A month ago I laid out the case and conditions for bottoming across the collection of ARK funds. The key pivot rested with the ARK Fintech Innovation ETF (ARKF). It still is the first and only of the pre-pandemic ARK funds to break its pandemic era closing low. Over the past month, ARKF struggled mightily to break away from that all-time low. Unfortunately, a 6.0% loss on Friday took the steam out the fight and sent ARKF decisively lower. That breakdown represents a significant setback for the ARK Funds in the fight for bottoming levels.

The ARK funds soared on the easy money policies that bridged the economy over pandemic era lockdowns, and the funds are proving incapable of freeing themselves from the downward drag of monetary tightening. Accordingly, the main thing that can “save” these funds in the short-term is an upside surprise from the Federal Reserve. Yet, if the Fed indeed gives in to the stock market’s cries of pain by standing down from normalizing monetary policy, the subsequent boost will likely prove temporary. The economic realities of stagflation are growing by the day. From Cathie Wood’s June 3rd update titled Inventories & Deflation (34:00 mark):

“We do believe the Fed will get the message that it cannot increase interest rates much more than it already has…By July when companies are talking about earnings and talking about the future, we think the Fed will get the message. This will be very positive for the equity markets. And this is what we’re waiting for. As I always say, darkest before the dawn.”

As a reminder, the ARK funds are ETFs (exchange traded funds), but they are niche and concentrated because of their shared theme: “innovation solves problems.” They trade very closely to each other and provide little room for diversification. Targeting innovative companies, some of which are yet to establish sustained commercial success, creates a portfolio full of speculative companies with a high dependence on investor enthusiasm for risk-taking and a willingness to pay premium prices for turbo-charged growth. Unfortunately, economic and corporate growth is dissipating along with investor appetites. The resulting 1-2 punch has created quite the calamity in the ARK funds. They transitioned from a perfect combination of tailwinds in the pandemic to a twisted convergence of perfect storms.

This next phase of bear market action comes along with downgrades in the private sector known as “down rounds.” To-date, Cathie Wood has fallen back to the high-priced valuations in the private markets to prove the mispricing of her collection of innovative companies. That barometer of risk-taking is starting to sour. As a result, the escape hatch for justifying high valuations is closing. Tech Crunch provides one of many examples:

“Many companies are now facing a Hobson’s choice between trying to maintain the high-flying valuation they’ve established over the last year — no matter the contortions necessary to do it — or conducting a “down round,” a financing that results in a lower valuation. And industry experts suggest the latter often makes more sense…

Brad Feld, who has been a venture capitalist for more than 25 years…says his “strong belief” that “just doing a clean resetting — at whatever the valuation so that everybody is aligned and dealing with reality — is much, much better for a company…

Even while he remains optimistic about the overall state of venture funding, founders “have to make the assumption that things will get worse from here, and that it’s going to take you twice as long to raise half as much money as you’re looking for.””

The time has likely long past for Wood and her ARK Fund colleagues to reset and adjust to the new reality of lower ceilings on speculation.

The Levels

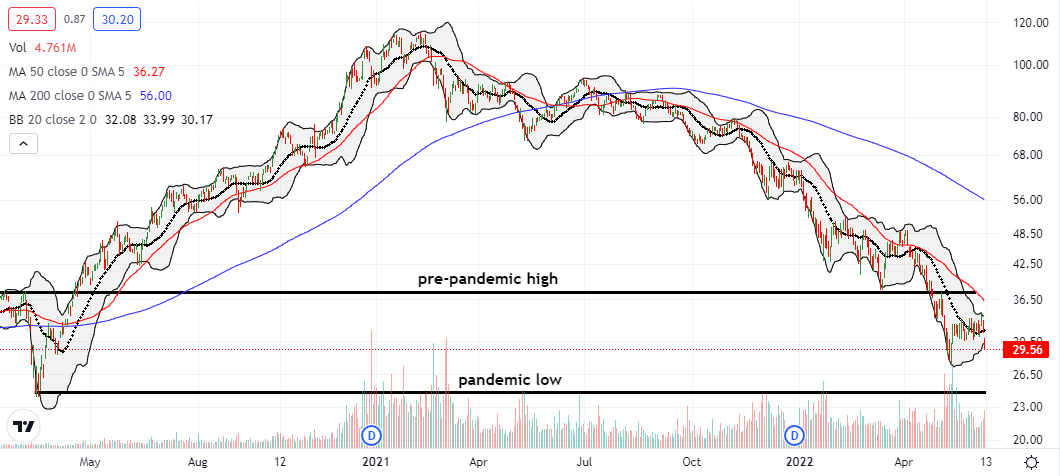

ARK Fintech Innovation ETF (ARKF)

ARKF was in a bullish position with last month’s breakout above the former all-time low. ARKF rallied back to its downtrending 20-day moving average (DMA) (the dotted line in the chart below) as I expected. Unfortunately, ARKF failed to make further progress from there. ARK has experienced only three lower closes than Friday’s breakdown below the former all-time low.

I did not profit from ARKF’s rebound despite two tranches of call options. I also finally dumped ARKF’s second largest holding, Coinbase (COIN). My concerns appear in “Coinbase Global, Inc: When A Disclosure is Not A Disclosure.” I see little point in jumping back into ARKF until it breaks out above last week’s congestion range…or plunges to an extreme during oversold trading conditions.

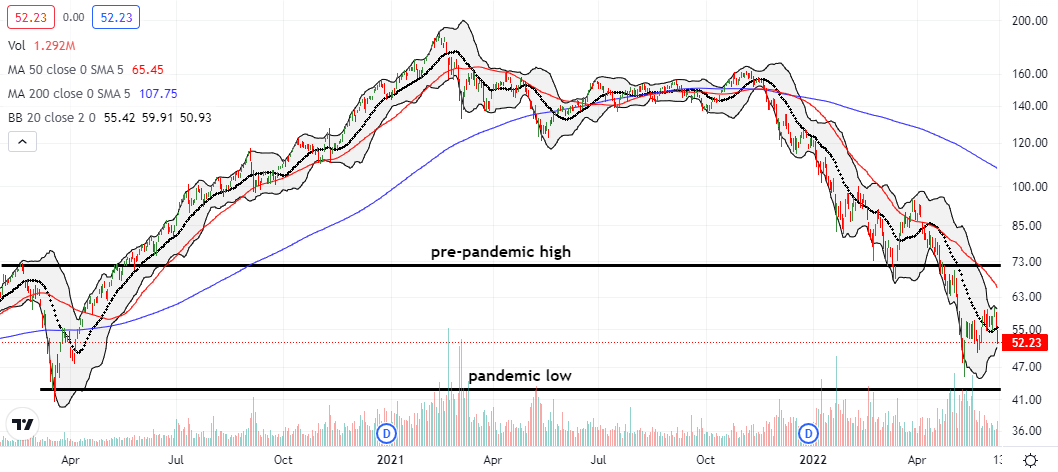

ARK Genomic Revolution ETF (ARKG)

In March, the ARK Genomic Revolution ETF (ARKG) bounced neatly off its pre-pandemic high. From there, ARKG has been unable to break away from the gravitational pull of its downtrending 20DMA and 50DMA (the red line below). Assuming ARKG will continue to follow trends lower, a test of the pandemic low is coming soon. Last month, ARKG stopped well short of that test.

I still the attractive risk/reward levels for ARKG comes from a breakout above its pre-pandemic high.

ARK Innovation ETF (ARKK)

ARKK is Cathie Wood’s flagship ARK ETF. The technicals on ARKK look almost identical to ARKG’s technicals. The proximity to the pandemic low provides the main differentiator. ARKK trades 15.3% away from its pandemic low and is 33.9% off its pre-pandemic high. Like ARKF, ARKK is also heavily dependent on Coinbase. COIN is ARKK’s 4th largest position. Tesla (TSLA) is keeping ARKK aloft with its 9.3% allocation of ARKK’s funds, the highest share in ARKK. TSLA trades an impressive 864% above its pandemic low.

ARK Autonomous Technology & Robotics ETF (ARKQ)

The ARK Autonomous Technology & Robotics ETF (ARKQ) is the only pre-pandemic ARK fund still trading above its pre-pandemic high. There are several stocks helping TSLA to prop up ARKQ. For example, Trimble (TRMB) remains 193% above its pandemic low. TSLA and TRMB are the two top holdings in ARKQ.

ARK Next Generation Internet ETF (ARKW)

The ARK Next Generation Internet ETF (ARKW) looks quite similar to ARKK. Like ARKK, TSLA is the fund’s top holding with an 8.7% allocation. COIN is the fund’s number 2 holding. Needless to say, I think the breakdown in ARKF greased the path for ARKW to test its pandemic low in due time.

ARK Space Exploration & Innovation ETF (ARKX)

The ARK Space Exploration & Innovation ETF (ARKX) remains a no-touch for me. ARKX has insufficient price history to judge the sustainability of May’s all-time lows. ARKX failed to trigger a buy with a 50DMA breakout. Instead, the ETF now trades below its 20DMA again. Number one holding TRMB is helping to keep ARKX aloft.

The Enablers

The bursting bubble for the ARK funds gave Cathie Wood and her team many opportunities to buy at lower and lower prices. Investors have blessed ARK with the funds to continue doubling down and more. Eric Blachunas, Senior ETF Analyst for Bloomberg, last provided flow data on May 24th. While ARKK finally got hit with a week of major outflows, the take for the year is still a whopping $1.6B. ARK is definitely a corner of the market that has yet to suffer from investor negativity and bearishness despite the contrary price action.

The Trade

My trading strategy on the ARK funds revolved around ARKF maintaining a bullish and bottoming position. ARK dealt that strategy an important setback that pushed me into a net bearish position on ARK funds. While two consecutive tranches of ARKF call options failed, I am still holding on to the partial hedges of ARKK put options and ARKQ shares short. The ARKK put options are the long side left over from a calendar put spread. I see no reason to get bullish on ARK funds until ARKF repositions above its former all-time low…at a minimum.

Still, the ARK funds are great candidates for trades on a bounce from oversold trading conditions. I expect these speculative funds to enjoy relatively large oversold bounces. In the meantime, a sustained bottom looks likely to remain elusive for ARK for now.

Be careful out there!

Full disclosure: short ARKQ, long ARKK puts

1 thought on “The ARK Funds Suffer A Setback in the Fight for Bottoming Levels”