I wrote little about the Japanese yen (FXY) over the past year or more. It’s time to pay closer attention.

As every forex trader knows by now, on Tuesday, January 9th the Bank of Japan (BoJ) slowed down its purchase of bonds with more than 10 years maturity. The yields of these bonds ticked up and only hit one-month highs, but that was enough to send shudders through the market in a scramble to speculate on the BoJ’s intentions. Given strong economic growth around the globe and a Nikkei that just hit a 26-year high, the BoJ is increasingly the laggard among its peers in monetary policy. The initiation of catch-up could translate into a tremendous rally in the yen. The rally in the yen so far this week is like a prelude of what could happen when a tightening cycle finally gets going. Yet, zooming out, the rally in the yen has so far failed to break new technical ground.

Source: FreeStockCharts.com

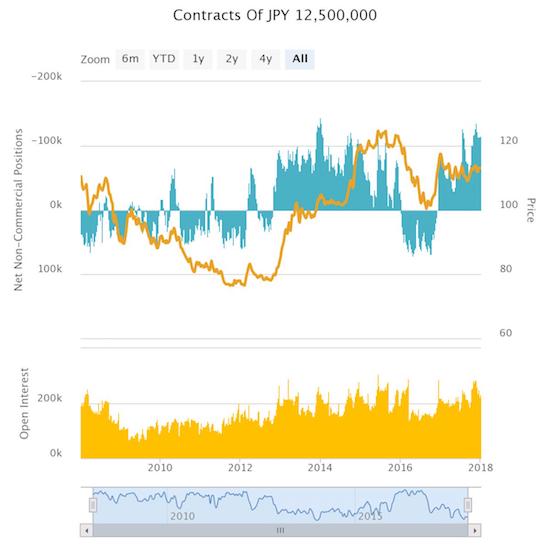

The stakes are high for a BoJ guessing game on the tightening of monetary policy in Japan. For example, speculators are sitting on a large pile of net short contracts. So it is not surprising that this week’s reaction to the BoJ’s bond moves was so sharp and abrupt.

Source: Oanda’s CFTC’s Commitments of Traders

In the meantime, traders should watch carefully for BoJ news and economic reports. The bond buying will of course receive a lot more scrutiny. Bloomberg provided a handy guide for January that I reproduce below:

Date, Time(Tokyo): Event

Jan. 11, 10:10 a.m.: BOJ bond-buying operation: 1~10 year maturities

Jan. 15, 10:10 a.m.: BOJ bond-buying operation: maturities of more than 5 years

Jan. 15: Kuroda speaks at BOJ branch manager meeting

Jan. 17, 10:10 a.m.: BOJ bond-buying operation: 1~5 year maturities

Jan. 19, 10:10 a.m.: BOJ bond-buying operation: maturities of more than 5 years

Jan. 23, Late a.m. to early p.m.: BOJ policy decision released, along with quarterly economic outlook report

Jan. 24, 10:10 a.m.: BOJ bond-buying operation: 1~10 year maturities

Jan. 26, 10:10 a.m.: BOJ bond-buying operation: 1~5 year maturities, and more than 10 years

Jan. 29, 10:10 a.m.: BOJ bond-buying operation: 5~10 year maturities

Jan. 31: Deputy Governor Kikuo Iwata speech and briefing with reporters

Jan. 31, 5 p.m.: Bond-purchase plan for coming month released

Late January: Potential appearances from BOJ officials at parliament.

Be careful out there!

Full disclosure: long AUD/JPY, short GBP/JPY