The U.S. Senate approved the U.S.-Mexico-Canada Agreement (USMCA) trade agreement on Thursday, January 16th. That timing may mark a major milestone and turning point for the Mexican peso against the U.S. dollar (USD/MXN). The following day, USD/MXN sliced through the low of 2019 and hit a 17-month low.

I have been bullish on the Mexican peso for several years, but I have yet to stick with my positions short USD/MXN. Instead, I have chosen to take profits in increments. Last week’s trading action made me zoom out and take another look at USD/MXN.

Source: TradingView.com

The weekly chart above shows USD/MXN peaked two months after the 2016 U.S. Presidential election. USD/MXN sold off from there for about 8 months. That run was part of my initial bullishness on the Mexican peso (it was also a time when I was still tracking equities and currencies that reversed post-election euphoria). Subsequent run-ups provided new opportunities to fade. USD/MXN has printed lower highs and lower lows since its September, 2019 peak. Put it all together and USD/MXN looks like it is “rolling over” into a confirmed peak (first below the April, 2018 low and ultimately the 2017 low). I will be trading accordingly. The currency market is anticipating a stronger Mexican economy ahead.

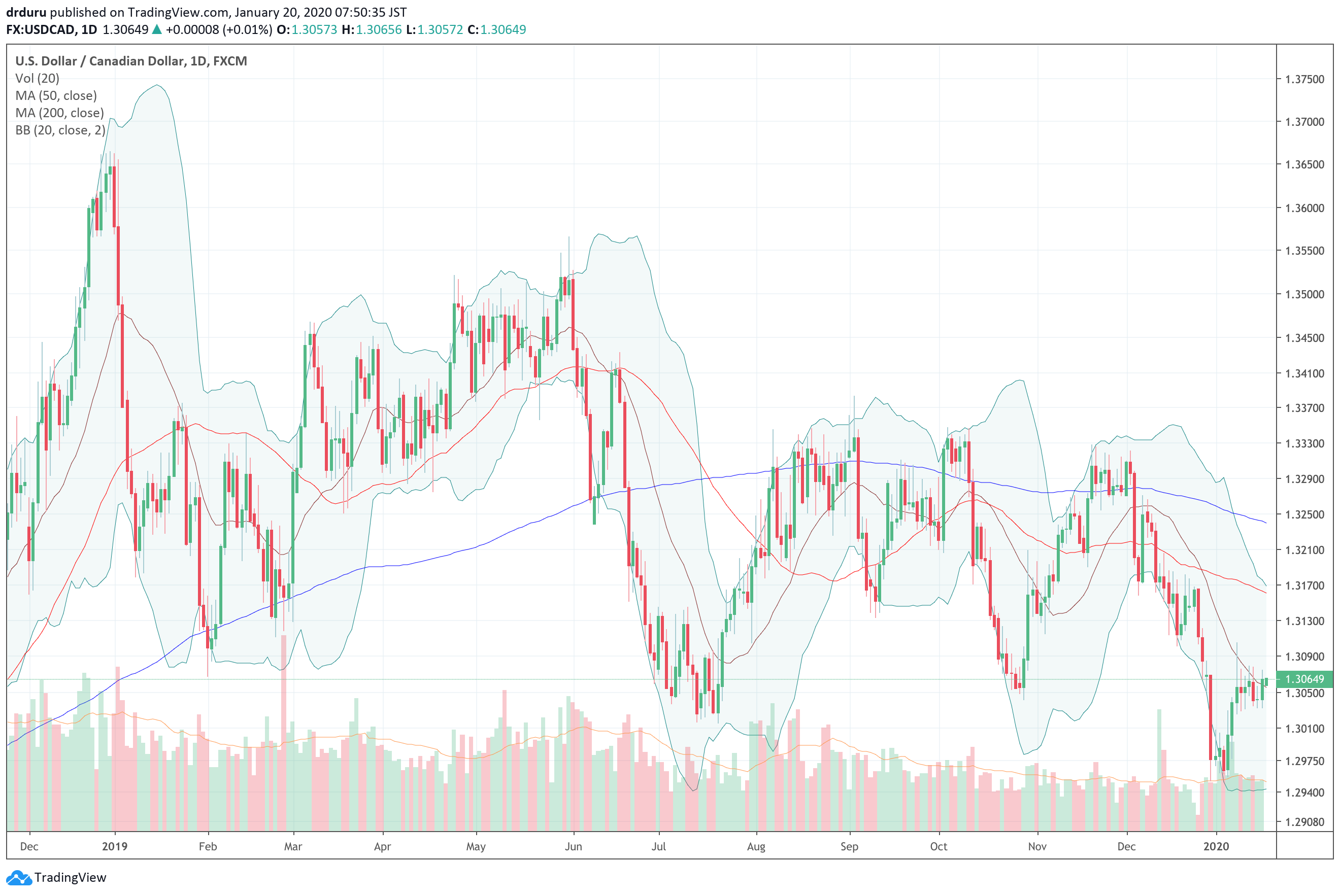

I am also bullish on the Canadian dollar (FXC), but the currency is not enjoying quite the same (relative) fortunes as the Mexican peso. USD/CAD managed to hit a 15-month low earlier this month, but rebounded sharply from there. USD/CAD was a lot lower in early 2017. I will remain patient on choosing points for fading USD/CAD rallies.

Source: TradingView.com

Adding to my bearishness on select U.S. dollar currency pairs is a U.S. dollar index (DXY) that is slowly fading. The 200-day moving average (DMA) is a critical pivot point for DXY. For 6 weeks, DXY has traded below the 200DMA. Since breaking out above the 200DMA in April, a dip in June is the only other time DXY spent time below the 200DMA as resistance.

Source: TradingView.com

The struggles of the U.S. dollar index may become the most important signal in forex for 2020.

Be careful out there!

Full disclosure: long and short U.S. dollar pairs