The iShares MSCI Brazil ETF (EWZ) hit its last peak on January 14, 2021 at $38.61. I was too busy trading around last week’s bearish action to notice that EWZ twice hit and bounced off the 20% correction point of $30.88. With my short-term trading call flipped to neutral, I was more keen to see buying opportunities this week. EWZ popped out to me as, once again, the Brazil ETF dropped to the 20% correction point. This time, I bought shares per my now very old, but well-tested, 20% rule for EWZ.

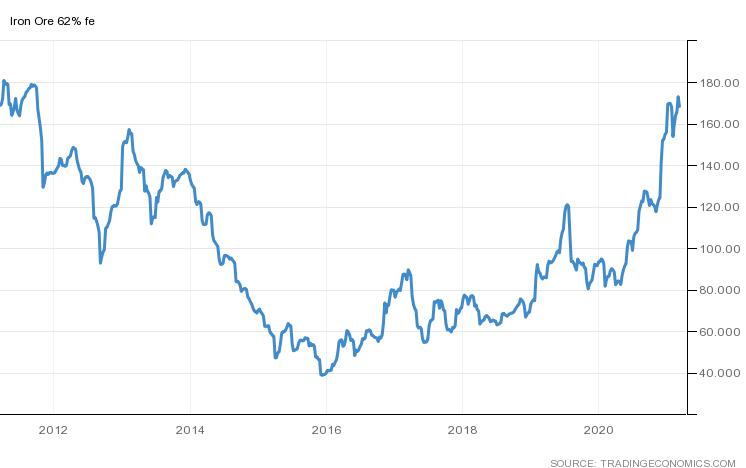

While I typically do not buy anything so soon after a 200DMA breakdown, I follow the 20% rule for EWZ no matter the news, no matter the technicals. The 20% rule is not a method for timing a bottom. Instead, the rule is a reminder of an opportunity to buy into Brazil’s longer-term economic success at a discount. In this moment, Brazil offers an attractive investment opportunity as a beneficiary of a weaker U.S. dollar and booming commodity prices, especially for iron ore. (Note that Dahlian iron ore futures plunged overnight in Asia going into Tuesday’s U.S. trading. Markets worried about temporary anti-pollution shutdowns of Chinese steel mills).

If EWZ continues to sell off, I will add more shares on a test of the October lows. A further dip to the lows of May would be an outright clearance sale. To the upside, I will sell at the recent highs if the ETF shows “too much” trouble trying to break out.

Be careful out there!

Full disclosure: long EWZ