The Setup

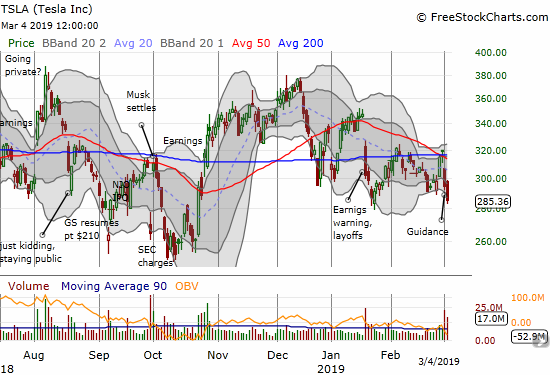

Tesla (TSLA) gapped down last Tuesday on the heels of news that the SEC wanted to go after Elon Musk for tweet contempt. Buyers stepped right in, and, with some help from more Musk tweets about imminent news, the stock shot straight up and even broke through converged resistance at 50 and 200-day moving averages (DMAs). The imminent news included guidance on Thursday evening that brought the sellers back into the stock in a big way. The latest fun came to a screeching halt after the news turned out to be loaded with negative points. On the heels of the news, TSLA lost 7.8%. The selling continued today with a 3.2% loss.

The drop caught me holding the bag on a March 1/8 calendar call spread at the $320 strike and got me thinking about the next potential trade. (Out of pure speculation, I doubled down on the remaining long side of my calendar call). TSLA is stuck in a 2-year trading range, so sharp moves tend to be reversed in short order. The stock is trendless and bounces sharply from one headline to the next. I found two interesting trading ideas, one short-term and one long-term, which I think could be combined for investors so inclined.

The Short-Term Bearish Trade

The short-term trading idea comes from CNBC’s Options Action. Michael Khouw is bearish on TSLA and discussed the benefits of buying an April/June $250 calendar put spread. As of the close on Friday, the April $250 put cost $8.00/$8.15 bid/ask. Today, this put jumped to $10.45/$10.60. The June $250 cost $18.40/$18.65 on Friday, and $21.60/$21.70 today. The calendar put spread gained another $0.80 or so in value. Depending on the fill, the cost of the position went from $10.25/$10.65 to $11.00/$11.25. The position profits as TSLA approaches $250 into the April expiration. Since $250 was strong support in 2018 – last tested in October in the wake of SEC charges against TSLA – the stock is not likely to lose the more than 12.4% required to break through that support in the next 7 weeks. However, if TSLA weakness persists, then the odds of a $250 break by the June expiration are good and will preserve and even increase net profits on the calendar put spread.

The Long-Term Bullish Trade

TSLA bulls who are fortunate enough to own TSLA stock in chunks of 100s of shares can continue playing the waiting game in the stock and profit along the way. Selling covered calls is a great tool for long-term holders of a stock stuck in a trading range. A friend of mine who publishes the TSLA Fan Insights YouTube video series explains the benefits of this investment starting at the 7:43 mark in his latest video.

A Tesla vehicle owner and stock bull gave my friend the idea. The idea is to sell a covered call with a strike $20 away from the strike price. Projected earnings are roughly 3% a month.

However, timing is still everything for an investment like this. For example, TSLA fell 25 points just on Friday. The weekly chart below as of last Friday shows TSLA went from a roughly $100 extended trading range from the summer of 2014 to the end of 2017 to a $120 wide trading range over the last two years. So, the covered call strategy could easily take an investor out the stock if the call is sold too low in the trading range. It thus makes sense to sell the covered calls into rallies toward the top of the range, say within $40 or so. Of course, it would take some time to recognize the trading range; the extended rally in early 2017 that transitioned TSLA to the higher trading range would have surely caused the stock to get called away. In other words, an investor would need a contingency strategy to guide re-entry.

Source: TradingView.com

Given what I see now, picking the right time and strike for a covered call is not easy. Fortunately, TSLA carries a lot of headline risk, both to the upside and to the downside, so options premiums are usually elevated. Timing still makes a huge difference. For the purpose of this example, I picked the $315 strike because it is $20 above Friday’s close and coincides with a convenient resistance point (the converged 50 and 200DMAs). Here are the premiums an investor could have collected over the next 5 months of expiration along with the percentage of the stock price the premium delivered for the bid price…

- March $315: $4.25/4.55 (1.4%)

- Apr $315: $13.20/$13.60 (4.5%)

- May $315: $21.05/$21.45 (7.1%; ~3.6% monthly)

- June $315: $26/$26.45 (8.8%; ~2.9% monthly)

- July $315: $29.55/$30.00 (10.0%; ~2.5% monthly

Picking an expiration 2 to 3 months out seems to be the sweet spot for targeting the 3% monthly return. The return does not include any changes to the stock of course.

Here is how the return profile changed after just a single day with a 3.2% loss in the stock.

- March $315: $2.30/2.37 (0.8%)

- Apr $315: $9.90/$10.15 (3.5%)

- May $315: $17.15/$17.55 (6.0%; ~3.0% monthly)

- June $315: $22.05/$22.45 (7.7%; ~2.6% monthly)

- July $315: $25.55/$25.95 (9.0%; ~2.2% monthly)

The return profile slipped the most for the nearer term strikes. The upshot is the gain in the stock from a rally back to the $315 resistance level would deliver a +10.4% kicker from Monday’s close.

The Combination Trade

If I owned 100 shares of TSLA I would be all about protection at this juncture. I would do another trade called a “collar” and use the $9.90 premium from April $315 call to pay $10.60 for the April $250 put spread. This net cost of $0.70 is a small price to pay for some (short-term) piece of mind. If I were a bit more bullish and firmly believed TSLA might stay stuck in a tight trading range through June, I would collected the net $0.35 premium from selling the June $315 call option and buying the June $250 put (probably just enough to pay commissions!).

If I were starting from scratch with a slight bullish bias, I would combine the April/June $250 put calendar spread with the June $315 covered call. However, since I will never own 100+ shares of TSLA, I prefer to go bullish with an April $290/$315 call spread for $9.95/$10.60 with a maximum profit potential of 151% (or risking $1.00 to make a net $1.50). On the bearish side, I like Khouw’s April/June $250 put calendar spread. For now, I am going to let my call options play out this week and afterward return to this post to think through my next TSLA setup.

Be careful out there!

Full disclosure: long TSLA calls

I’m huge long TSLA calls.

Good luck! See my updated commentary on TSLA here: https://drduru.com/onetwentytwo/tag/tsla/