Stock Market Commentary

The market delivered a contradictory signal to end the week. For example, while swingtradebot flashed very bullish technical indicators, market breadth declined the last two days of the week. This divergence is symbolic of the swirling tensions in the air. After, the three-week sell-off into a bear market took advantage of rising economic fears and uncertainty, the Federal Reserve presented enough confidence to maintain some calm. Finally, near market close on Friday and with a countdown looming for an April 2nd round of reciprocal tariffs, President Trump teased out the possibility of “flexibility” on tariffs. While tariff flexibility is meaningless in this political environment until deals actually get done, the market received a more hopeful launch for the countdown.

Trump has marketed April 2nd as America’s “Liberation Day”. Tariff flexibility could provide just enough of a salve to rally markets as if liberation from economic chaos is indeed imminent, the ultimate display of hoping for the best.

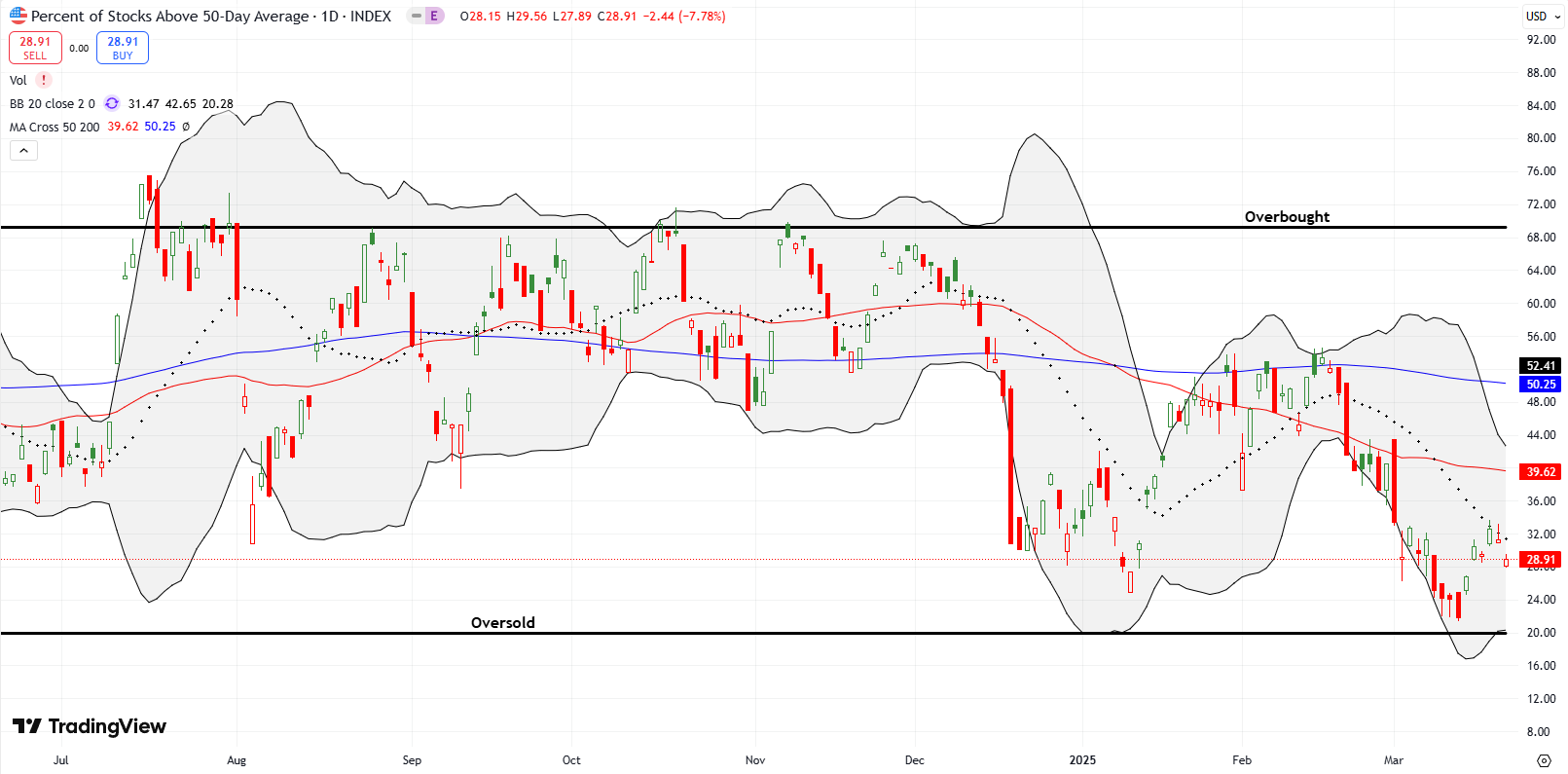

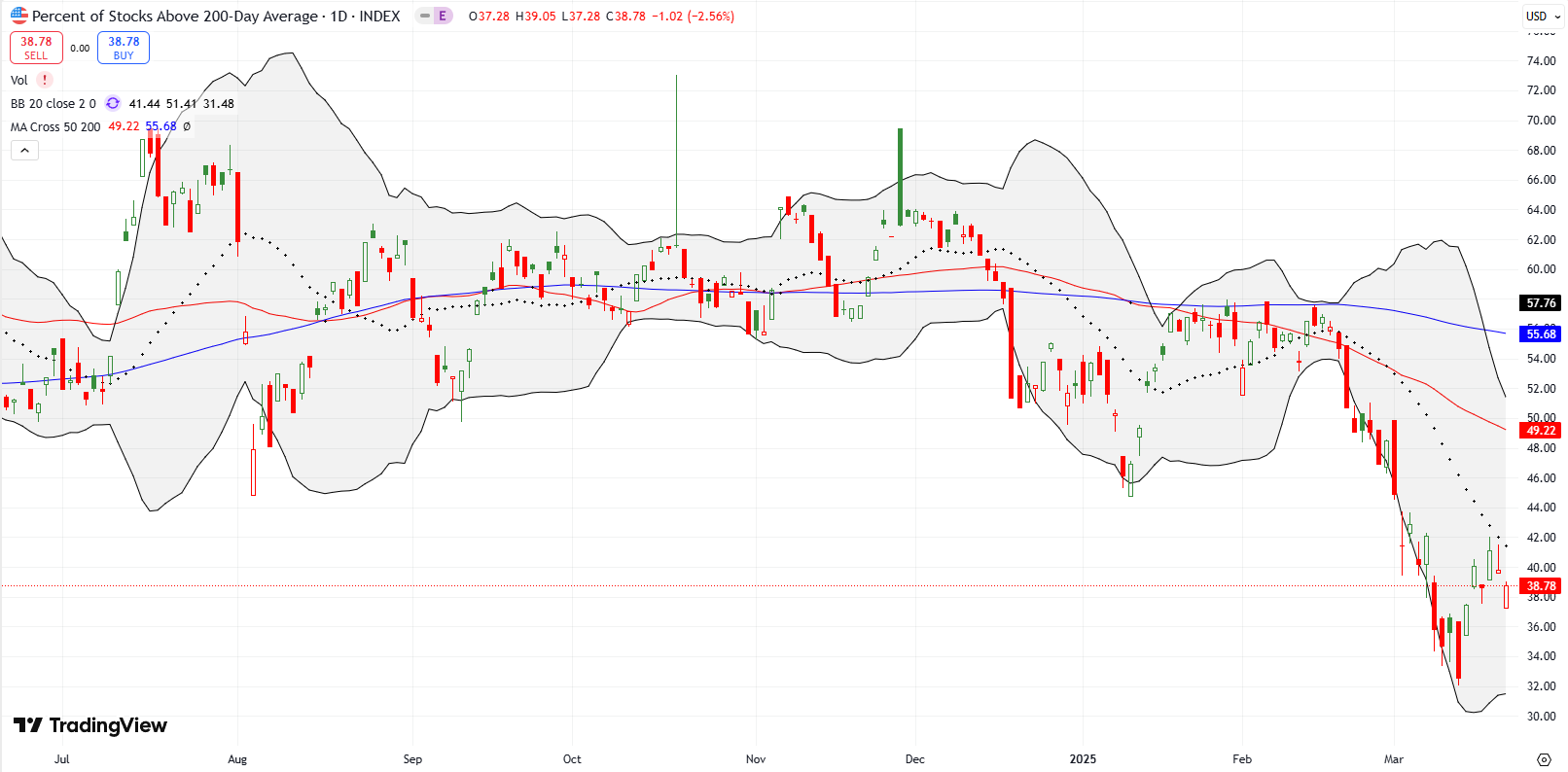

Fortunately, we do not need to wring our hands about politics when the financial markets provide ample signals for action. Currently, market breadth is close enough to oversold to warrant trades in anticipation of the next rebound into, at least, the next key resistance levels. Deeper selling from current levels would set up more aggressive short-term trading opportunities from oversold conditions as defined by the AT50 trading rules. Eager longer-term investors can start deploying more cash knowing that this dip is “extreme enough” relative to a multi-year investing horizon. More conservative longer-term investors can wait until the bear market ends with convincing closes above 200-day moving averages (DMAs). I will have more to say on these approaches and principles in an upcoming “refresher” post.

The Stock Market Indices

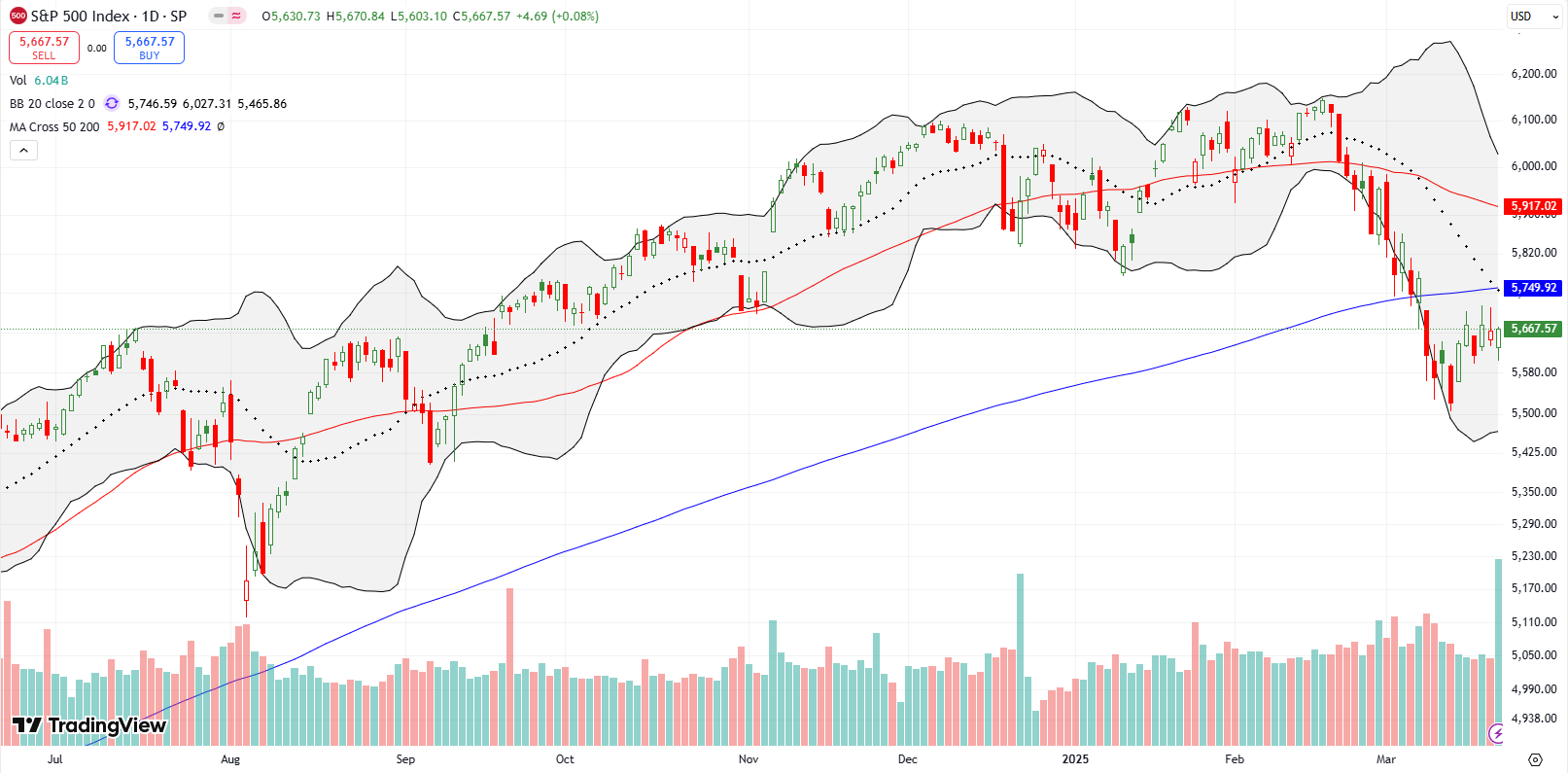

The S&P 500 (SPY) showed the kind of intraday choppiness I suspected would happen thanks to Wednesday’s post-Fed trading behavior. Thursday saw a gap down, a recovery to the Fed high, and another intraday selloff. Friday brought a breakdown of post-Fed support but little follow-through.

Friday’s late-session bounce seemed driven by Trump’s tariff flexibility. CNBC’s Fast Money even turned this concept into a meme going through a series of applicable F-bombs: flexibility, fluidity, flummoxed, and fleeting. Combined, these F-bombs speak to the current uncertainty and chaos. Regardless, since tariff flexibility failed to close the S&P 500 above the previous intraday high for the week, overhead resistance from the converged 20-day moving average (DMA) (the dotted line) and the 200DMA (blue line) loom large. The sustainability of this bear market hangs in the balance.

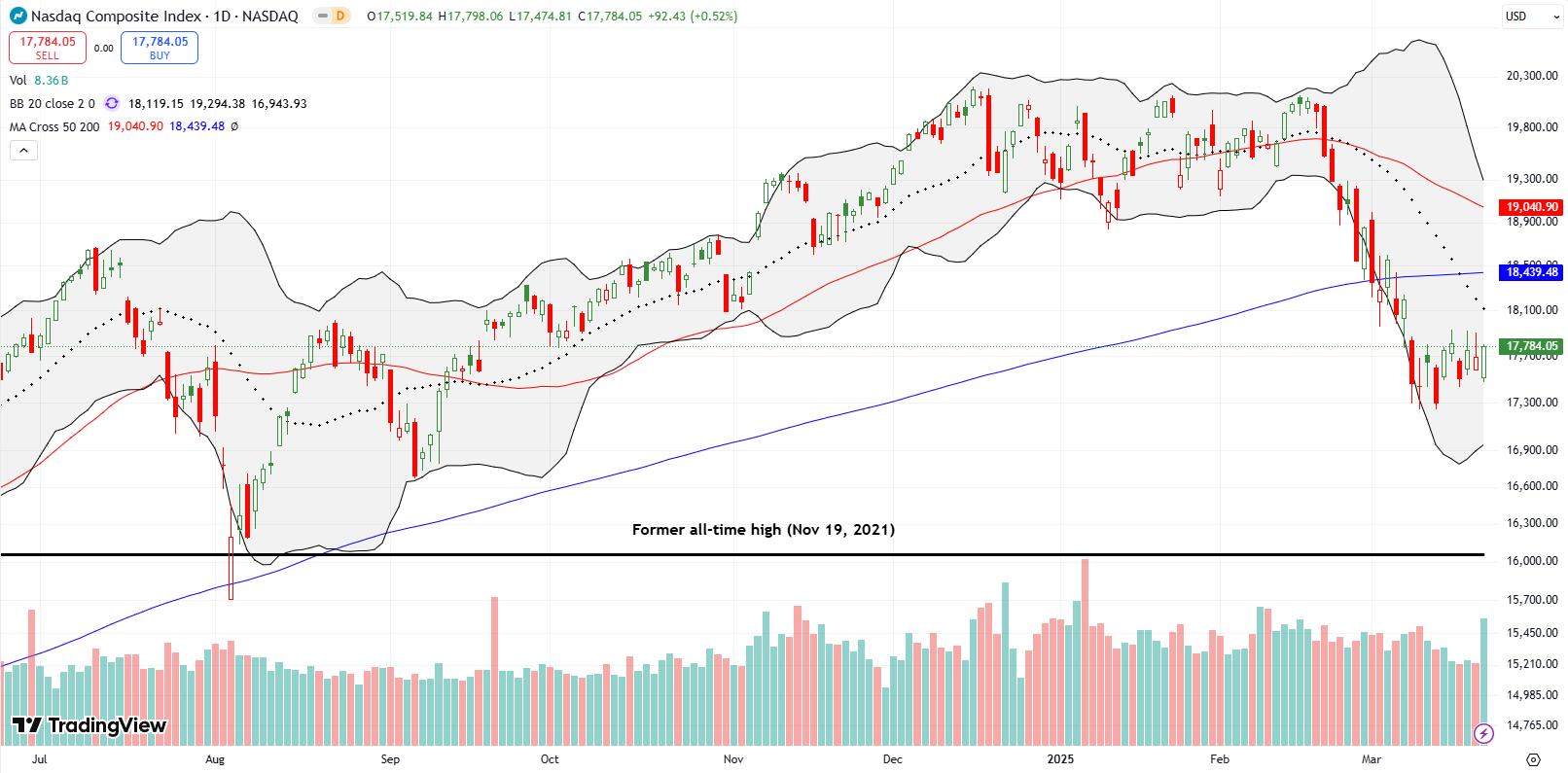

The NASDAQ (COMPQ) is in a deeper bear market than the S&P 500, but the tech-laden index also chopped in range for the week. The NASDAQ received the most intense fallout from the recent economic chaos and uncertainty, so its ability to deliver follow-through for bear market relief was a welcome respite. Prices fell so fast that the NASDAQ’s 20DMA cleanly sliced away from the 200DMA. Thus, tech traders have a fight ahead just to get to 200DMA resistance.

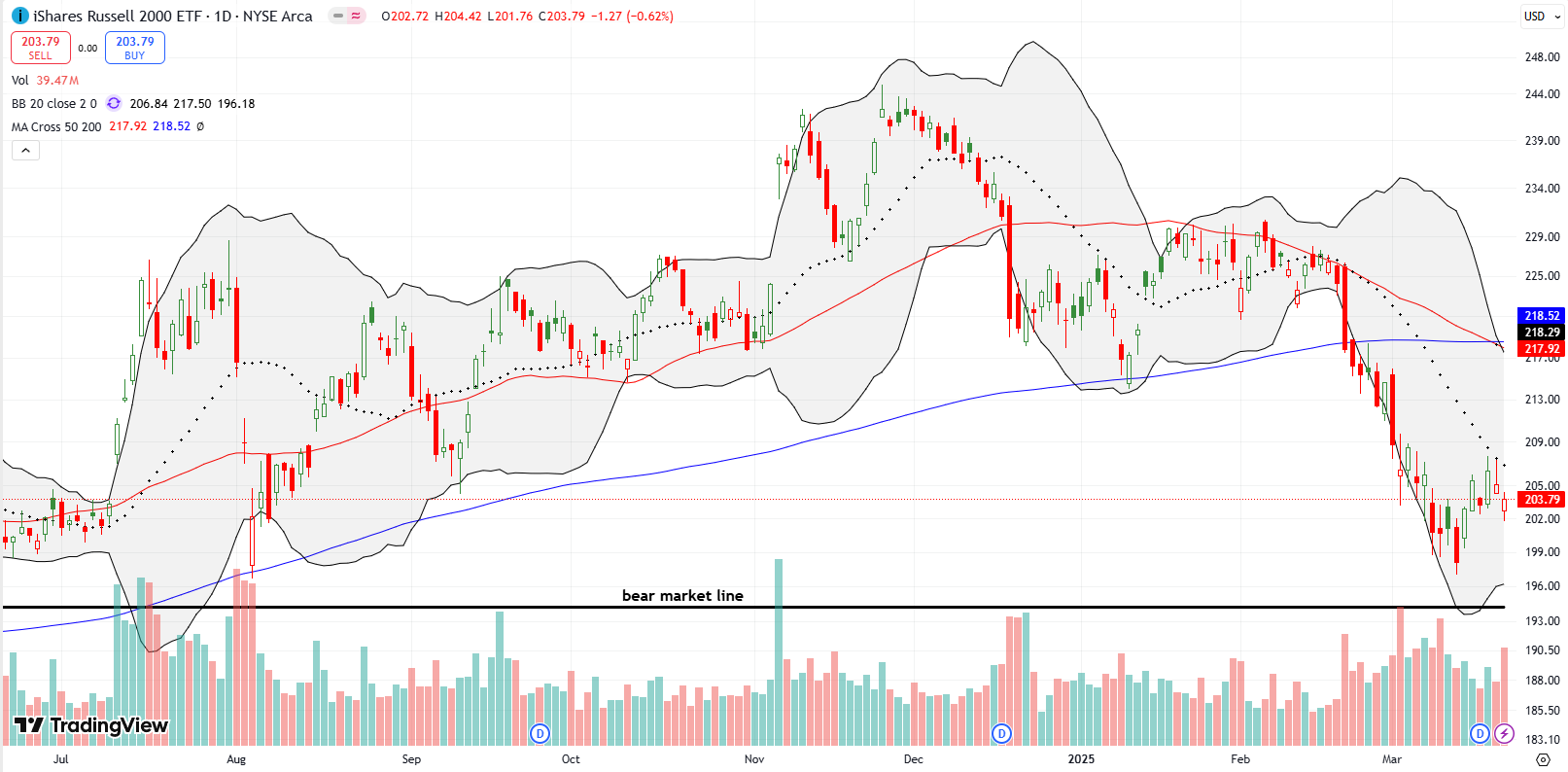

The iShares Russell 2000 ETF (IWM) was at least one source of Friday’s weakened market breadth. On Thursday, the first full post-Fed day, IWM gapped down and then proceeded to fail intraday at 20DMA resistance. Buyers made a tiny comeback after Friday’s follow-through gap down. Still, I bought an IWM weekly call option as a trade on the prospect of a rebound in the coming week. Like the S&P 500 and the NASDAQ, the 20DMA looms overhead as the first line of tough resistance.

The Short-Term Trading Call With Tariff Flexibility

- AT50 (MMFI) = 28.9% of stocks are trading above their respective 50-day moving averages

- AT200 (MMTH) = 38.8% of stocks are trading above their respective 200-day moving averages

- Short-term Trading Call: cautiously bullish

AT50 (MMFI), the percentage of stocks trading above their respective 50DMAs, dropped below 30% for a close at 28.9%. Despite this bearish divergence from the S&P 500, I remain cautiously bullish. Short-term traders must remain flexible and brace for volatility driven by tariff flexibility.

AT200 (MMTH), the percentage of stocks trading above their respective 200DMAs, also declined, reinforcing the bearish divergence between market breadth and the S&P 500 and other technical indicators.

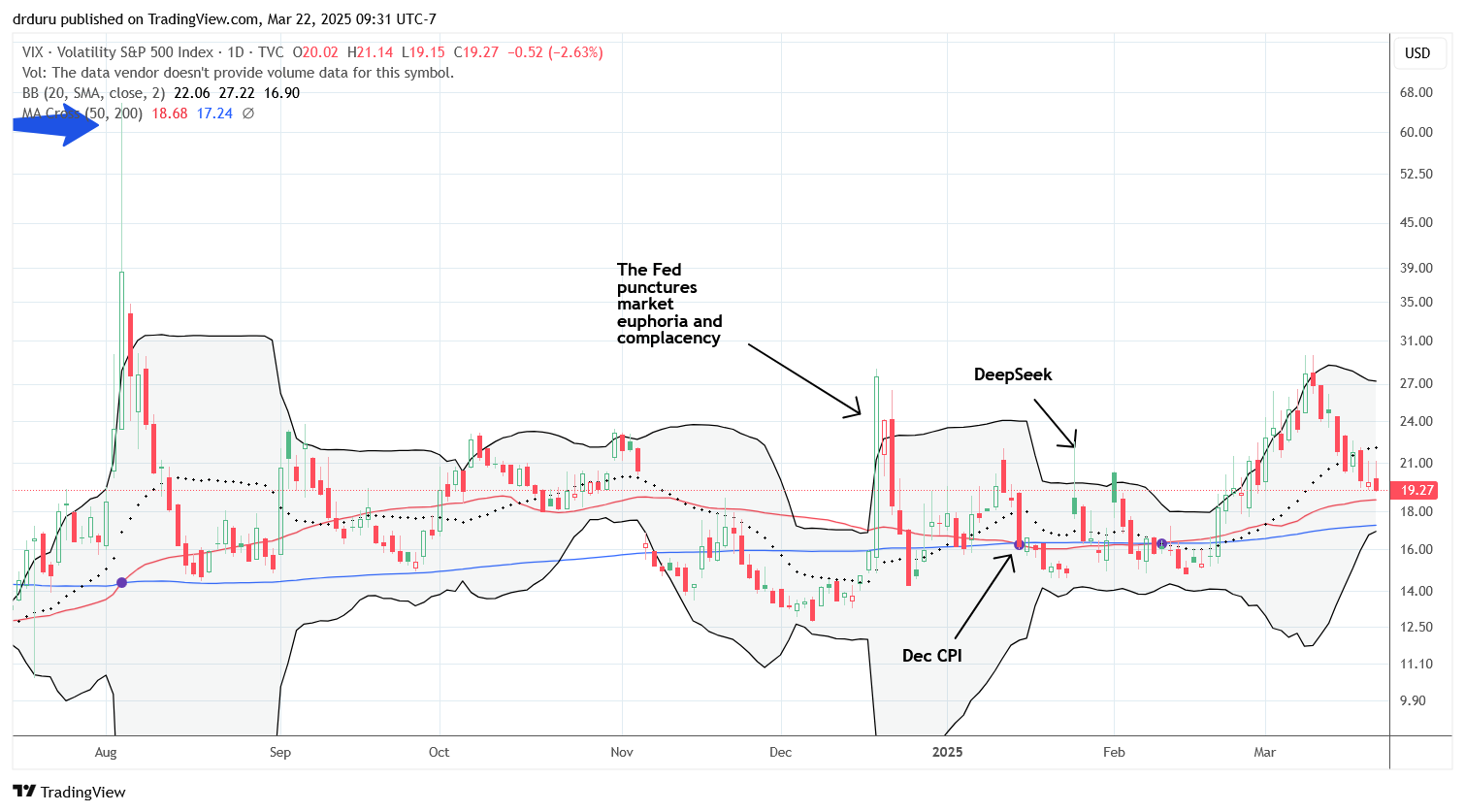

The volatility index (VIX) continued its steady decline and now trades under the 20 level. As the April 2nd tariff deadline approaches, a declining VIX would suggest that either 1) the market expects April 2nd to be a nothing-burger, or 2) the market has finally come to terms with tariff policy. Either way, such a market would be quite vulnerable to the next surprise in tariff flexibility. I prefer a market that is pricing in risk rather than assuming it away.

The Equities

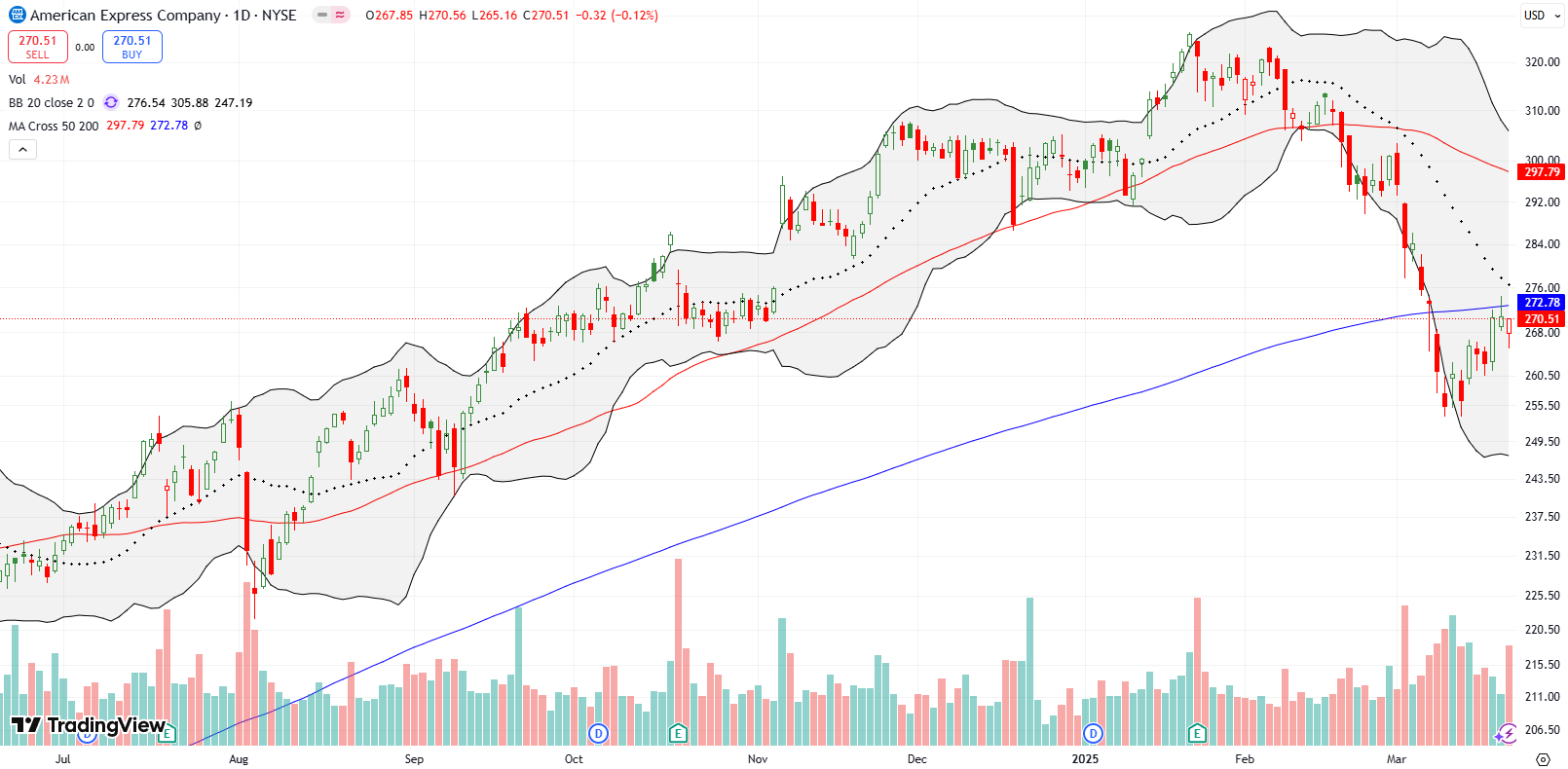

American Express Company (AXP) rallied to its 200DMA and definitively stalled. The repeated failures at this resistance suggest a potential breakdown ahead. However, a confirmed close above the 200DMA and then the declining 20DMA would flip the trading signal to the bullish side of the ledger.

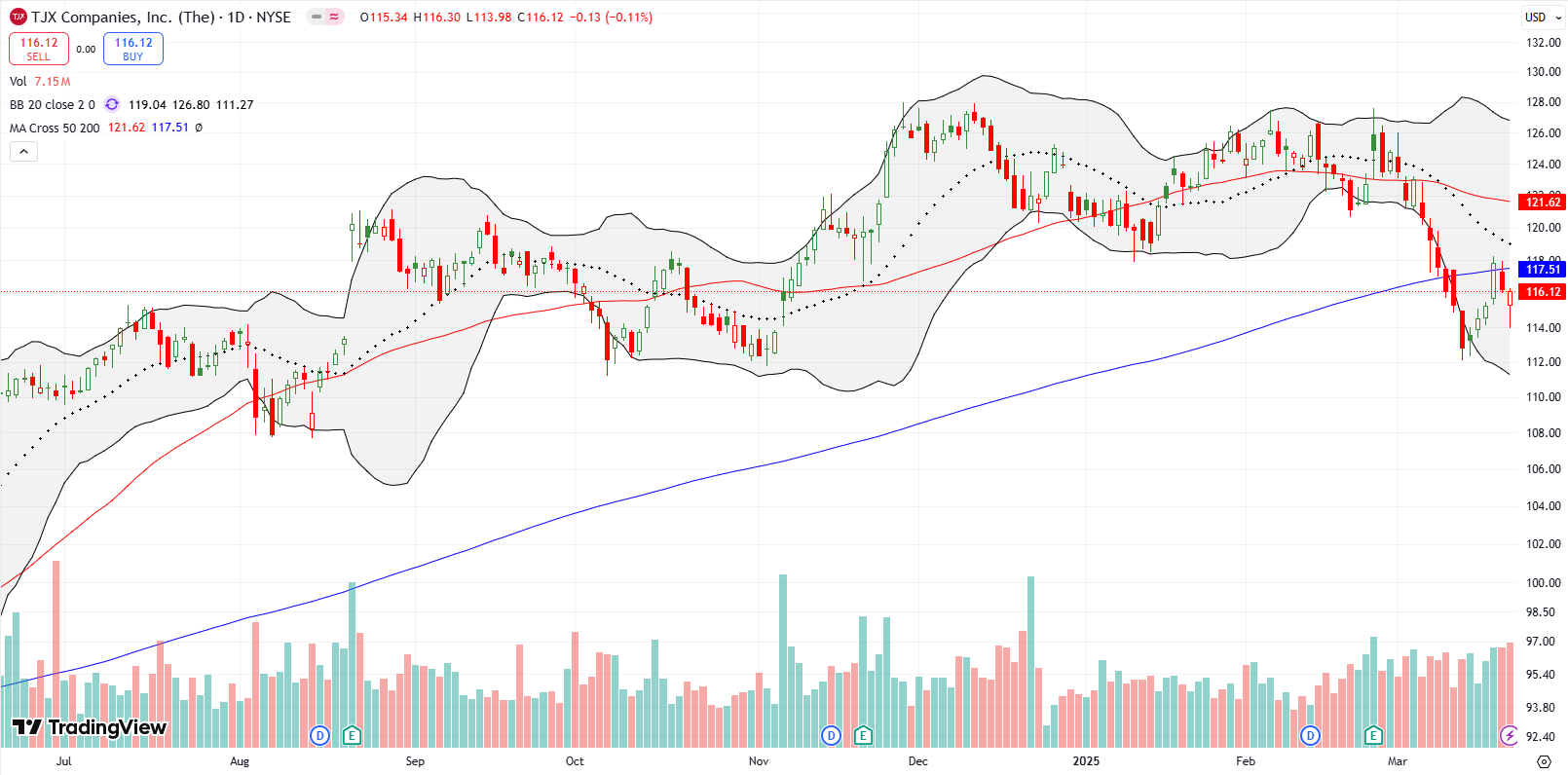

TJX Companies, Inc. (TJX), often a well-loved, stock market favorite, still suffered from the March sell-off. The stock plunged into an area of technical vulnerability. This month, TJX closed below its 200DMA for the first time in about two and a half years. After stumbling post-Fed at 200DMA resistance, TJX is at increased risk of a prolonged downdraft.

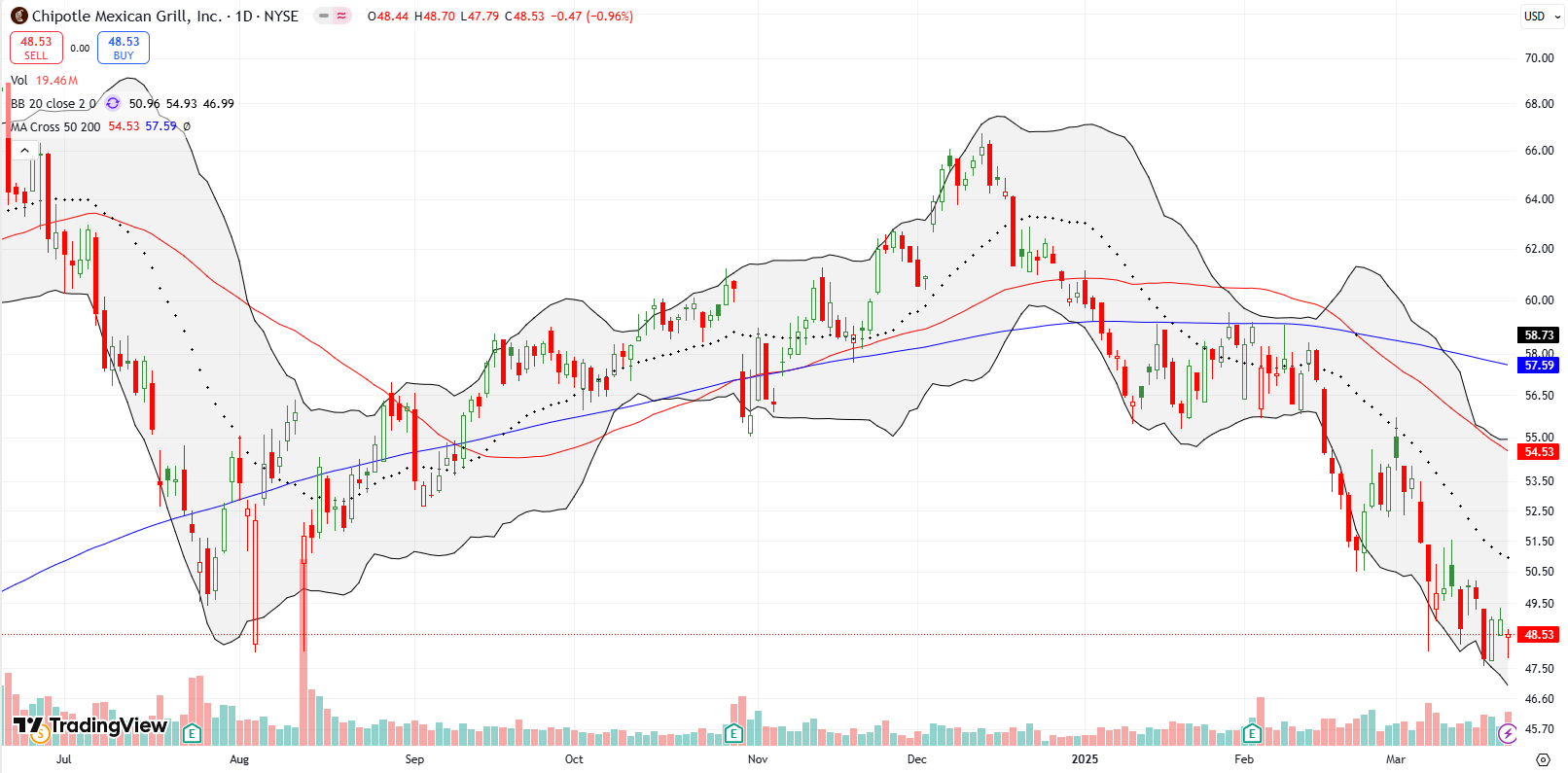

Chipotle Mexican Grill, Inc (CMG) offers a classic example of the perils of falling from market darling status. CMG peaked last summer three months after announcing an overdue stock split. The stock sold off sharply after the payable date on the stock split and has yet to recover. Last week, CMG tested the intraday low from the day the company announced the departure of its former CEO who fled to go save Starbucks (SBUX). Now what will save CMG from a more damaging sell-off?

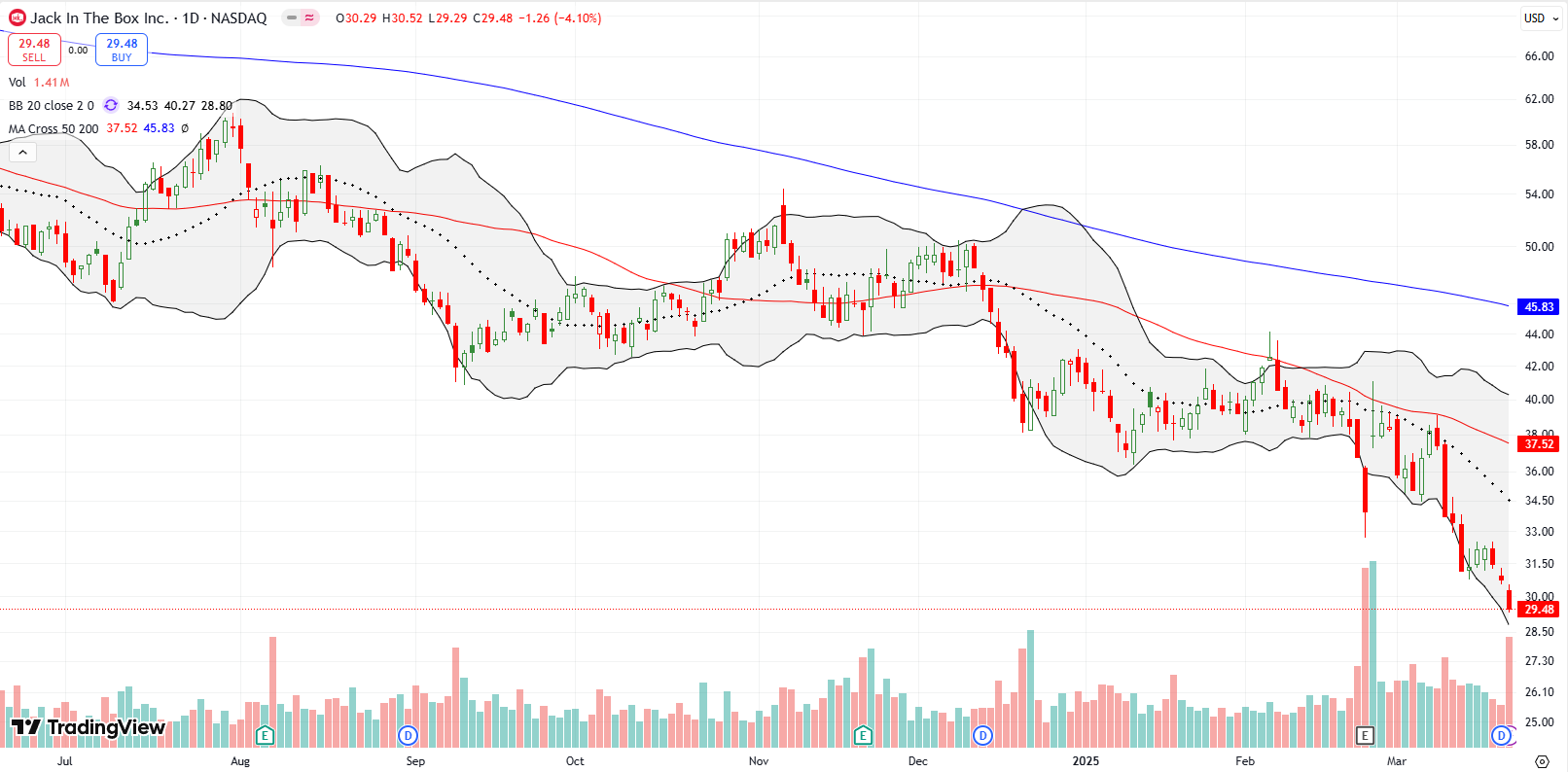

My question looms large because all sorts of fast food and casual dining stocks are falling off a cliff as if to send early warning signals of a weakening consumer and/or rising input costs. For example, Jack in the Box Inc (JACK) suffered renewed selling last week while the rest of the market tried to stabilize. JACK fell 4% on Friday alone as it approaches lows last seen in the immediate aftermath of the pandemic. There is seemingly no relief anywhere in sight for this hapless stock…

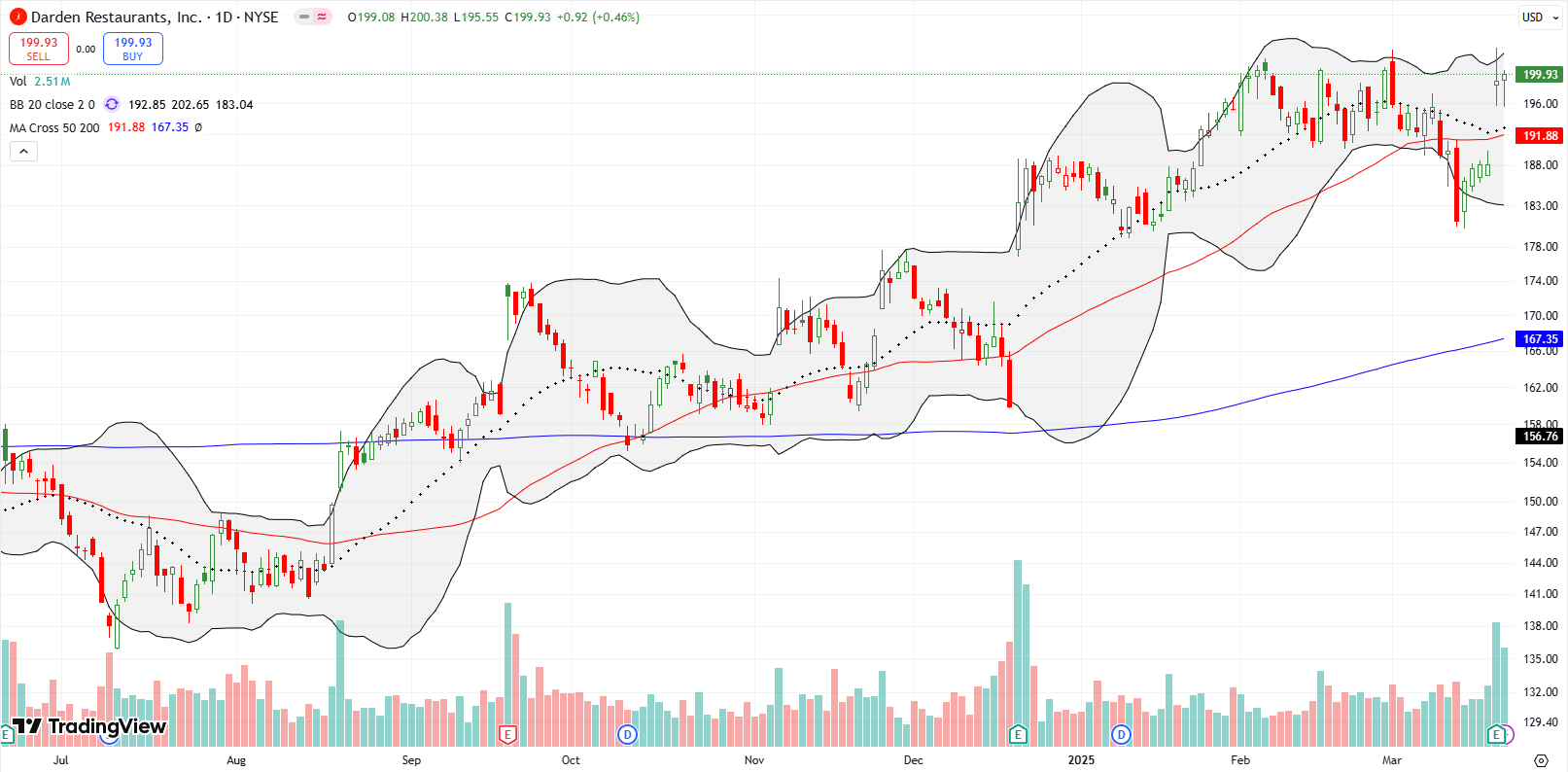

On the other hand, Darden Restaurants (DRI), owner of Olive Garden, revived hope after a 5.8% post-earnings gain. DRI not only invalidated an ominous 50DMA breakdown but also the stock traded right under its all-time highs set last month. Still, I remain wary. DRI needs to set new all-time highs to convince me it is not in the early stages of topping out.

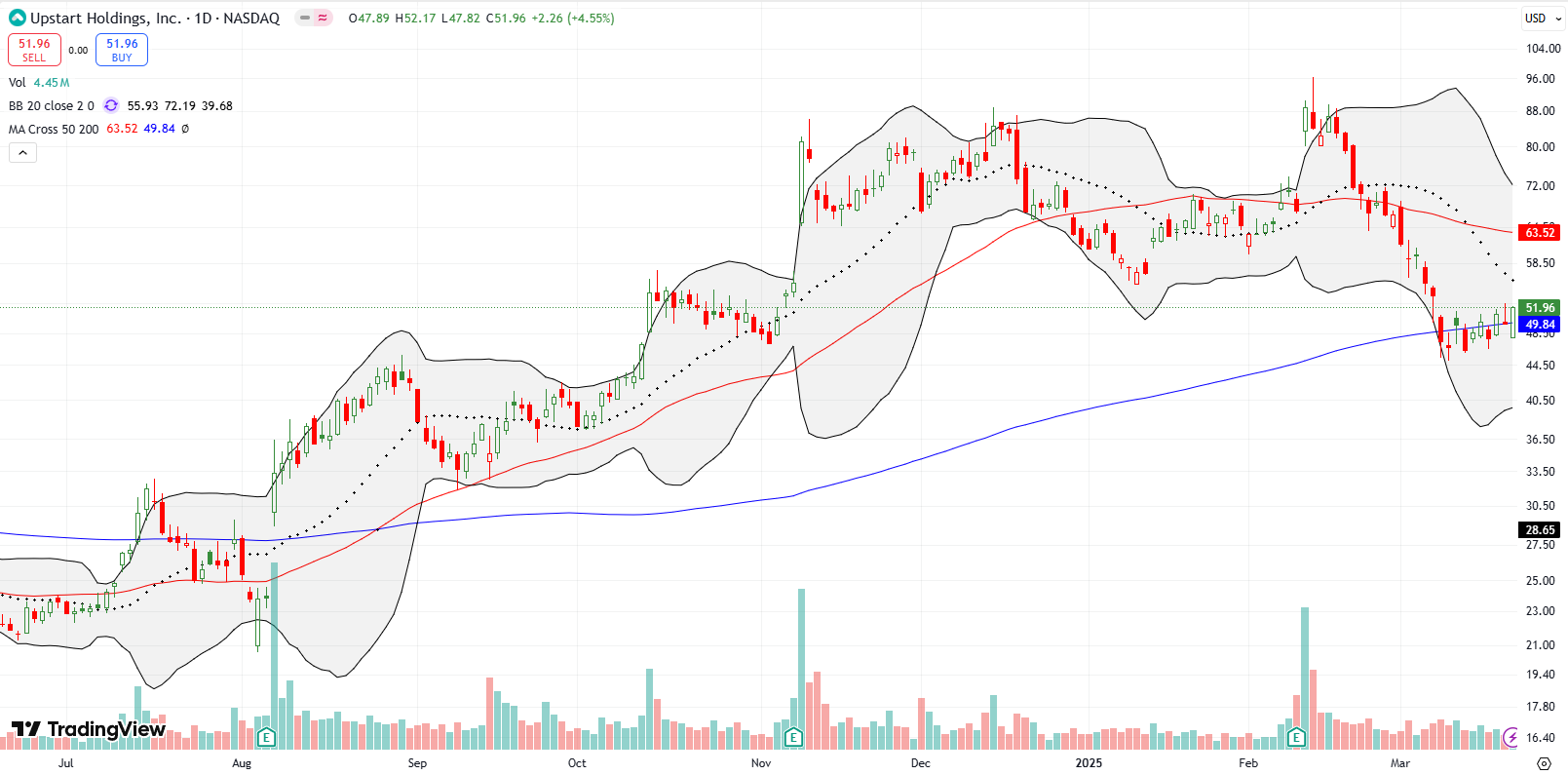

Upstart Holdings (UPST) is a fintech heavily dependent on loans to consumers. The stock trades well below its highs from the heady pandemic period. The stock has had a very choppy recovery since bottoming in the 2022 bear market. UPST surged 31.8% post-earnings last month to a near 3-year high before soon succumbing to the general market sell-off. The subsequent selling not only wiped out those gains but also wiped out November’s monster post-earnings surge (a second reversal). UPST is now down 42% from its recent highs as it clings to a tight pivot around its 200DMA.

This kind of wild trading action tells me that the market has no idea how to interpret UPST’s business performance. If the last two earnings reports meant anything, UPST is an amazing steal here for at least a short-term trade. However, if UPST makes a new low from here, I could easily see the stock moving fast to reverse its August post-earnings gains. In other words, I see big stakes in the ultimate resolution of the price action from this consolidation period.

Dollar General Corporation (DG) may be in the early stages of a sneaky comeback, at least for the short-term. After staging a 6.8% post-earnings rebound, DG confirmed 50DMA support and has crept higher ever since. The stock overall completely ignored the general turmoil in the stock market that started in late February. I am not quite ready to buy shares to bet on a comeback, so I nibbled with an April $85/90 call spread….placed right below 200DMA resistance of course.

While discount retailing could start a comeback with DG, premium retail with the likes of Lululemon (LULU) could resume a secular decline. Unlike DG, LULU suffered along with the overall market sell-off. LULU’s malaise conveniently ended right around its 200DMA support. With last quarter’s 15.9% post-earnings gains long gone, LULU’s earnings report coming up this week takes on extra significance. I am thinking of a post-earnings trade in the direction of resulting sentiment.

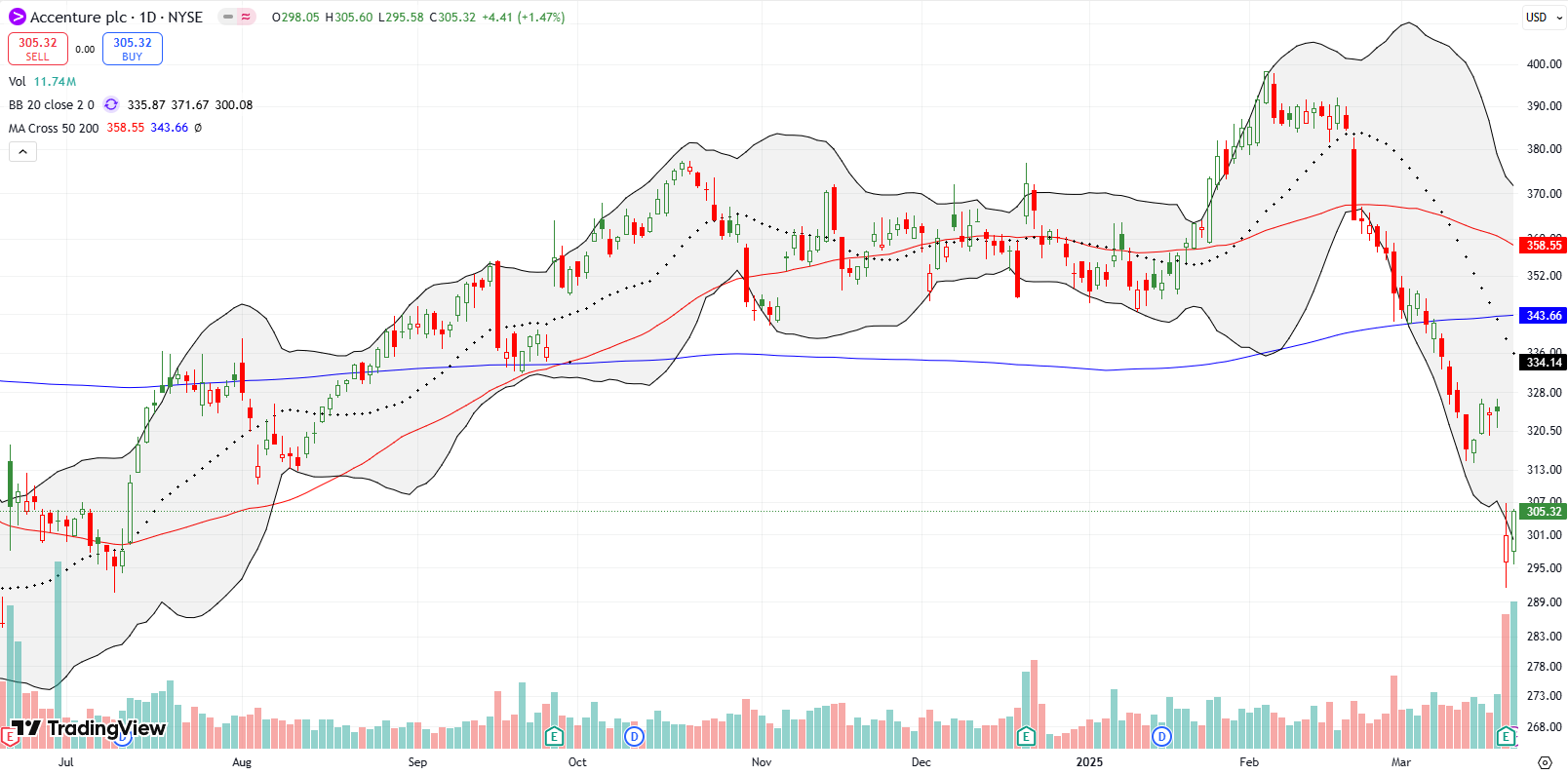

Accenture plc (ACN) is a consulting firm specializing in IT projects….which of course means it has contracts with the Federal government. Thus, I took great interest in its 7% post-earnings drop to levels last seen in July. The company of course had to address its Federal business in the earnings call. From the Seeking Alpha transcript:

“Federal represented approximately 8% of our global revenue and 16% of our Americas revenue in FY ‘24. As you know, the new administration has a clear goal to run the Federal government more efficiently. During this process, many new procurement actions have slowed, which is negatively impacting our sales and revenue. In addition, recently, the General Service Administration has instructed all federal agencies to review their contracts with the top 10 highest paid consulting firms contracting with the U.S. government, which includes Accenture Federal Services.

The GSA’s guidance would determinate contracts that are not deemed mission critical by the federal — by the relevant federal agencies. While we continue to believe our work for federal clients is mission critical, we anticipate ongoing uncertainty as the government’s priorities evolve and these assessments unfold. Based on our significant experience across federal and commercial clients, we see major opportunities over time for us to help consolidate, modernize, and reinvent the federal government to drive a whole new level of efficiency.”

For a company that only grew EPS by 2% and revenue by 8.5% year-over-year, a significant slowdown in this Federal business is a big deal. Still, ACN is experiencing on-going success in AI-related deployments: “We had another milestone quarter in genAI with $1.4 billion in new bookings and approximately $600 million in revenue.” This genAI business gave me a successful trade last summer in ACN. Back then, the technicals underlined the case after the post-earnings pop. This time around, the unfavorable technicals and political headwinds keep my hands tied. Ironically, ACN is back to trading right around where I bought it last year, a fresh reminder on the often short-term nature of these themed trades.

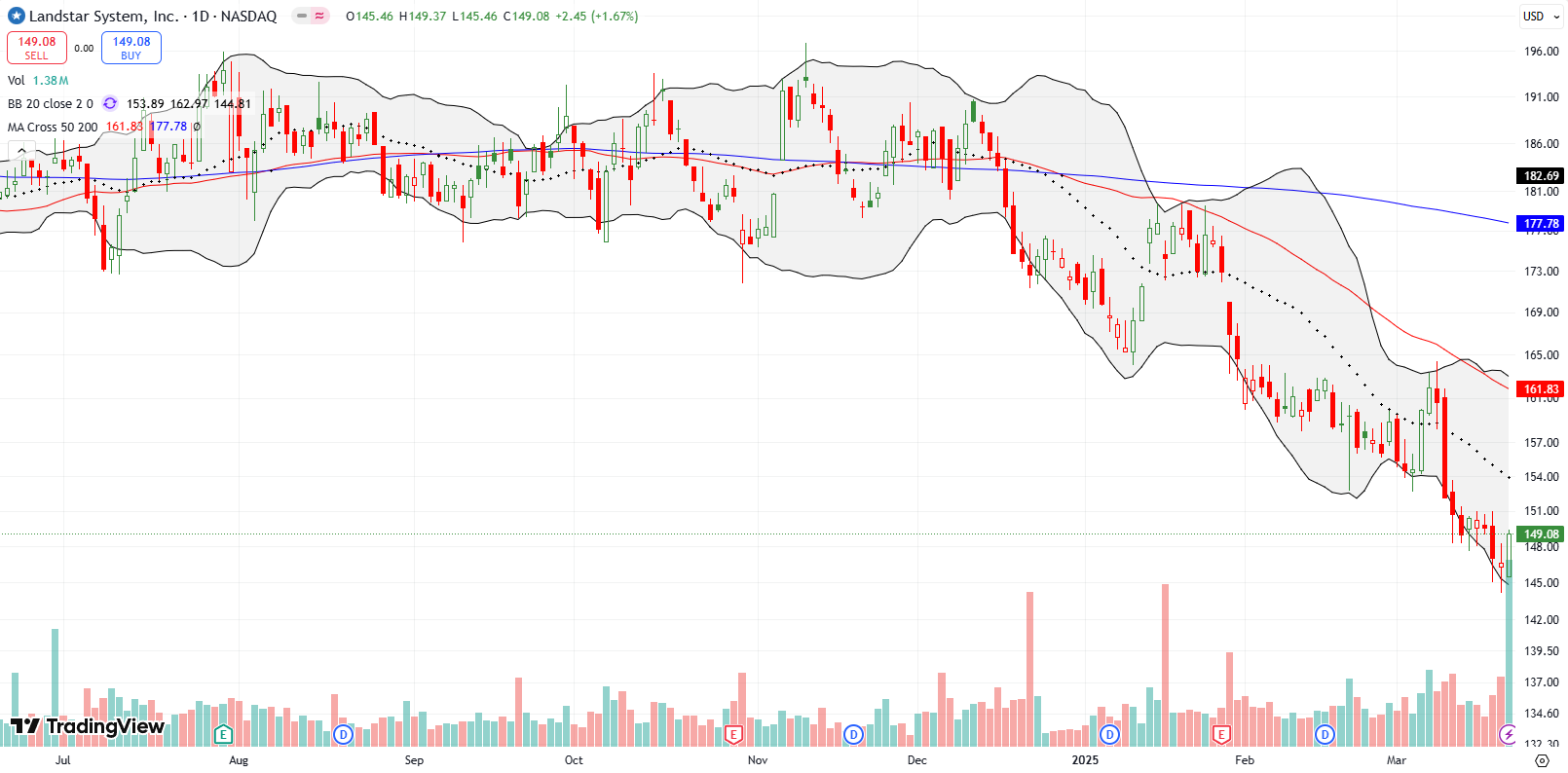

Speaking of political headwinds, transportation management company Landstar System (LSTR) is caught right in the middle of tariff flexibility. A significant portion of its business relies on shipping between and within Canada, Mexico, and the U.S. Despite this dependence, LSTR still popped 6.0% in the day after the election. Unsurprisingly, LSTR soon topped out from there. The stock slowly declined and then accelerated downward starting with January earnings.

LSTR gained 1.7% in the wake of tariff flexibility, but the stock was in rally mode all day. Thus, I am wondering whether I can use LSTR as an effective gauge of market sentiment towards tariffs. I am definitely keeping a closer eye on this stock. In the meantime, LSTR trades near its bear market trough from 2022.

The SPDR EURO STOXX 50 ETF (FEZ) returned gently to its 20DMA, support which has held all year. I hope my picture-perfect opportunity to buy does not slip away come Monday morning! With European governments signaling increased spending, especially in Germany, FEZ could sustain its optimistic trading for a while. Stock markets are big fans of government spending…not withstanding the bloodthirsty glee in the U.S. over the performance art from DOGE chainsaws.

Be careful out there!

Footnotes

Subscribe for free to get email notifications of future posts!

“Above the 50” (AT50) uses the percentage of stocks trading above their respective 50-day moving averages (DMAs) to measure breadth in the stock market. Breadth defines the distribution of participation in a rally or sell-off. As a result, AT50 identifies extremes in market sentiment that are likely to reverse. Above the 50 is my alternative name for “MMFI” which is a symbol TradingView.com and other chart vendors use for this breadth indicator. Learn more about AT50 on my Market Breadth Resource Page. AT200, or MMTH, measures the percentage of stocks trading above their respective 200DMAs.

Active AT50 (MMFI) periods: Day #318 over 20%, Day #1 under 30% (underperiod ending 4 days over 30%), Day #15 under 40%, Day #27 under 50%, Day #54 under 60%, Day #155 under 70%

Source for charts unless otherwise noted: TradingView.com

Full disclosure: long IWM call, long CMG, long DG call spread

FOLLOW Dr. Duru’s commentary on financial markets via StockTwits, BlueSky, and even Instagram!

*Charting notes: Stock prices are not adjusted for dividends. Candlestick charts use hollow bodies: open candles indicate a close higher than the open, filled candles indicate an open higher than the close.

* Blog notes: this blog was written based on the heavily edited transcript of the following video that includes a live review of the stock charts featured in this post. I used ChatGPT to process the transcript.