(This is an excerpt from an article I originally published on Seeking Alpha on March 13, 2016. Click here to read the entire piece.)

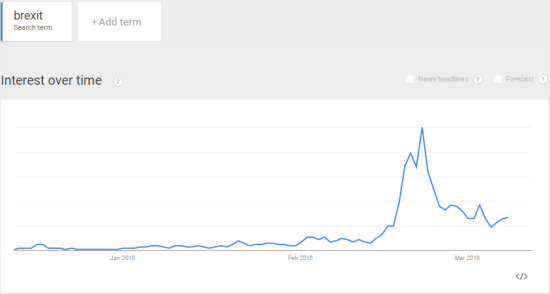

When I last wrote about the British pound (FXB), the currency was reaching the bottom of its latest downdraft. I did not know the bottom was near, but I did claim that market sentiment suggested that “the British pound’s losses SHOULD at least decelerate if not abate altogether sooner than later…” I used Google Trends on the search term “Brexit” as a proxy for sentiment. Now, search interest in Brexit has faded all the way back to where it sat right before the British Prime Minister set the date for the Brexit referendum.

Source: Google Trends

{snip}

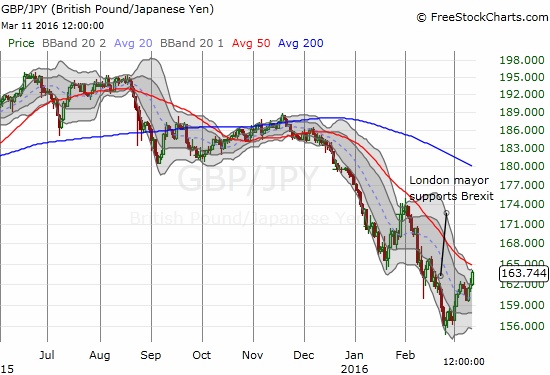

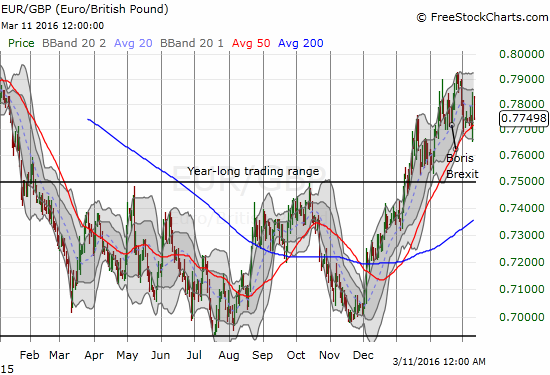

Source for charts: FreeStockCharts.com

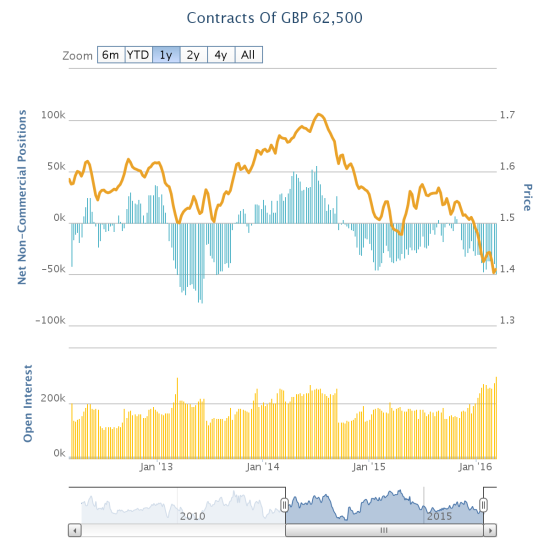

Ironically, as the pound has lifted off from its latest woes, speculators have pressed their bets against the currency. {snip}

Source: Oanda’s CFTC’s Commitments of Traders

Polling could provide a catalyst for renewed selling in the pound. {snip}.

London Mayor Boris Johnson could still be an important catalyst, especially if he can sway the polling. On Friday, March 11th, he stepped up the rhetoric against staying in the EU. In his first major speech on Brexit, Johnson emphatically declared that no one in their right mind would want to join the EU as it stands today. {snip}

With economics swirling in the middle of the Brexit debate, I find it interesting to note that the UK’s trade deficit with the EU sits at a record high (data tracked since 1998). {snip} Could UK voters look at these numbers and trends and conclude that the UK is not so dependent on the EU for economic stability after all? A little over three months to go until vote time…

Be careful out there!

Full disclosure: net short the British pound

(This is an excerpt from an article I originally published on Seeking Alpha on March 13, 2016. Click here to read the entire piece.)