(This is an excerpt from an article I originally published on Seeking Alpha on September 11, 2012. Click here to read the entire piece.)

In August, 2011, Prime Minister Naoto Kan stepped down from power to resolve gridlock over the budget of the Japanese government. On September, 7, 2012, current Finance Minister Jan Azumi made headlines after warning the opposition party that the Japanese government could run out of money by the end of November if it does not help resolve the latest deadlock over the budget (see “Japan government could run out of money by end-Nov – finance minister” in Reuters). So far, this Japan-style “fiscal cliff” has forced the suspension of “administrative spending and payouts to local governments that were planned for September-November.” Further postponements of payments will occur in October to avert a government shutdown if the budget remains unresolved.

It seems no one expects Japan to tumble over the edge. {snip}

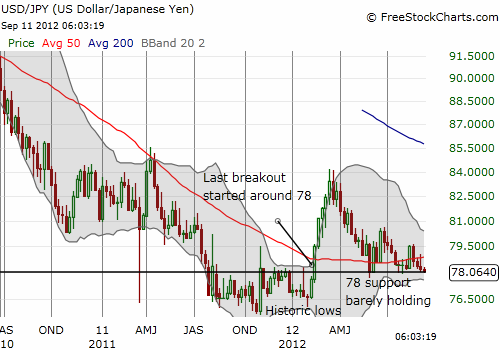

Source: FreeStockCharts.com

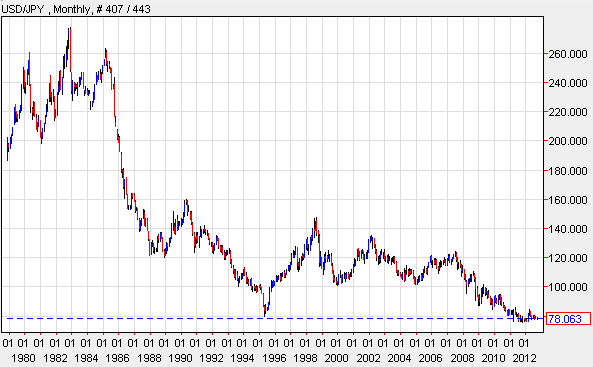

Source: Dailyfx.com forex charts

When I wrote the “Federal Reserve Minutes Renew Pressure On Japanese Yen“, the USD/JPY currency pair had just confirmed the end of a nascent rally by plunging from 79.3 to as low as 78.25 in one day. The pressure from there has only ever so slowly accumulated, but at this point, I cannot see how the 78 level holds…{snip}

Be careful out there!

(This is an excerpt from an article I originally published on Seeking Alpha on September 11, 2012. Click here to read the entire piece.)

Full disclosure: no positions