As someone who watched too much of this year’s crypto run-up from the sidelines, I welcome the recent implosions of Bitcoin (BTC/USD) and Ethereum (ETH/USD). These top cryptocurrencies are inherently extremely volatile, so sharp and deep corrections are features not bugs for crypto traders. As long as these assets enjoy a broad fan base of die-hard believers, these sell-offs are like putting cryptocurrencies on sale. Combined extremes in Google search trends and the price drops suggest a tradable bottom is in place.

Bitcoin Bottom

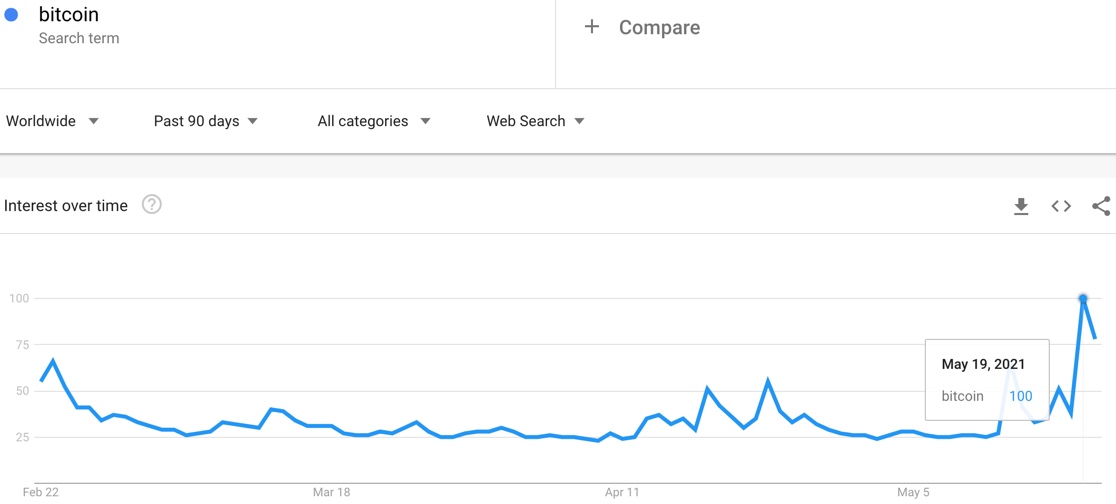

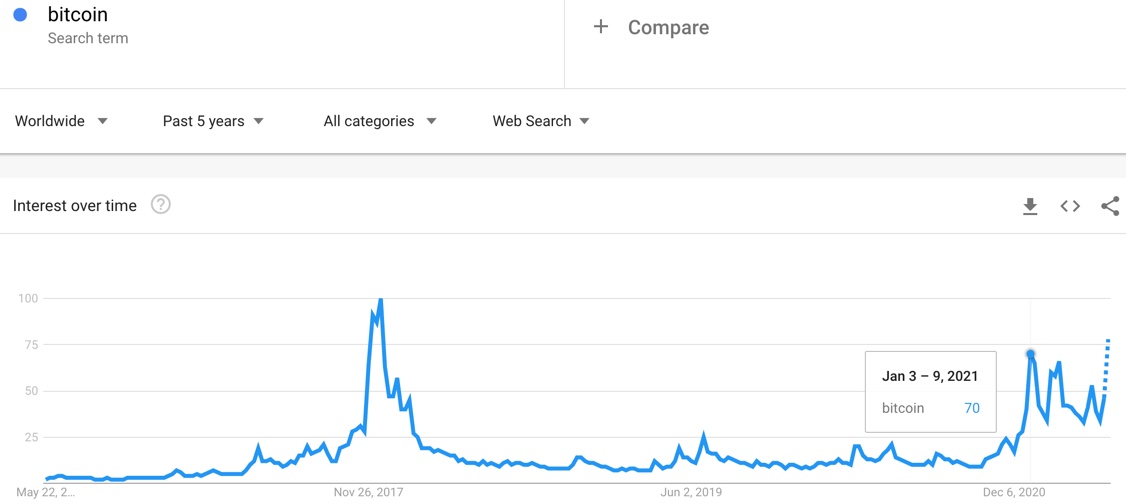

The Google Trends Momentum Check (GMTC) is flashing bright green for Bitcoin. On May 19th, worldwide Google searches for Bitcoin soared to a high over the past 90 days. Google Trends projects this week’s searches will reach their highest point since the Bitcoin bubble of late 2017 imploded. According to the GTMC, a combination of extreme search interest and extreme price action sets up the (sufficient but not necessary) conditions for a reversal in price.

Two waves define the severe price action in Bitcoin. Various tweets from Elon Musk ostensibly triggered the first wave. I have little interest in covering the correlations. Musk has become a crypto distraction and a near caricature with his capricious attitude. Fresh moves by China to ban crypto trading and mining greased the skids for the latest wave of selling. Clearly, traders are looking for excuses to sell as this news is not surprising and even a second round of the same news proceeded fresh selling pressure. China is tightening its grip on the monetary options for its citizens. The country is also securing the place of its own domestic digital currency. China’s preference for centralized control are naturally antithetical to the very existence of cryptocurrencies.

For me, the most intriguing flashpoint is Coinbase (COIN). Bitcoin topped out exactly on the day of the IPO for this crypto trading platform.

The good news, so far, is the strong buying interest over the last 4 days of intraday lows. Google search interest peaked as Bitcoin bottomed at 30,066 and a 54% plunge from the all-time high set just over a month ago. The 2021 lows from January also represent approximate support.

Ethereum Bottom

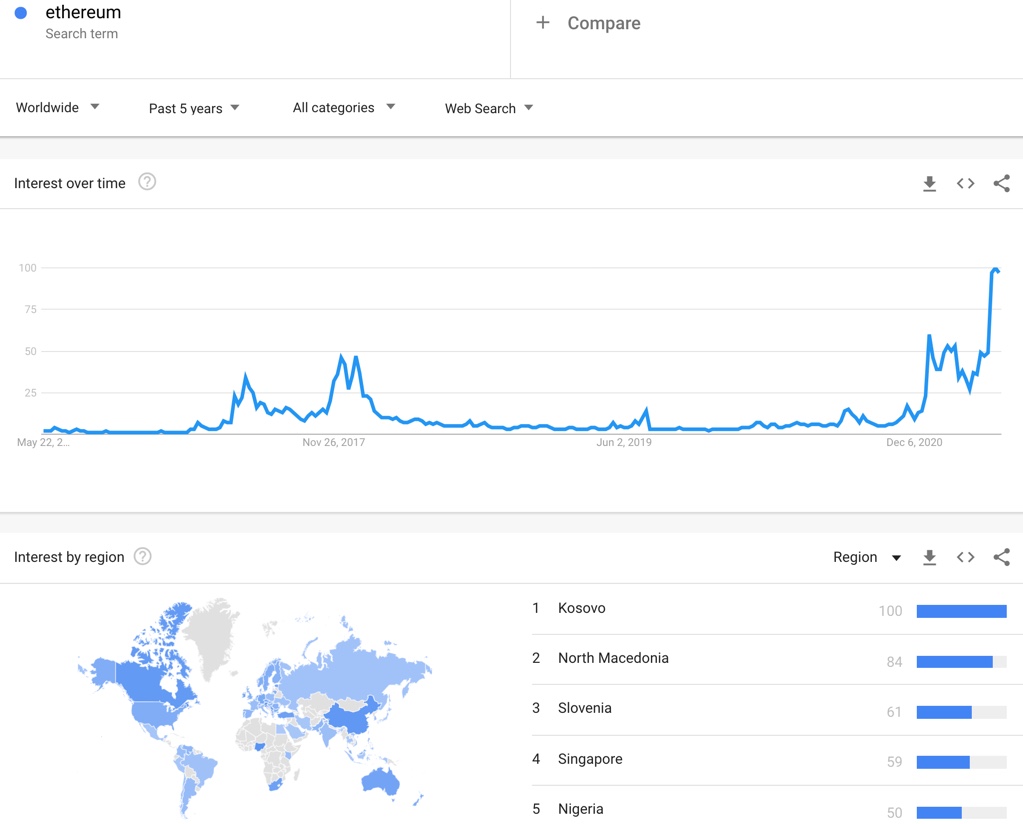

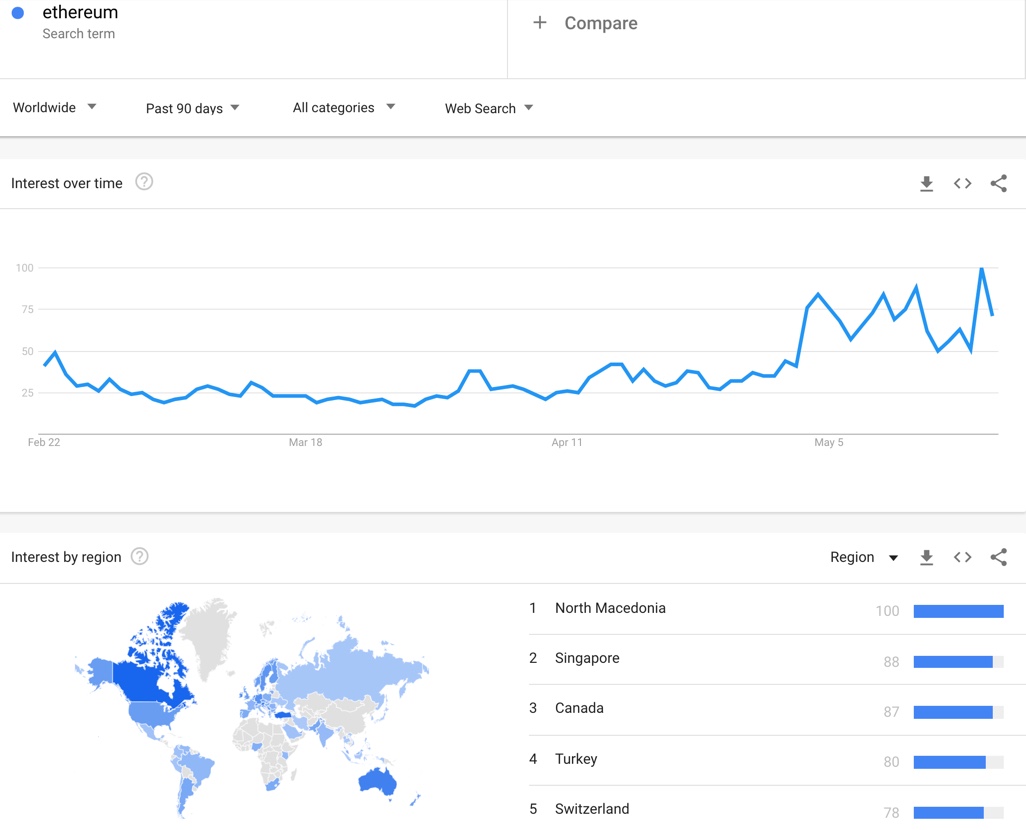

The Google Trends Momentum Check seems to work a little differently on Ethereum but similar enough. Unlike Bitcoin search interest, Ethereum search interest hit an all-time in January of this year and set new all-time highs over the past week. In fact, search interest is double its levels from the 2017 bubble days.

Zooming into the past 90 days shows that Google search interest first peaked on May 4th in the middle of a strong breakout for ETH/USD. Search interest stayed relatively elevated from there until hitting a new all-time on May 19th. Assuming the GMTC applies to Ethereum as well as it does to Bitcoin, Ethereum looks like it has reached a bottom. Like Bitcoin, buyers have aggressively stepped in over 4 days of intraday lows.

The Trade

I have accumulated fresh positions in both Bitcoin and Ethereum. I am being particularly aggressive in Ethereum given the expanding applications using the ETH platform. My current positions represent all my crypto trading profits to-date. Either I ride this house’s money from here through the next extended rally, or I get ready to accumulate even more aggressively on a (surprising) fresh wave of selling that takes Bitcoin and Ethereum a lot lower from recent intraday lows. On a fresh breakdown, I will once again lean on the Google Trend Momentum Check to assess trading sentiment.

Speaking of die-hard believers, Cathie Wood believes Bitcoin is already in a capitulation phase.

Be careful out there!

Full disclosure: long BTC/USD, long ETH/USD, long COIN