The Swiss National Bank (SNB) released its latest decision on monetary policy on Thursday, March 21. Apparently the warnings from the SNB were drowned out by the rallies in financial markets that day. The SNB dropped its growth forecast, its inflation forecast, and reiterated that economic risks are biased to the downside. I took particular interest in these quotes:

“Global economic activity has weakened more than expected in recent months. Growth was curbed in part by temporary factors. However, the underlying momentum in many advanced economies also slowed.

…in its new baseline scenario for the global economy the SNB has made a downward revision to its growth outlook for the advanced economies for the first half of 2019…the risks are still to the downside.

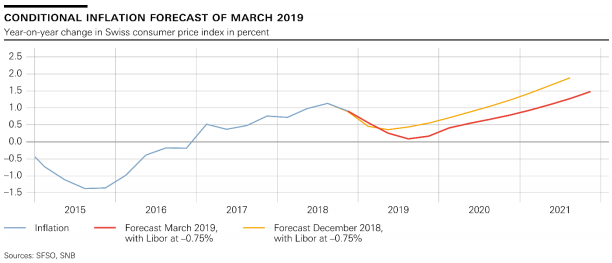

The downgrade is partially refelcted in the SNB’s reduced forecast for inflation in Switzerland. The SNB now sees inflation returning to last year’s peak just above 1% in early 2021 instead of mid-2020.

The SNB kept rates at their historic negative levels as it has done for years; nothing new there. What is notable is the recognition of increased risks in financial markets. SNB chair Thomas Jordan called them out clearly and directly in remarks during an interview:

“We have seen the downside risks have increased. We still have the conflict between America and China, we have the whole Brexit issue and the conflict between the European Commision and Italy.”

The SNB succeeded in stemming the strength of the Swiss franc (FXF) against the U.S. dollar for now.

Source: TradingView

However bigger problems in the eurozone meant that the Swiss franc kept gaining speed against the euro. EUR/CHF closed the week near its low for the year.

Source: TradingView

Given the SNB will continue to hold rates negative for the foreseeable future, I am looking for a fresh opportunity on a carry trade with the U.S. dollar (DXY). I currently do not trust any other major currencies enough to trade against the franc for such a trade.

Be careful out there!

Full disclosure: short the euro, net long the U.S. dollar