up Twilio Inc (TWLO).

IPO is also dominated by large positions (surprisingly!). Almost one third of IPO’s current holdings are in AirBnB (ABNB) at 10.8%, Snowflake (SNOW) at 9.2%, Palantir (PLTR) at 6.5%, and DoorDash, Inc (DASH) at 5.1%. While I like this concentration better from a business standpoint than ARKK’s, I cannot see any of these stocks ever achieving new all-time highs. IPO is a rules-based ETF based on market caps, so it will not get weighed down by overly aggressive purchases in a downtrend, but it will also not benefit as much as ARKK from the lows of sell-offs. From the Renaissance site:

“Each quarter the ETF is rebalanced as new IPOs are included and older constituents cycle out three years after their IPO. Constituents are weighted by float-adjusted market capitalization with a cap imposed on any weightings exceeding 10%.”

Note that IPO currently has zero overlap with the stocks of the S&P 500 whereas TSLA is a major component of the S&P 500. Since the S&P 500 only includes well-established companies in its index, IPO will likely never overlap with the S&P 500. Thus, IPO offers an intriguingly “high octane” way to diversify holdings for major upside potential.

To-date, I have sat in IPO and traded in and out of ARKK. I last laid out an ARKK trading strategy last September in “The Bottom Falls Out of ARK.” My trades in ARKK this year featured multiple rounds of selling calls against shares until finally my ARKK position was called away from me two expirations ago.

Being ARKK-less leaves we without a new strategy. I think last Thursday’s TSLA-driven 5.7% plunge in ARKK opens the potential for a fresh dip buying opportunity, hopefully at support at the 20-day moving average (DMA). (True to form IPO lost less than ARKK with a 2.8% downdraft on the day). My first re-entry will likely feature shares married with short calls. If the sell-off continues from there, I will broaden my view to relaunching my entire hedged ARK portfolio strategy.

Be careful out there!

Full disclosure: long IPO, long ZM call spread, long ABNB, long COIN put spread, long TWLO call spread