“We believe there is a chance of disruption and highly illiquid conditions in the forex market during the coming weeks (and/or months). Please be aware that market gaps tend to occur over the weekend – that is, currencies trade at prices considerably distant from previous levels.”

This is the warning FXCM, Inc. (FXCM) sent out via email the night of January 8, 2015 (Friday). This was after another rough close in financial markets; the Japanese yen (FXY) even surged right through after hours to close the first trading week of 2016.

Source: FreeStockCharts.com

FXCM has delivered several warnings of increased volatility ever since the company itself got disastrously caught off-guard by the historic capitulation of the Swiss National Bank (SNB) a year ago. However, I believe this latest announcement marks the first time a warning referenced an extended period of risk. Previous warnings referenced the episodic risk of a single macro/global event. The latest source of angst is the current struggle of the People’s Bank of China to guide its currency, the yuan. Here is how FXCM explains the situation in a related article:

“Sharp volatility in Chinese financial markets has helped push the Chinese Yuan to fresh five-year lows, and official reactions have made it clear that China’s central bank is prepared to allow further USD/CNY appreciation. The Offshore Chinese Yuan (CNH) has likewise followed the reference rate sharply lower, but it is important to know that the spread between the offshore and onshore has suddenly surged to its largest on record.”

FXCM goes on to explain that this large gap between the onshore and offshore rates implies an increased likelihood for large swings in the USD/CNY pair. The author explains that USD/CNY is racing higher as markets anticipate further depreciation in the onshore currency. Yet, the People’s Bank of China has put markets on notice that it may act to keep the currency stable. This means, the Bank may periodically move to defend the currency even as the overall, longer-term trend continues toward depreciation. Thus, the offshore Chinese yuan may lurch violently up and down on its way to its ultimate “destination.”

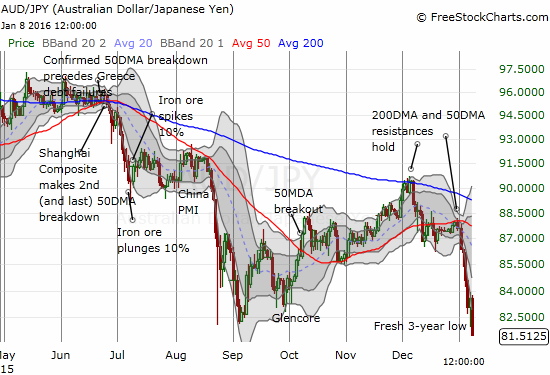

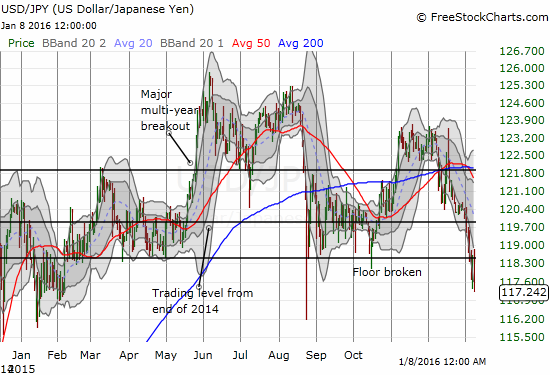

The volatility in the yuan will likely impact traders in other currencies. The market’s reactions to the volatility may itself become erratic thus generating overall volatile trading conditions. In such times, risk averse traders and investors typically turn to the Japanese yen (see “The Japanese Yen Flashes Red for 2016“) as a “safety” currency. As I demonstrated in the above chart, the yen has indeed been the main story of the week. Against the Australian dollar, the yen has punched out a three-year high (three-year low on AUD/JPY). Even the U.S. dollar (DXY0) is giving way to the yen’s surge. USD/JPY has not been this low since the August flash crash. On a closing basis, USD/JPY is approaching 2015 lows.

Source: FreeStockCharts.com

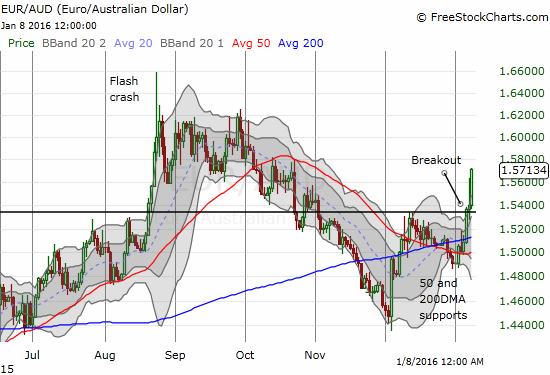

Along with risk aversion comes carry trade avoidance. A carry trade involves selling (or borrowing against) a low-yielding asset to buy a higher-yielding asset. Carry trades using the yen are blowing up, like AUD/JPY, and the euro (FXE) is also regaining favor. The breakout in EUR/AUD I pointed out a few days ago experienced strong follow-through on Friday.

Source: FreeStockCharts.com

So, while the trends appear very clear right now, the path along that trend promises to stay very bumpy (for example, EUR/AUD covered Friday’s entire range on a major reversal on Thursday). I think FXCM is correct to warn about general currency risks and not just risks to traders in the Chinese yuan. As always, I look to AUD/JPY as a major indicator of market sentiment. I also pair that up with my favorite equity technical indicator: the percentage of stocks trading above their respective 40-day moving averages (DMAs), or T2108.

Be careful out there!

Full disclosure: long and short various positions against the Japanese yen and the euro; net short the Australian dollar; net long the U.S. dollar; long FXCM