Housing Market Intro and Summary

What happened in the housing market in January, 2025? The bear market that scarred the landscape for builders came to an end just ahead of an important December inflation report. Relief from that report combined with relief from a builder’s earnings report helped to seal the deal on the three week bear market. However, the bears are still roaming free in the woods given December housing data and January sentiment only made marginal improvements on the outlook for the spring selling season. Perhaps most importantly, mortgage rates pushed to 8-month highs and remain above 7.0%. Devastating and tragic fires in Southern California increased the spotlight on the potential for rising insurance costs to further exacerbate the affordability challenges in the market.

- The seasonally strong period for the stocks of home builders provided its first profitable trades but further upside in the core position looks tenuous for now.

- While home builder sentiment improved by another point, sharply divergent changes in the underlying components and regional shifts still warn of a potential coming top in sentiment.

- Single-family housing starts increased 6.5% for the year over 2023 despite going nowhere the last 5 months of the year.

- Sales of new single-family homes increased 2.5% for 2024 but remained overall range-bound for the last two years.

- Sales of existing homes managed to continue a rebound off 14-year lows. Still, sales for 2024 registered a 30-year low. On-going inventory and price dynamics suggest little relief is ahead for 2025.

- Sales of existing homes in California managed to gain 4.3% for the year, but this increase was the first since 2021.

- Mainly driven by regulatory constraints, the historic scarcity of starter homes is exacerbating the affordability challenges in the housing market.

- Household formation among young adults stalled in 2023. This slowdown could undermine a key demographic tailwind for home builders.

- Mortgage rates jumped over 7%.

Housing Stocks

The iShares US Home Construction ETF (ITB) lept away from its brief trip to a bear market after a favorable inflation report brought new hope for lower interest rates. A relief rally following an earnings report from KB Home (KBH) also helped. December was ITB’s worst monthly performance since March, 2020, the start of the COVID-19 pandemic, so some kind of relief rebound is not surprising. However, even with January’s month-to-date rebound of about 5.8% (compare to a 3.1% month-to-date gain for the S&P 500 (SPY)), the seasonal trade on home builders is still experiencing one of its worst starts since ITB’s inception.

Thank to the relief rebound, I was able to scrape out a complete a round of seasonal trades on Toll Brothers (TOL) and M/I Homes (MHI). Both trades triggered ahead of the December inflation report as the stocks cleared technical hurdles (see below). I took profits at or close to overhead resistance levels. I maintained tight reins because of my substantial holding in ITB as part of the seasonal trade. ITB is struggling under overhead resistance from its 50-day moving average (DMA) (the red line below) and 200DMA. This nearly converged resistance raises the stakes a day ahead of the next decision on monetary policy from the Federal Reserve.

As a reminder, my three individual stocks to trade for the seasonal trade are M/I Homes (MHO), Toll Brothers (TOL), and Pulte Homes (PHM). MHO and PHM have earnings reports this week, and I plan to buy on a post-earnings dip that does not extend beyond the recent bear market lows.

MHO triggered a buy after it jumped 5.3% off its recent low. This buy was my most aggressive and riskiest because the stock did not establish consolidation ahead of the rebound. MHO was in decline until the rebound. Moreover, the presumed short-term upside looked capped by resistance from the line marking the 2023 breakout. Sure enough, MHO failed to push through this resistance, and I took profits after the fourth failure to break through.

Toll Brothers (TOL) was a more confident buy as the trade triggered after clearing a short consolidation period. Still, I took quick profits after the stock seemed to stall around its 200DMA. A 3.6% surge yesterday convincingly confirmed TOL’s 200DMA breakout. Now the stock is trying to fight through 50DMA resistance. A breakout above 50DMA resistance would likely bring me back into the stock. TOL’s relative strength among builders makes sense given its focus on luxury home buyers.

Housing Data

Home Builder Confidence: The Housing Market Index – January, 2025

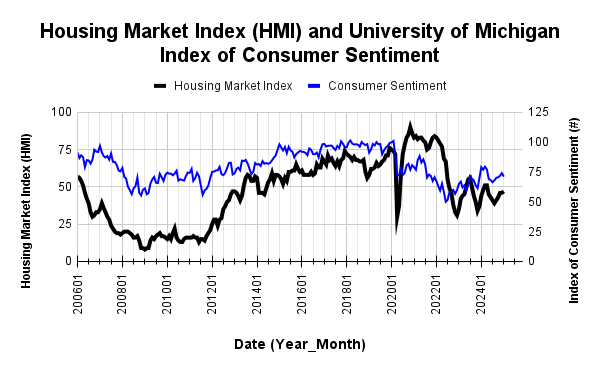

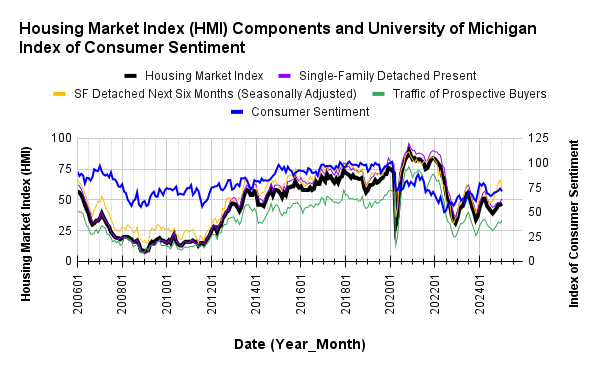

The National Association of Home Builders (NAHB)/Wells Fargo Housing Market Index (HMI) managed to nudge higher by a point to 47 after spending two months at 46. Once again, the HMI components were quite divergent. The HMI index for current sales conditions, “Single-Family: Present”, followed along with HMI by increasing (3 points) after two months at 48. The HMI index “Traffic of Prospective Buyers” rebounded two points after December’s decline. This component reached a new 17-month high. However, the HMI for sales expectations in the next six months, “SF Detached Next Six Months (Seasonally Adjusted)”, plunged 6 points and ended a 7 month run-up that started one month before HMI bottomed. In December, the NAHB pointed to this component as a sign of underlying builder optimism. So it is not surprising to read a much more cautious tone in the January report:

“Builder sentiment edged higher to begin the year on hopes for an improved economic growth and regulatory environment. At the same time, builders expressed concerns over building material tariffs and costs and a larger government deficit that would put upward pressure on inflation and mortgage rates.”

Source for data: NAHB and the University of Michigan

Consumer sentiment ticked down but remains in a general uptrend from the recent low. History suggests resilient consumer sentiment should help support builder sentiment.

There was again little change in the pricing metrics. The 30% share of builders cutting prices is down from December’s 31%. The share of builders providing incentives increased slightly month-over-month from 60% to 61%. The average price discount was flat again at 5%.

Like December, January delivered surprisingly sharp regional divergences. Thus, I still think the aggregate HMI is topping out. The Northeast was most notable with a large downward revision for December from 62 to 57 and an accompanying surge in January 67. The Northeast HMI was last this high in May, 2022 and is the most bullish region by a mile, especially given it is the only region above the 50 threshold. The Midwest retreated to 44 after staying flat at 48. The South retreated by 2 points to 47. The West gained 3 points to 42 but remains well below highs from last year. I suspect the HMI in the West will drop notably in the wake of the tragic fires in Los Angeles.

New Residential Construction (Single-Family Housing Starts) – December, 2024

Single-family housing starts stayed above the 1M mark. The 1,050,000 starts were 3.3% above November’s 1,016,000 (revised up from 1,011,000) but down 2.6% year-over-year. For all of 2024, single-family housing starts increased 6.5% year-over-year.

![Housing starts US. Bureau of the Census, Privately Owned Housing Starts: 1-Unit Structures [HOUST1F], first retrieved from FRED, Federal Reserve Bank of St. Louis, January 17, 2025](https://drduru.com/onetwentytwo/wp-content/uploads/2025/01/20250117_Housing-starts-December-2024.png)

After a briefing flattening following the summer trough, building permits are turning upward again. Permits are still down 3.8% from January’s high of 2024.

Sequential gains were non-negative across all regions with the South exactly flat. The results were mixed on a year-over-year basis with two regions up and two regions down. The Northeast, Midwest, South, and West each changed +8.5%, +14.3%, -1.8%, and -15.3% respectively year-over-year. I previously thought the November starts augured poorly for the spring selling season. The December starts are just a little more encouraging.

New Residential Sales (Single-Family) – December, 2024

In October, new home sales plunged to levels last seen November, 2023. The hope that this drop was exaggerated by hurricane-related impacts was dashed by a meager rebound in sales for November. A meager rebound continued in December with sales increasing 3.6% month-over-month and 6.7% year-over-year to 698,000. While the uptrend from the 2022 and 2023 lows is over, a solid range for sales seems to be in place. The next question is whether spring sales can push new home sales to new highs with home builders scrambling to provide sufficient incentives to prop up sales pace. The U.S. Census Bureau and the U.S. Department of Housing and Urban Development reported an estimated 683,000 new homes were sold in 2024. This is 2.5% above 2023’s 666,000.

![new home sales US. Bureau of the Census, New One Family Houses Sold: United States [HSN1F], first retrieved from FRED, Federal Reserve Bank of St. Louis, January 27, 2025](https://drduru.com/onetwentytwo/wp-content/uploads/2025/01/20250127_New-home-sales-December-2024.png)

The median price for new homes has been on a very slight downtrend, but December’s jump to a 4-month high threatens to end that downtrend. There were just four year-over-year price increases in 2024. For November, the median price dropped near a 3-year low to 402,500, so the sharp 6.1% sequential rebound in December means there is now well-established volatility in month-to-month pricing. The median price also increased 2.1% year-over-year. Much of these swings seem to be due to rapid changes in mix.

While there have been no definitive trends in the distribution of sales across the price ranges, a very strong shift in sales to the lowest price tier skewed November’s median price. For December, sales migrated to the $500,000 to $999,999 range. The book-ending tiers each lost share. However, compared to a year ago, the story is more mixed. Sales pushed out to the edges of the distribution with the under $300,000 and the $800,000 to $999,999 ranges gaining share at the expense of all the other tiers. For context, sales of homes under $300,000 have been increasing in share for at least the last 3 years (I did not go back further). November’s 22% was the highest of this time series. In other words, the affordability crunch is pushing more and more people, as a share of sales, into the cheapest single-family homes.

December’s inventory dropped from November’s 8.9 to 8.5 months of sales. For comparison, a year ago inventory sat at 8.2 months of sales. Absolute inventory is continuing to rise sharply after remaining flat for most of the year. Absolute inventory was last this high 17 years ago. Note that overall inventory, new plus existing homes, remains below historical norms at 4.0 a steep drop from November’s 4.9. The NAHB pointed to limited existing home sales inventory helping to boost new home sales. Inventory could be a key story in 2025 as the housing market teeters on its next slowdown in activity.

Each region gained sales year-over-year with the Northeast and the Midwest notching significant gains. The Northeast, Midwest, South, and the West changed +29.5%, +40.3%, +0.5%, and +6.9% respectively.

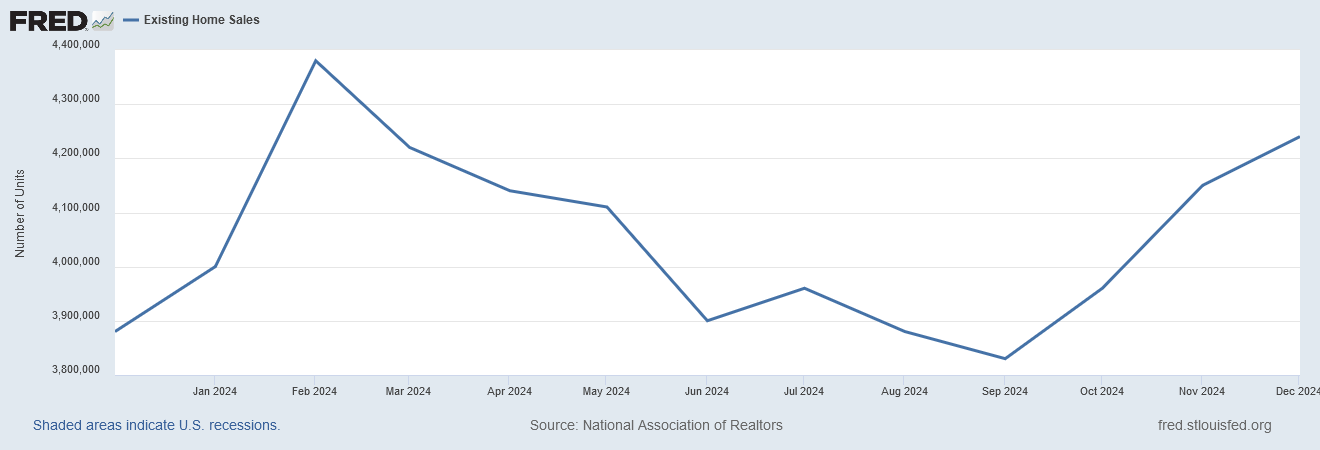

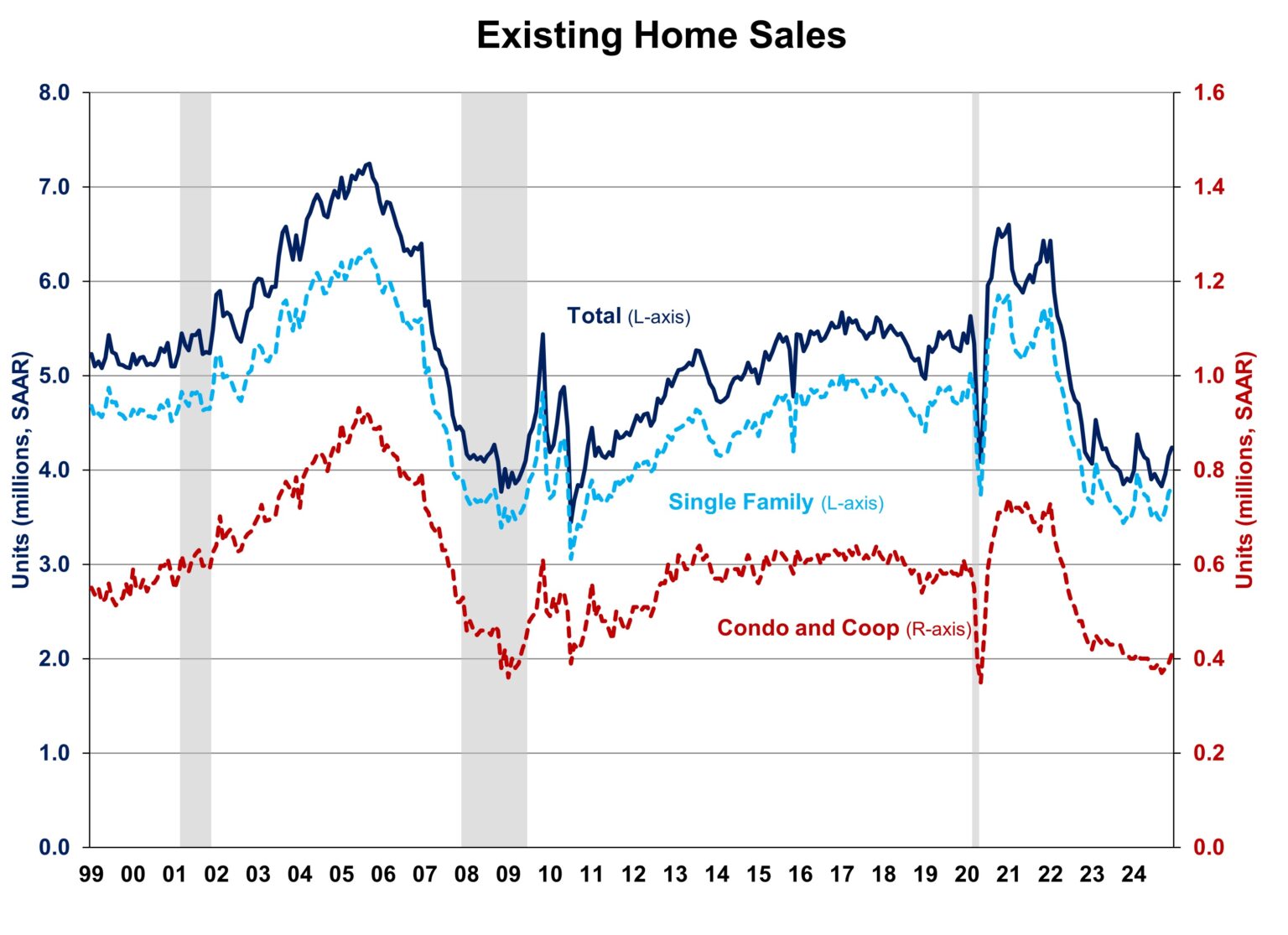

Existing Home Sales – December, 2024

In October, existing home sales jumped sharply off 14-year lows for a 3.4% sequential gain for the first year-over-year gain in over 3 years. Monthly sales have continued higher since then. December’s 2.2% sequential gain and 9.3% year-over-year surge (thanks to favorable comparables) surprised me. However, the excitement of December’s gain is tempered by the near 30-year low for overall 2024 sales of 4.06M. Still, the monthly jump was impressive relative to stubbornly high mortgage rates and high prices.

(For historical data from 1999 to 2014, click here. For historical data from 2014 to 2018, click here) Source for chart: National Association of Realtors, Existing Home Sales© [EXHOSLUSM495S], retrieved from FRED, Federal Reserve Bank of St. Louis, January 24, 2025

The increase in December sales ate into November inventories even as inventory surged year-over-year, similar to November’s dynamics. The NAR reported December inventory at 1.15M, a 13.5% decrease month-over-month and up 16.2% year-over-year. According to the NAR, “Unsold inventory sits at a 3.3-month supply at the current sales pace, down from 3.8 months in November but up from 3.1 months in December 2023.” The months of supply and absolute inventory declined for a third month in a row. The jump in sales puts a relative strain on already limited inventories, but also I now suspect the sequential decline represents homes coming off the market.

Once again, the big change in inventories and sales did not impact the median price on a sequential basis. Once again, it is telling that year-over-year pricing jumped despite the surge in year-over-year inventories. The NAR (finally) explained that a mix shift toward higher-end homes pushed the median price higher: “Sales rose by 35% from a year ago for homes priced above $1 million, while sales fell for homes priced under $250,000”. The median sales price of an existing home hit an all-time high at $426,900 in June. December’s median price stayed exactly flat at $404,400, another healthy 6.0% year-over-year increase. For the year, the median price hit a record high of $407,500, a stark contrast to the annual sales decline to a near 30-year low.

The average time on the market for an existing home increased to 35 days in December, up from 32 days in November and up significantly from the 29 days in November 2023. I am again surprised to see such a large sequential increase in time on market even as sales continue higher. Perhaps higher-end homes are the ones tending to stay on the market longer.

In an encouraging sign, the share of sales to first-time home buyers gained again. These sales increased from 30% in November to 31% in December, and up from the 29% in December 2023. The NAR’s 2017 Profile of Home Buyers and Sellers reported an average of 34% for 2017, 33% for 2018, 33% for 2019, 31% for 2020, 34% for 2021, 26% for 2022, 32% for 2023, and a plunge to an all-time low of 24% in 2024.

All four regions increased year-over-year in existing home sales. The regional year-over-year changes were: Northeast +10.4%, Midwest +6.5%, South +9.0%, West +12.9%.

Every region also continued to experience year-over-year price increases. The regional year-over-year changes were: Northeast +11.8%, Midwest +9.0%, South +3.4%, West +6.0%.

Single-family existing home sales increased by 1.9% from November to 3.83M in December and jumped by 10.1% year-over-year. The median price of a single-family home was $409,300, up 6.1% year-over-year and essentially flat month-over-month.

California Existing Home Sales – December, 2024

{Note that California Association of Realtors (CAR) did not publish a report for November sales}

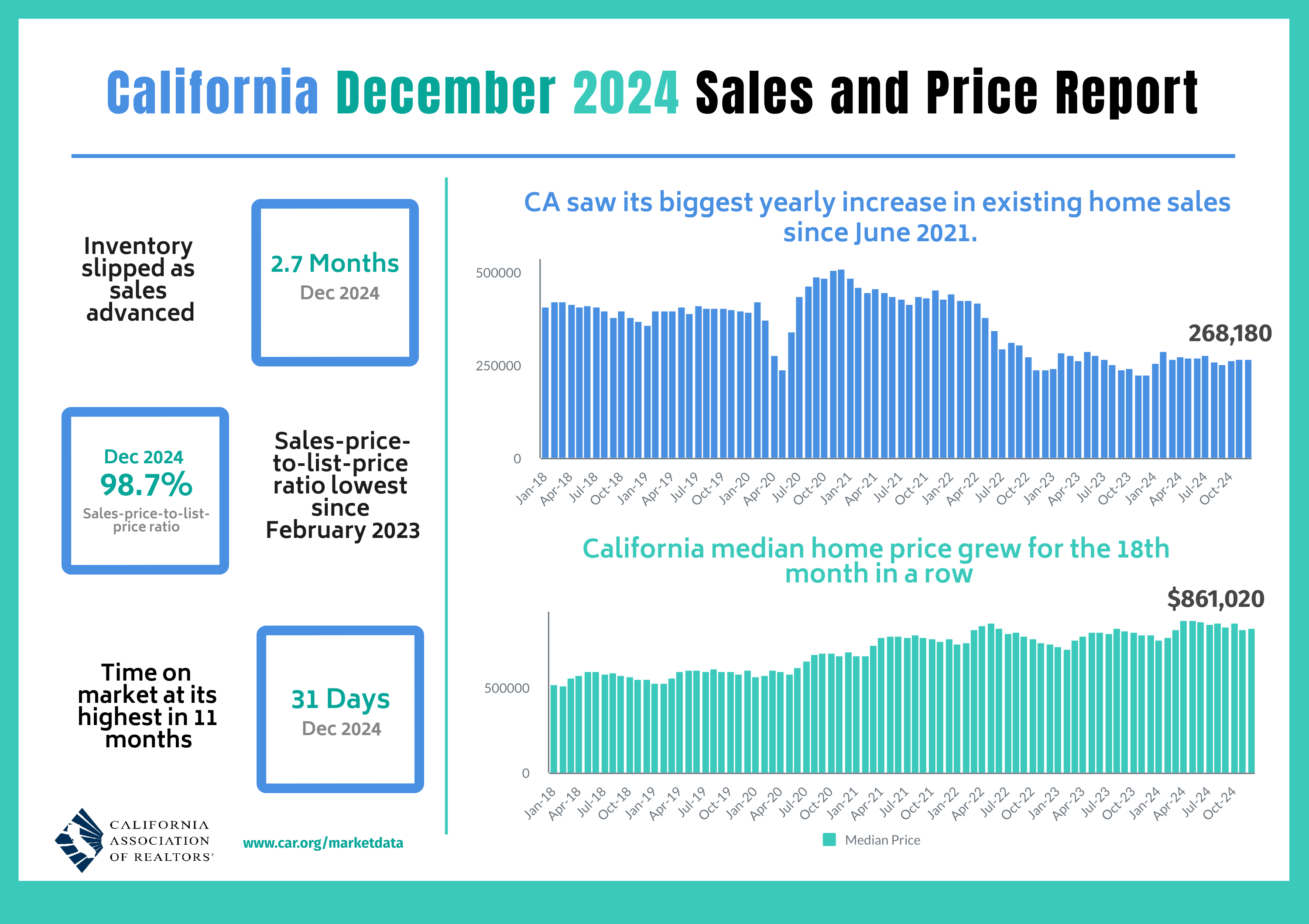

The wait-and-see attitude that the California Association of Realtors (C.A.R.) blamed for slow sales in September gave way to a flood of interest in October. At the time I claimed that the proof of stronger sales may have to wait until the 2025 spring selling season. Since then sales have ever so slowly crept upward on a sequential basis with some slim signs of hope for a decent spring selling season despite the tragic fires in Southern California. For the year 2024, California single-family existing home sales increased 4.3% to 269,030. The last annual increase was in 2021. The median price for the year increased 6.3% over 2023.

According to the latest report from the California Association of Realtors, existing single-family home sales came to 268,180 in December, a 5-month high that marked a minimal 0.1% increase from November and a 19.8% year-over-year surge. C.A.R. reminded us that 2023’s final months were unusually low.

Sales pace at the low and high ends of the market continue to exhibit stark contrasts: “The year-over-year growth in sales for the $1 million-and-higher price segment maintained a double-digit gain of 28.7 percent last month, while sales in the sub-$500,000 market dipped by 0.4 percent in December.” I assume that inventory availability is a contributing factor to the slower sales growth at the low end.

Partially thanks to the preponderance of higher end sales, the median home price in December increased 1.0% month-over-month to $861,020 and jumped year-over-year by 5.0%. This year-over-year increase marked the 17th consecutive month of gains.

The median time it took to sell a home in California rose to 31 days in December, up from 26 days a year ago.

The statewide sales-price-to-list-price ratio fell to 98.7%. The ratio was 99.0% in December, 2023. The price per square foot for an existing single-family home in California was $413 in December, a 4.0% increase from a year ago.

The C.A.R. only provided county-level numbers for new active listings. Forty-seven of 53 counties experienced an increase in the number of properties on the market. The Unsold Inventory Index (UII) also rose but just year-over-year. The UII plunged from 3.3 months in November to 2.7 months in December. UII was 2.6 months a year ago.

Home closing thoughts

Starter Homes

In 1980, 40% of homes built were starter homes (under around 1400 square feet). The share has steadily declined ever since. Now, only 9% of home construction is spent on starter homes. The CNBC segment below fingered the following problems: zoning and other regulations. Regulations can constitute up to 25% of the cost of a home. More dense forms of housing would open up more starter home supply. Rising prices have further exacerbated the issue as only the most well-off are able to buy, and they are reaching beyond the starter homes.

Household Formation Among the Young Has Stalled

The NAHB recently concluded that household formation among 25-34 year olds flattened from 2022 to 2023. In “Moving Out of Parental Homes is On Hold“, the NAHB analyzed the 2023 American Community Survey (ACS) Public Use Microdata Sample and found that the rate of household formation remained flat at 19% from 2022 to 2023. The rate of living with parents was highest in the sunbelt and the Northeast as affordability challenges in these areas held young people in place.

These findings surprised me given some home builders continue to claim that household formation continues to increase among young people. For example, in its last earnings report, KB Home (KBH) said the following (from the Seeking Alpha transcript):

“The housing market is benefiting from solid employment and wage increases. Demographics have been and we expect will continue to be a significant factor in driving housing demand with the largest generational cohorts, millennial and Gen Z buyers, demonstrating a strong desire for homeownership and contributing to the growth in household formations.”

Given these claims, I wish I did not have to wait another year to see the analysis of 2024’s data!

Spotlight on Mortgage Rates

The Mortgage Bankers Association (MBA) reported two weekly increases in mortgage applications in January versus one decrease as mortgage rates continued to bounce in a tight range. New home mortgage purchase applications continued a strong year-over-year performance with an 8.9% jump in December. In July, new home mortgage purchase applications soared 9.5% year-over-year, increased 4.5% in August, soared 10.8% in September, soared 8.2% in October, and surged 7.2% in November. December’s year-over-year increase was the 23rd consecutive month of such gains which is again surprising given new home sales have been relatively range bound for almost two years. The completion or conversion rate on these applications must be far below 100%.

After creeping higher in November, and stopping short of 7% in December, mortgage rates jumped over the 7% mark in January. Accordingly, I expect to see slower sales numbers for January and more home builders reporting squeezes on margins as they try to maintain pace for the important spring selling season.

![Freddie Mac, 30-Year Fixed Rate Mortgage Average in the United States [MORTGAGE30US], retrieved from FRED, Federal Reserve Bank of St. Louis; January 28, 2024](https://drduru.com/onetwentytwo/wp-content/uploads/2025/01/20250128_30-Year-Fixed-Rate-Mortgage-Average-in-the-United-States.png)

Be careful out there!

Full disclosure: long ITB shares