Dave & Busters Entertainment (PLAY) is a major gaming and dining entertainment center that recently expanded internationally. Insiders – corporate executives and especially one particularly eager institutional shareholder – have expanded ownership in the company for many months. When I recently read in briefing.com that a 10% owner purchased 214,588 shares, I finally jumped into the pool. Yes, the stock market remains in a bearish trading mode. However, I happily make an exception to consider the significance of insider buying. As the adage goes, insiders sell for many reasons, but they buy to make money (usually).

The Insider Purchases

The volume, duration, breadth, and persistence of the insider buying is quite impressive. As a result, I consider it very meaningful and supportive of a longer-term positive story for Dave & Busters Entertainment. The following list of 2022 market price purchases (excluding the exercise of stock options) comes from the SEC’s record of filings:

- April 8: Kevin Sheehan, Interim CEO: 10,000 shares for $40.58 each (spent $405,800)

- April 8 to April 12: Hill Path Capital Partners, LP: 463,542 shares through derivates notionally worth a presumed total of $19.6M (4/9/29 expiration)

- April 13: Michael Quartieri, Chief Financial Officer: 5,000 shares for $45.28 each (spent $226,400)

- April 13 to April 14: Hill Path Capital Partners, LP: 264,156 shares through derivatives notionally worth a presumed total of $12.0M (expiring 4/9/29)

- April 25 to April 27: Hill Path Capital Partners, LP: 324,470 shares through derivatives notionally worth a presumed total of $15.1M (expiring 4/9/29)

- April 28 to May 2: Hill Path Capital Partners, LP: 485,902 shares through derivatives notionally worth a presumed total of $22.4M (expiring 4/9/29)

- May 3 to May 5: Hill Path Capital Partners, LP: 425,961 shares through derivatives notionally worth a presumed total of $19.4M (expiring 4/9/29)

- May 6 to May 9: Hill Path Capital Partners, LP: 425,961 shares through derivatives notionally worth a presumed total of $19.4M (expiring 4/9/29)

- May 6 to May 9: Hill Path Capital Partners, LP: 252,519 shares through derivatives notionally worth a presumed total of $11.1M (expiring 4/9/29)

- July 13: Christopher Daniel Morris, CEO: 33,400 shares for $30.54 each (spent $1.0M)

- October 7 to October 12: Hill Path Capital Partners, LP: 153,227 shares through derivatives notionally worth a presumed total of $4.9M (expiring 4/9/29)

- October 11: Michael Quartieri, Chief Financial Officer: 5,000 shares for $31.73 each (spent $158,650)

- October 12: Les Lehner, SVP, Chief Procurement Ofc: 12,154 shares for $32.81 each (spent $398,773)

- October 11 to October 12: Hill Path Capital Partners, LP: 300,000 shares costing a total of 9.7M

- October 14: SVP, Chief Operating Officer: 14,823 shares for $33.86 each (spent $501,907)

- December 8: Michael Quartieri, Chief Financial Officer: 4,025 shares for $35.07 each (spent $141,157)

- December 8 to December 9: Steve Klohn, EVP Chief Information Officer: 14,287 shares costing a total of $502,633

- December 8: Ashely Zickefoose, EVP Chief Marketing Officer: 3,000 shares for $34.49 each (spent $103,470)

- December 8 to December 12: Hill Path Capital Partners, LP: 287,961 shares costing a total of 9.98M

- December 14 to December 15: Antonio Pineiro, SVP Chief International Development Officer: 2,000 shares costing a total of $70,150

- December 14 to December 16: Hill Path Capital Partners, LP: 353,500 shares costing a total of $12.1M

- December 19 to December 21: Hill Path Capital Partners, LP: 535,000 shares costing a total of $17.9M

- December 22 to December 27: Hill Path Capital Partners, LP: 410,202 shares costing a total of $14.2M

- December 28 to December 30: Hill Path Capital Partners, LP: 214,588 shares costing a total of $7.5M

Hill Path Capital Partners, LP dominates this long list (the SEC also provides a ledger of Hill Path D Fund LP transactions). I cannot tell whether the derivatives they bought earlier in 2022 were exercised to make the purchases later in the year, but the underlying message is clear: this institutional investor wants to sit on a large stack of shares in PLAY. At the end of 2022, Hill Path owned 11.6% of PLAY. The company’s top executives definitively add to the bullish picture by purchasing shares alongside Hill Path.

In December, 2020, James Chambers, a partner and co-founder of Hill Path, joined Dave & Busters’s Board of Directors and Audit, Finance and Compensation Committees. So, Hill Path is an activist investor in PLAY. They have an out-sized interest in the success of PLAY even with an agreement to cap its stake at 20%.

The Trade

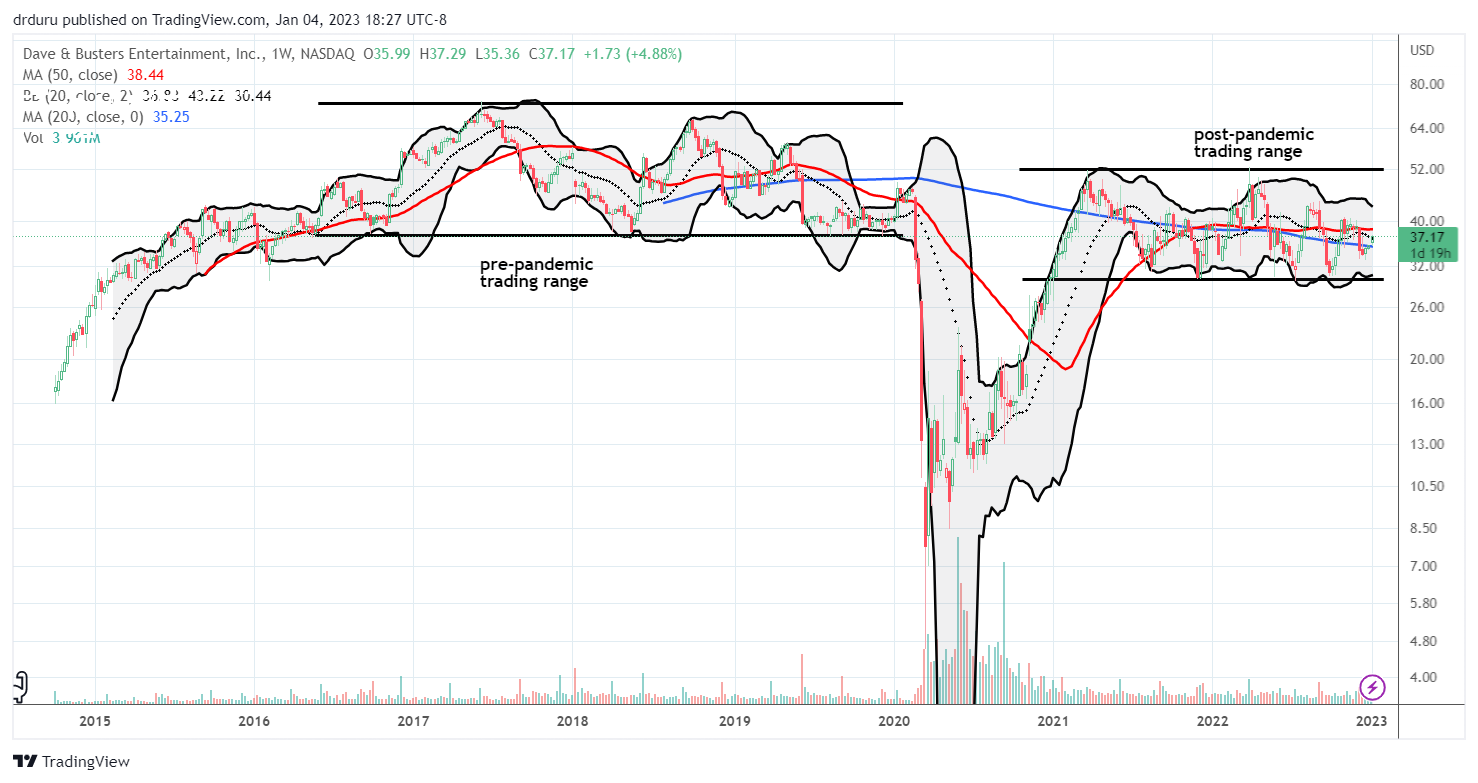

Interestingly, the stock market his not impressed with all this insider buying. From April 8, 2022 to year-end, PLAY lost 12.4%. The S&P 500 (SPY) lost 14.5% over this time. Two of three earnings reports in this period generated negative market reactions. Overall, PLAY has been stuck in a trading range since the beginning of 2021. Before the pandemic started in March, 2020, PLAY churned in a trading range after a December, 2016 breakout.

This chart suggests that a trade riding the coattails of the insiders has time to run. Accordingly, I felt comfortable starting small with a collared play. This position pairs 1 call option and 1 put option for each 100 shares. It is a low risk position that offers a small, but decent, upside. I gave PLAY a 5-month runway with a long June $30 put and a short June $40 call. The options netted a $100 credit. So if PLAY continues to churn in the next 5 months, I should come away with a small profit at minimum.

If PLAY breaks out, I will have a slightly larger profit. If PLAY sells off on no new company-specific catalysts, I will take any profits on the put option and use them to add to my PLAY position. In other words, I am trading in anticipation of a positive longer-term story, even if that story only takes PLAY to the top of its trading range.

Finally, on the valuation side, PLAY looks relatively reasonable at 1.0 price/sales (P/S) and 14.1 trailing P/E. The chart below shows PLAY is at the bottom range of P/S. The big jump happened after the pandemic drove revenues into the ground. Each tick on the x-axis is 2 years; the last tick is 2022.

Be careful out there!

Full disclosure: collar position on PLAY

Want more articles like this? Subscribe to this blog for free by click here.