Perhaps it is the pressure of having member companies whose stock trade on public markets. Perhaps it is a coincidental divide in politics. Whatever the explanation, the split in opinion on the impact of Republican tax reform on the housing market became even more stark this week as The National Association of Home Builders (NAHB) completed its divergence from the National Association of Realtors (NAR) and got on board with tax reform. Over the weekend, the NAHB gave its full blessing and endorsement to tax reform and even touted its reported benefits to home buyers and home owners in a brief press release titled “NAHB Supports Final Tax Bill“:

“‘NAHB fully supports the final conference report on tax reform legislation and commends the work of House-Senate conferees. This comprehensive overhaul of the nation’s tax code will help middle-class families, maintain the nation’s commitment to affordable housing and ensure that small businesses are treated fairly relative to large corporations. Lower tax rates and a fair tax code will spur economic growth and increase competitiveness, and that is good for housing. We urge the House and Senate to move quickly to pass this legislation.'”

This approval and support from the NAHB marks a 180 degree shift from its previous opposition. However, this change explains and is consistent with the distinct change in positioning communicated by Toll Brothers (TOL) in its last earnings report. TOL focused on reassuring analysts that tax reform would not change the purchase decisions of its wealthier customer base.

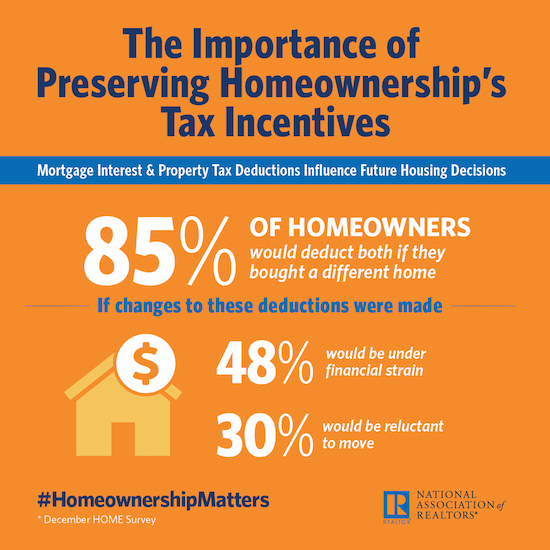

On the flip side, the National Association of Realtors (NAR) maintained its opposition as recently as December 12th. The NAR produced select findings from its fourth quarter Housing Opportunities and Market Experience (HOME) survey that “…clearly indicate that the proposed changes in the current House and Senate tax reform bills undercut the incentive of owning a home and would have a detrimental effect on many homeowners’ financial situation and future desire to move.” The NAR summarized its findings in the following infographic:

Source: The National Association of Realtors (NAR)

Note that the NAR is pointing out a negative impact on the number of real estate transactions, an important measure for realtors depending on commissions for their livelihood. Home builders on the other hand are only need to sell a home once and have little to no interest in the number of transactions that occur on that home in the future.

The NAR and NAHB are clearly on very different sides of tax reform. The NAHB’s acceptance might help explain why traders and investors so quickly moved on from the previous angst: “someone” knew the harmonic convergence was likely!

Source: FreeStockCharts.com

To get another industry perspective, I turned to REALTORS® at realtors.com. In synch with the Senate vote on tax reform, REALTORS® published an opinion piece asking the question: “Does the New Tax Plan Really Threaten the American Dream of Owning a Home?.” The article positioned itself right down the middle. Unlike the NAR and THE NAHB, REALTORS® broke out the specific numbers to present a more nuanced assessment of tax reform’s impact.

According to REALTORS®, most home owners and buyers should not see any impact: “the new cut is expected to affect only about 1.3% of new mortgages.” The major pain will be felt in high-cost, high-tax areas: “Washington, DC; California; Hawaii; Massachusetts; and New York.” These areas have homes with median prices in excess of the new $750K cap on mortgage debt eligible for a deduction. Residents in these areas will also get slammed from the reduced ability to write off high bills from state and local property and income taxes. As a result of this analysis, REALTORS concluded with a classic economist’s conclusion…on one hand – on the other hand:

“Whether or not they can deduct the mortgage interest is not likely to dissuade too many people from buying. Homeownership is the American dream, after all. Conventional wisdom says it’s an opportunity for the middle class to build equity and wealth over time. Plus, many folks don’t like the idea of forking over their hard-earned cash on rent or not being able to modify their abodes as they wish.

But the changes could dissuade some buyers on the margins to continue renting. That’s because when these more cash-strapped folks do the math, they won’t be saving nearly as much by owning the roof over their heads.

This could lead to housing prices to fall. Or, if more prospective buyers suddenly see more money in their paychecks thanks to the tax cuts, they could enter the market. And that could push prices up.”

I was surprised by the expressed optimism about the power of the American dream to conquer economic decision-making. I was also surprised to see the conclusion depart a bit from the original premise that the vast majority of Americans will feel no impact. Regardless, it appears that tax reform is not part of a disinvestment thesis for home builders at this juncture. Yet, until some evidence emerges that buyers with lower tax bills and/or higher wages from companies with lower tax bills feel wealthy enough to buy homes they otherwise would NOT have purchased, I will go forward with a baseline assumption that tax reform will not deliver added stimulus to the housing market.

Be careful out there!

Full disclosure: long TOL call options