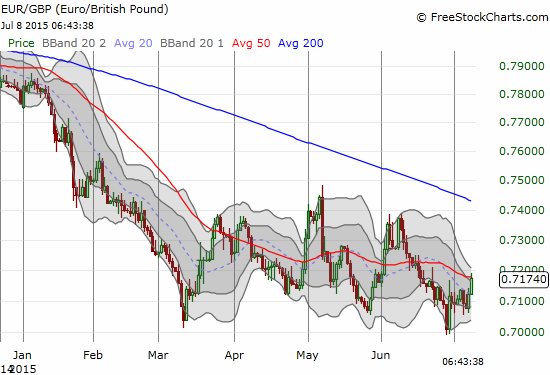

Perhaps as a great irony, the British pound (FXB) is suddenly losing favor even as the euro appears to stabilize in the wake of the latest drama in Greece. Since touching the 0.70 level last week, the euro has made steady gains against the British pound as seen here in EUR/GBP.

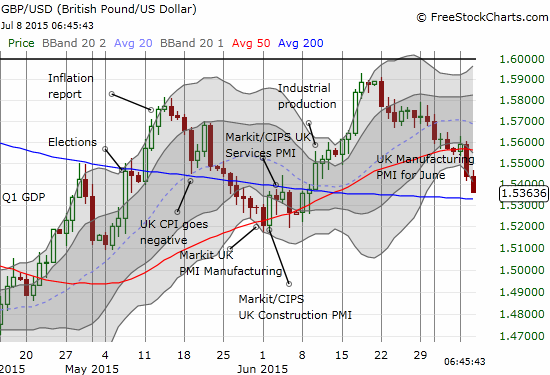

Now, the British pound has made two critical breakdowns that have me starting to rethink my recent bullishness.

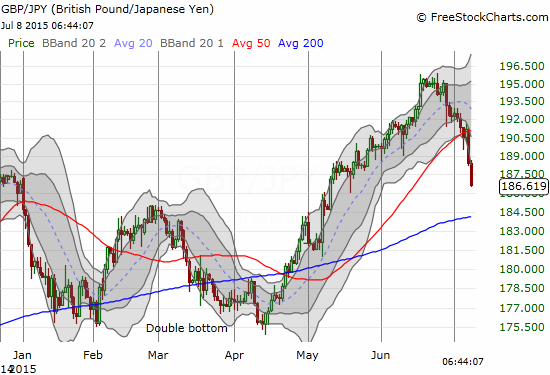

The Japanese yen (FXY) is currently surging against all major currencies; the impact on the recent uptrend for GBP/JPY is particularly dramatic. The primary uptrend has ended with GBP/JPY diving deep into oversold territory well below the lower-Bollinger Band (aka the “BB”, this band describes the number of standard deviations away from the 20-day moving average (DMA)).

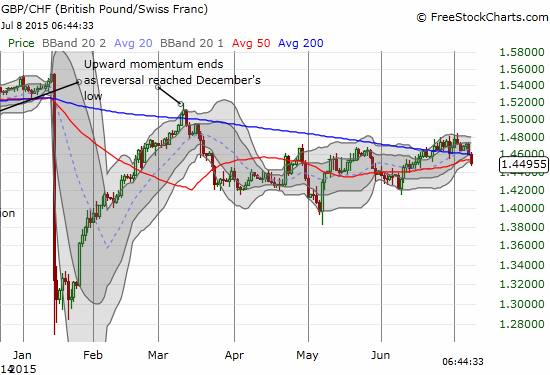

The “final straw” has come with a breakdown against the Swiss franc (FXF). Note how the 200DMA seems to hold as resistance. The convergence with the 50DMA could provide an even tighter seal to the upside for some time to come.

I am still looking for the British pound to bounce back in due time, especially if we actually get some constructive news out of Greece. However, the recent bout of selling has definitely cooled my heels until I see a fresh positive catalyst coming from the economic numbers in the United Kingdom.

Be careful out there!

Full disclosure: net long the British pound

Addendum: literally RIGHT after I posted this, GBPCHF soared higher from around 1.45 to 1.46 in less than 30 minutes! Could be more SNB intervention as the Franc looks weaker across the board. Perhaps it is related to news that Poland has proposed to convert franc-denominated mortgages into the local currency.