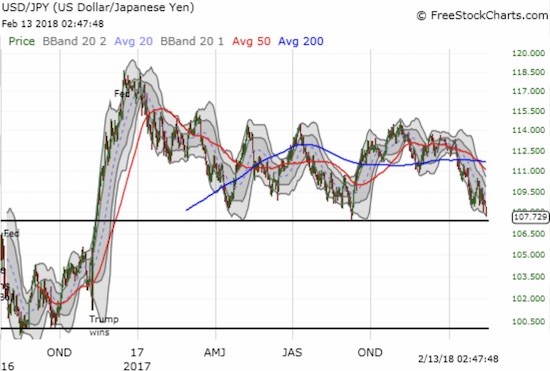

A month ago, I described the Japanese yen (FXY) as a currency on edge given a sharp and abrupt response to a feared tightening cycle from the Bank of Japan (BoJ). So far, no tightening cycle has launched, but the yen has steadily strengthened over the last month. For example, USD/JPY broke down below support at its 200-day moving average (DMA) the day after my post. Its downtrending 20DMA has guided the currency pair downward to an important test of approximate support just above 107. This “line in the sand” may be the last barrier between here and a complete reversal of USD/JPY’s big breakout and run-up from after the November, 2016 Presidential election.

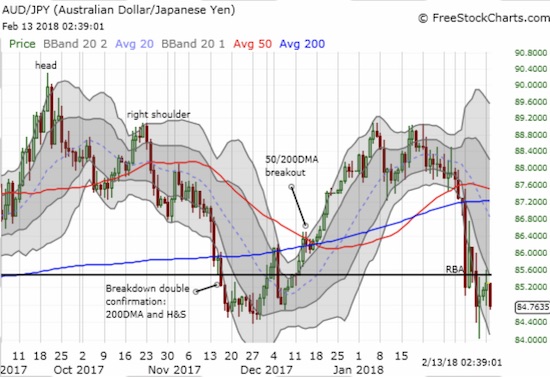

I use the trade against the Australian dollar as an indicator of market sentiment. So the on-going strength in the Japanese yen means that AUD/JPY continues to flash subtle warnings despite the positives of the current oversold condition in U.S. markets.

Source for charts: FreeStockCharts.com

I am resisting getting overly concerned by AUD/JPY’s fresh decline given its sharp decline in from September to November occurred while the S&P 500 (SPY) rallied nearly non-stop during the same period. The concern comes when/if the stock market behaves bearishly at the same time AUD/JPY sells off.

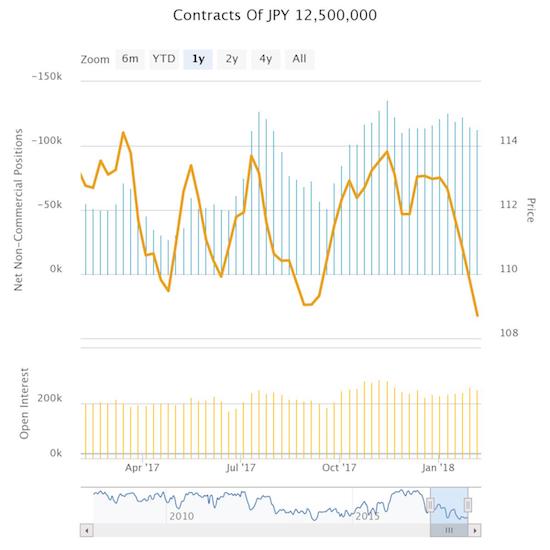

Surprisingly, speculators are facing down the on-going strength in the Japanese yen. They are sitting undeterred on top of large net short positions.

Source: Oanda’s CFTC’s Commitments of Traders

Something has to give. So If USD/JPY cracks the 107 level, a rapid shift from bearish to bullish the yen could accelerate the decline for USD/JPY. Currency pairs including the Japanese yen may be the most important pairs in forex to watch in coming days and weeks.

Be careful out there!

Full disclosure: short AUD/JPY