A False Breakout

I started the week with Micron Technology, Inc (MU) as my favorite trade prospect. The breakout from last week was near poetry. MU enjoyed buying support most of the week as it first pushed through resistance at its 200-day moving average (DMA) (the blue line in the chart below) and next sliced through 50DMA resistance (the red line below). MU finished trading at its high for the week. So when the stock pulled back 2.2% to start the current week’s trading, I assumed the stock market served up a gift on a platter. Full of confidence, I bought a September 80/85 call spread and sold short a September 80/75 put spread to pay for the the call spread. The market’s “gift” quickly transformed into a false breakout the very next day as selling pressure continued.

My alarm bells should have screamed loudly once MU sliced through both 50 and 200DMA support, a double breakdown, on heavy selling volume. The stock closed the day with a 5.4% loss. Finally, two days later, the reason for the selling became crystal clear. Morgan Stanley (MS) downgraded MU from overweight to equal-weight with a $75 price target. I can only assume some intrepid trader(s) “got the drop” on the upcoming bad news (one more reminder of the importance of price action and technicals!). Although MU closed the prior day right at $75, investors rushed for the exits anyway. In the wake of the downgrade, MU plunged another 6.4%.

How to Recover

While I still have a month from expiration, my bullish position has little hope of even delivering salvage value. Fortunately, the losses are tightly capped by the put spread. Unlike shares, options provide protection against sudden gap downs. However, the volatility in MU offers a potential opportunity to recoup some losses. A recovery from a false breakout pivots on riding the new momentum and/or the new catalyst. I see at least three potential options:

- Short shares or buy puts with a stop above the day’s intraday high of $72.20.

- Buy shares or call options with a stop below the intraday low of $68.81.

- Wait until Micron successfully tests the downtrend line shown in the above chart before going long.

Turning bearish defers to the new downward momentum. The position works if MU is effectively returning to the previous downtrend defined by the diagonal line show in the above chart. I connected the trend line using the lowest closes below the 50DMA. This downtrend suggests a downside target of $66.

However, MU already trades below the $75 price target from Morgan Stanley. All else remaining equal, MU has upside going back to $75. Accordingly, I prefer remaining bullish on MU. The last two trading options offer this upside. As a trader of extreme conditions, I naturally prefer buying into a test of the downtrend line. If enough analysts step in to defend MU, the stock could even trade back to overhead resistance at its 50/200DMAs.

Timing is everything in this trade. MU’s path to recovery from the false breakout should be a long one. Accordingly, shares or a call spread are the best options for allowing time to unfold. Since I remain wary of a market sell-off before the end of September, I ultimately prefer buying a December $70/75 call spread on further price weakness.

The Big Switch

The CNBC Fast Money crew debated the prospects for Micron Technology, Inc. Dan Nathan wondered allowed whether the semiconductor ETF SMH created its own false breakout. Guy Adami asked incredulously what changed in just the one month since analysts offered $105 and $115 upside price targets.

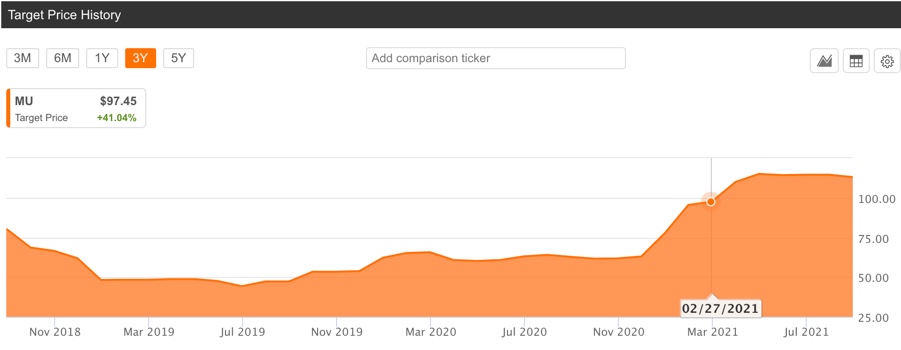

Needless to say, analyst chatter offers the a large wildcard for trading MU going forward. According to Yahoo Finance, 24 analysts cover Micron Technology with an average price target of $118. That crew provides a LOT of candidates for defenders! Seeking Alpha offers a $113 average price target. The following price target history shows analysts around or above $100 for most of 2021:

Be careful out there!

Full disclosure: long MU call spread, short MU put spread