(This is an excerpt from an article I originally published on Seeking Alpha. Click here to read the entire piece.)

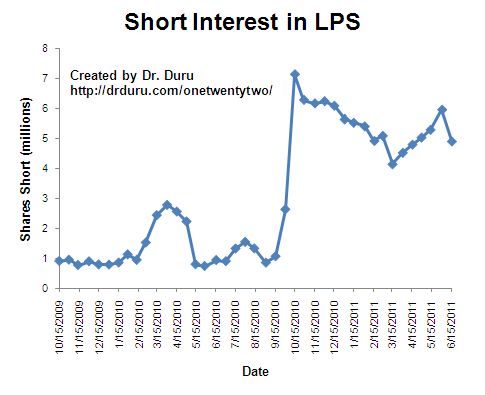

After discovering that shorts ramped ahead of earnings for Research In Motion (RIMM), I decided to check in again on the short interest in Lender Processing Services (LPS)…

{snip}

Source: NASDAQ.com

So LPS caught bulls AND some bears by surprise. However, the bearish reaction was swift. Not only did LPS close down 13% after the earnings and revenue warning, options players stampeded for puts. Schaeffer’s Investment Research reports that the put/call ratio jumped from 2.0 to an incredible 19.2! This open interest is still heavily concentrated in September strikes.

Source: Schaeffer’s Investment Research

I am sure vocal LPS short Cody Willard will be relieved to see that he has fewer shorts joining him in the stock, but the surge in put-buying could be even more significant company. This tremendous amount of put-buying must consist of a good amount of purchased protection for large holdings of shares. If so, LPS is likely to find a floor for the next few months. The stock could even begin some kind of counter-trend rally, especially as the company repurchases shares under its new $100M authorization. However, if LPS manages to crack fresh 31-month lows, I imagine even more shorts will rush in to join the renewed downward momentum.

{snip}

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha. Click here to read the entire piece.)

Full disclosure: long LPS