General Motors (GM) and Amazon.com (AMZN), fascinating partners in anything, are reportedly going to co-invest in electric pickup truck company Rivian. The company has toiled away since its founding 2009. This rumor/news comes on the heels of Rivian’s big reveal late last year and likely confirms that the company is close to getting product into the hands of consumers.

Every time there is new major news about an electric vehicle, heads turn to Tesla (TSLA). Adam Jonas, a Morgan Stanley (MS) global auto analyst, came on CNBC’s Fast Money to discuss the implications of fresh competition for TSLA. The current king of the EV road accounts for 80% of North American unit volume and 90% of revenue, so if competition is not growing the market, then TSLA has significant downside potential. Jonas, and others on the Fast Money crew, argued that TSLA’s funding scenarios are more important than the possibilities of competition. Jonas has a fair value of $283 on TSLA.

TSLA investors, as usual, were barely fazed by the news. TSLA lost 1.2% as it slid slightly away from its 200-day moving average (DMA).

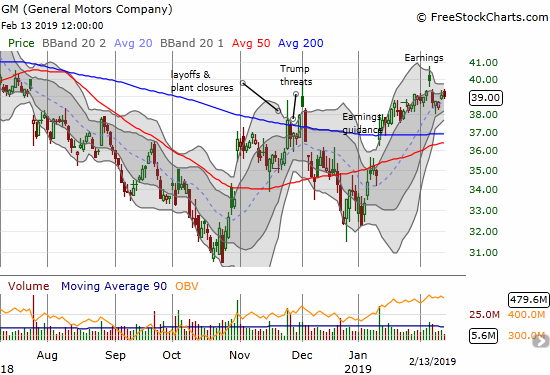

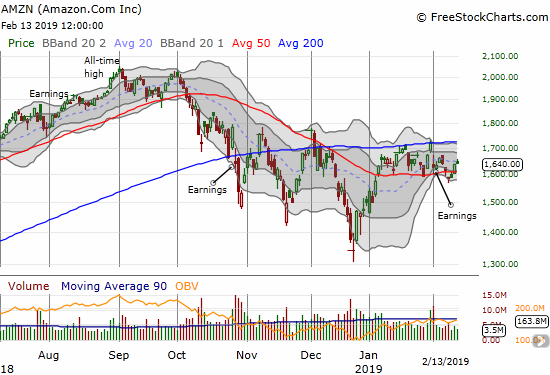

The stocks of GM and AMZN did not appear to respond either. GM faded back to flat on the day, and AMZN did the same.

I started thinking more about TSLA’s competition during the Super Bowl after Audi rolled out this funny ad for its all-electic e-tron which will be available soon and is currently reservable. Audi plans to electrify one-third of all its new models by 2025.

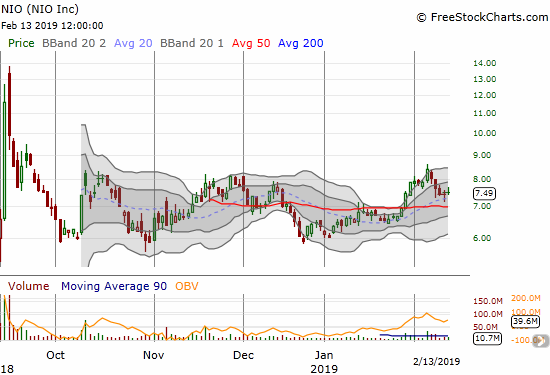

The Monday after the Super Bowl I checked in on Chinese electric car company Nio (NIO). The company came to market on September 12th and the next day soared 75.8%. The stock immediately sold off from there and has been stuck in a trading range ever since. A delivery report on January 10th failed to generate fresh excitement in the stock, but the stock did finally break out above its 50DMA 20 calendar days later.

The latest electric car company to catch fire is ElectraMeccanica Vehicles (SOLO). The company reignited excitement to the tune of a 220% gain on the day after a virtual roadshow webinar broadcast from Vancouver, Canada. The interest in the stock to the tune of 37.3M shares traded versus the previous average of about 282K vastly outstripped the one lone question asked at the end of the webinar.

SOLO has been designing and making sports vehicles since 1959, and it got into the electric vehicle business in 2015. The company has an audacious goal to close the last gas station. The Solo is a compact car designed for the solo driver. The company plans to ramp up to 20,000 cars by 2020. Prospective customers can reserve a car with a $250 deposit.

Source for charts: FreeStockCharts.com

The investable and tradeable options on the EV story continue to grow. Elon Musk, TSLA’s CEO, freely welcomes competition if it means accelerating the the EV industry. I was surprised to hear him go so far as to say he would be OK with TSLA going out of business if it meant the success of a better competitor. While I agree with others that funding issues will be more important than competition in the foreseeable future, the growing number of competitors means Musk’s challenge to the industry may one day get answered.

Be careful out there!

Full disclosure: long TSLA and AMZN call spreads