(This is an excerpt from an article I originally published on Seeking Alpha on April 2, 2013. Click here to read the entire piece.)

{snip}

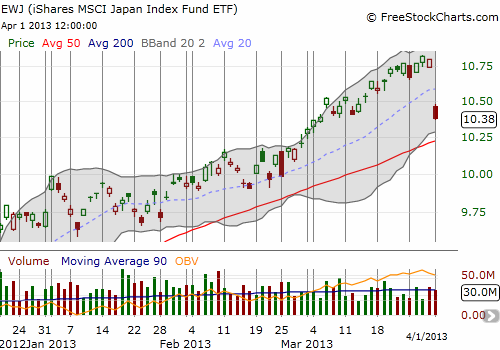

The Japan-based ETF took an even bigger hit, falling 3.9% and almost wiping out all of March’s hard fought gains in one day:

The highlights I read in one of the more insightful summaries about the tankan survey (see Reuters article ““Abenomics” lifts Japan business mood, households’ inflation expectations“) suggest that economic activity is mostly on the rebound in Japan. These are all quotes from the article:

{snip}

I suspect that today’s dip is the start of a rare buying opportunity as the Bank of Japan (BoJ) meets this week and is likely to talk as aggressively as ever about attacking Japan’s deflationary malaise. Of course, its work will not be easy as we learned last week that deflation still firmly rules the land. February’s consumer prices fell 0.3% year-over-year, marking the fourth month in a row of declines.

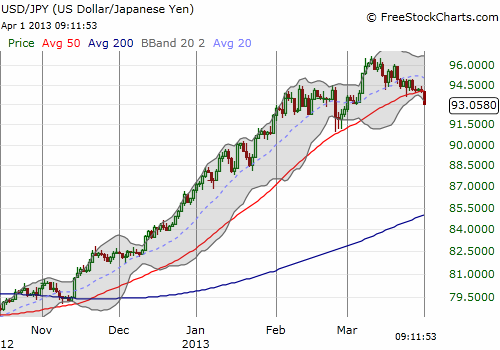

I am relatively agnostic about surveys of intent and plans and find much more value in actual results. However, I DID find the survey’s results on expectations for the Japanese yen (FXY) of particular interest… {snip}

{snip}

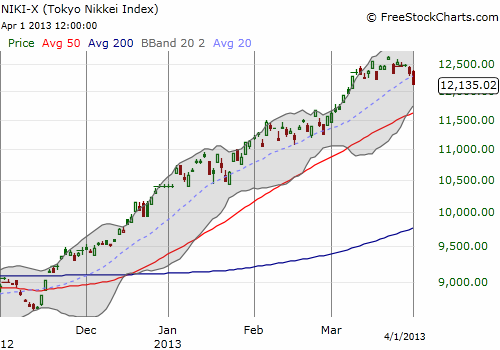

Source for charts: FreeStockCharts.com

{snip}

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on April 2, 2013. Click here to read the entire piece.)

Full disclosure: long EWJ, net short Japanese yen (at time of writing)