When Cathie Wood anticipated a “doozie of a correction” in early 2021, she surely did not expect a complete collapse in the mania and bubble she had enjoyed during the first year of the pandemic. However, the cash machine betting on the downtrend in the ARK Funds may finally stop operations soon. Last week, one of the ARK funds, ARK Fintech Innovation ETF (ARKF), became the first of the pre-pandemic group of ETFs to crash to all-time low levels. After printing that gut-wrenching milestone, ARKF promptly rebounded 5.3% the next day. Buyers followed through with a gap up and 12.4% surge. While that move aligned with the general stock market’s picture-perfect bear market bounce, ARKF’s milestone could still signal the emergence of sustainable bottoming levels.

With a downtrend still firmly in place, confirmation of a bottom will come from breaks through higher technical levels. This post examines the performance and levels of the six largest ARK funds in search of the so far elusive bottom.

So are we there yet? Well, despite the strong buying to end the week, ARKF still closed DOWN 6.2% for the week. Buyers have a LOT of work ahead to heal the leveling of one of the most well-recognized bubbles in the stock market.

The Performance Grid

The “performance grid” for the ARK funds shows high correlations and a synchronized bursting of the bubble in the underlying stocks of these funds. Only one fund still retains some gains from the pre-pandemic highs. The rest have completely reversed those gains and then some. The four worst performing funds are highly correlated, unsurprising given the common philosophy of speculating on companies chasing innovation. This strategy performed like a rocket ship when the Federal Reserve sponsored easy money, highly accommodative monetary policies. This strategy has so far completely backfired without that support. Now investors are more interested in pricing in risk than pricing in hopes and dreams.

This grid shows the performance over four important time periods in reverse chronological order: since last week’s bear market bottom, year-to-date, since the all-time high, since the pandemic low (March, 2020), since the pre-pandemic high (all based on closing prices). These numbers provide context for the potential upside as the funds struggle to regain their former momentum.

| ARK Fund | From bear market bottom | YTD | From all-time high | From pandemic low | From pre-pandemic high |

| Fintech Innovation ETF (ARKF) | +18% | -55% | -71% | +4% | -32% |

| Genomic Revolution ETF (ARKG) | +15% | -47% | -71% | +29% | -14% |

| Innovation ETF (ARKK) | +18% | -54% | -72% | +26% | -28% |

| Autonomous Technology & Robotics ETF (ARKQ) | +8% | -32% | -47% | +91% | +21% |

| Next Generation Internet ETF (ARKW) | +18% | -52% | -70% | +32% | -22% |

| Space Exploration & Innovation ETF (ARKX) | +6% | -24% | -32% | N/A | N/A |

The ARK funds are not a place to go for diversification. Four of six of these funds each fell the same amount off all-time highs. They also enjoyed similar gains from the recent bear market bottom. Performance differentials show up with more time as in the comparisons to pandemic-related levels. The Autonomous Technology & Robotics ETF (ARKQ) avoided giving up all its pandemic-era gains with support from a heavy weighting in Tesla (TSLA) of 9.5%. Number two holding Trimble (TRMB) has also held up relatively well in the middle of this bear market.

Since bear market rallies tend to be sharp and swift, they often favor the most damaged goods in the market. Traders and speculators see these stocks as “cheap” and oversold. Moreover, shorts can (should!) move out of these names quickly in order lock in gains. Indeed, the most beaten-up ARK funds, based on YTD or the collapse from all-time highs, were the ones that bounced the most from the recent bottom. These price dynamics provide good targets for a range of strategies whether speculation, pairs trades, or shorting. This post of course is focused on bottoming levels.

The Levels

ARK Fintech Innovation ETF (ARKF)

ARKF is in a bullish position with the breakout above the former all-time low. ARKF is poised to rally at least back to its downtrending 20-day moving average (DMA) (the dotted line in the chart above). The former all-time low provides a natural stop-loss point. I would sell ARKF on a second close below this line under the assumption of higher risk of even lower prices. Note how a simple stop-loss rule would have saved a lot of money over the past several months.

Oversold trading conditions provide an important exception to this rule. Since markets form bottoms during oversold periods (like the current one), it is “too late” to sell during such periods – better to wait for the bounce from oversold levels.

ARK Genomic Revolution ETF (ARKG)

Two months ago, the ARK Genomic Revolution ETF (ARKG) bounced neatly away from its pre-pandemic high. Algorithms, whether human and/or robot, were clearly tuned to the full reversal of pandemic gains as a buying trigger. Such a trade worked briefly on ARKF after it approached its pre-pandemic high in January. What was support now becomes resistance as people who failed to bail at higher levels will see this level as a second chance to preserve capital. Such sellers showed up after May 4th when ARKF tested that line of resistance.

ARKG will first need to overcome resistance from the downtrending 20DMA. After that challenge, an even more important line of resistance comes from the 50DMA (the red line in the chart below). The downtrending 50DMA has guided ARKG downward for over a year. Traders faded brief breakouts. The recent widening gap between the 50DMA and 20DMA shows how selling recently accelerated.

I am not ready to trade a presumed bottom in ARKG without a test of the pandemic low. Instead, the attractive risk/reward levels will not come until ARKG breaks out above its pre-pandemic high.

ARK Innovation ETF (ARKK)

ARKK is Cathie Wood’s flagship ARK ETF. ARKK hit $35.10 at its Thursday intraday low. The 41 cents distance from the pandemic low is “close enough” to a test. The 5.6% gain that day seemed to signal a successful test. Friday’s 11.8% gain confirmed the bottoming move. ARKK looks like a buy on the dips from here until/unless it closes below the pandemic low and triggers a potential stop loss.

Like ARKF and ARKG, the steep downtrend in the 20DMA offers a first point of overhead resistance and profit-taking/capital preservation. Over time, ARKK should be able to ride more positive sentiment to the downtrending 50DMA. A close above the pre-pandemic high should put the worst of the bear market and busted bubble in the rear view mirror for ARKK.

ARK Autonomous Technology & Robotics ETF (ARKQ)

The ARK Autonomous Technology & Robotics ETF (ARKQ) last failed support when it sliced through the 2022 lows on May 5th. The selling occurred the day after ARKQ tested overhead resistance levels at the downtrending 20DMA. Like ARKG, I have little confidence that ARKQ carved out a battle-tested bottom. If a relief rally fails at the 20DMA, or even the 50DMA, I would expect an eventual test of the pre-pandemic high even though this scenario seems unlikely for now.

ARK Next Generation Internet ETF (ARKW)

The ARK Next Generation Internet ETF (ARKW) came within a 5.1% loss of testing the pandemic low, not quite “close enough.” The selling going into that low was so steep, that I suspect ARKW will not make it to the downtrending 20DMA before selling off again. As a result, I have less confidence that ARKW has passed a test of bottoming levels.

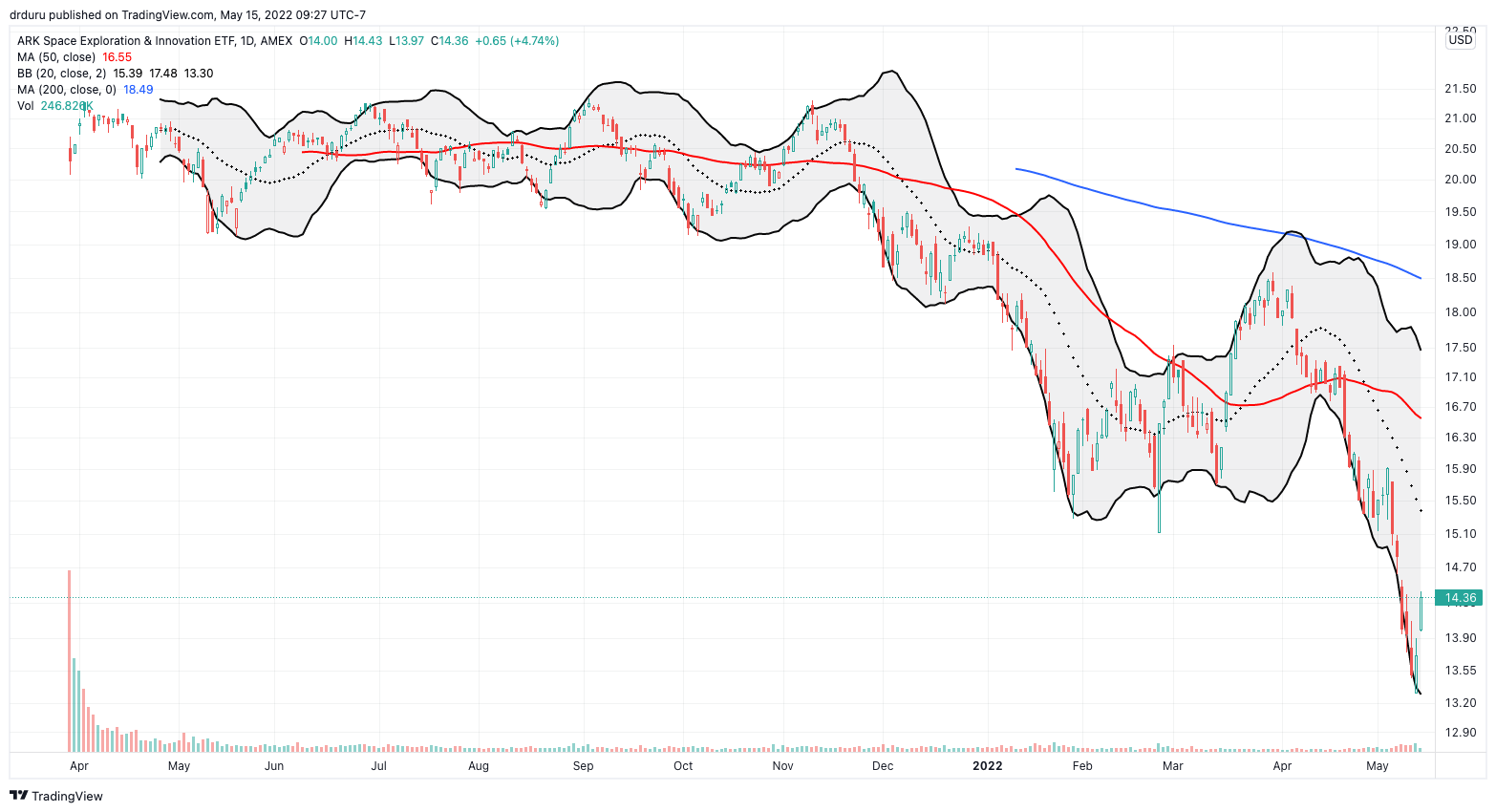

ARK Space Exploration & Innovation ETF (ARKX)

The ARK Space Exploration & Innovation ETF (ARKX) is essentially a no-touch for me. Sure it has the same price action at the recent lows as the other ARK funds, but there is insufficient price history to judge the sustainability of those lows. I would not even consider buying ARKX until it achieved a fresh 50DMA breakout…and stabilized from there.

The Enablers

The bursting bubble for the ARK funds has provided Cathie Wood and her team a lot of opportunities to buy at lower and lower prices. Most mere mortals would quickly run out of money chasing price downward with this kind of Martingale strategy. A Martingale strategy features constant doubling down on bets. In the world of stocks, Martingale lowers the cost basis and shortens the time horizon to a positive return, assuming prices eventually recover. A healthy amount of support from cash inflows enables this strategy. The replacement of sellers with ARK buyers could, over time at least, provide stabilization for the underlying stocks. However, last week’s surge in fund inflows counters the theory that major bottoms happen after a major flush of sellers. The major drawdown in March provided only a temporary bottom.

The Trade

The above technical review went through the important levels to consider for evaluating bottoms in the ARK Funds. For some, these technicals could read and look like incantations to the trading Gods. I submit this assessment is no more mystical than the valuation arguments and rolling 5-year investment windows that supported the ARK bull case with little deference to mania-like market conditions. Innovation solves problems, but innovation has yet to nullify market cycles and the gravity of risk attitudes.

Given the high correlation in performance across the funds, the technicals could be most informative looking at all funds together. So, for example, ARKF delivered the most positive sign of a bottom with its ability to recover above the pandemic low. That milestone could create a positive cascade throughout these speculative ETFs. Similarly, a fresh breakdown in ARKF could very well signal an imminently renewed collapse in the rest of the group.

These unified price dynamics provide options for hedged strategies. The most promising should be pairs trades that feature going short one fund and long another (preferably with options on one side of the trade). I started such a hedged strategy by first opening short sides: short ARKQ shares and a calendar put spread on ARKK. I am looking to get long at least ARKF (call options) in the coming week. I will prefer to be net long the ARK funds as long as trading conditions are oversold. Positioning after the end of oversold trading will depend more on the levels I reviewed above.

Be careful out there!

Full disclosure: short ARKQ, long ARKK calendar put spread