When speculators finally flipped bullish on the British pound (FXB), it looked like the action came right as the currency was making a peak against the U.S. dollar (DXY0). The timing of my observation happened to mark the bottom for GBP/USD, and now speculators have backed down from their nascent pound bullishness. They now hold a very slight net bearish position on pound contracts.

Source: Oanda’s CFTC’s Commitments of Traders

Source: FreeStockCharts.com

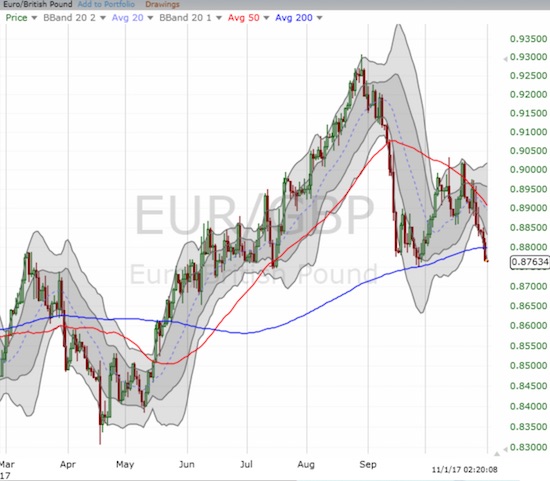

The pressure is building for GBP/USD as the pivoting around its 50DMA is converging upon the intraday low from the first post-Brexit day. Given the uptrends in both the 50 and 200DMAs, odds favor an upside breakout. Supporting strength in the pound is its resurgence against the euro where EUR/GBP just broke through critical support at its 200DMA. This breakdown confirms the downward sloping 50DMA as resistance.

Source: FreeStockCharts.com

Overall, the pound is at a critical juncture here. I am still inclined to bias bearish against the British pound, but I have to respect the charts here. Going forward, I will be watching the moves of speculators for potential (contrary?) clues. Ultimately, the Bank of England’s (BoE) on-going chatter about what it MIGHT do will likely rule the day (another meeting and interest rate decision coming up this Thursday) even as trading dives into a week heavy with economic data and a U.S. Federal Reserve decision on monetary policy.

A key quote from Bloomberg in a pre-BoE article:

“So far, though, pay is not accelerating. More important, the economic outlook is getting worse: Investment and business confidence may come under increasing pressure as the Brexit nightmare unfolds. Changes in interest rates take time to affect the economy, so by the time any increase starts making a difference, there might be more slack, not less. That would force the bank to reverse itself — making monetary policy a source of added instability.

Granted, consumer debt is rising fast and could become a threat to financial stability in its own right. However, this problem can be addressed without changing interest rates. The bank has already used so-called macro-prudential policies for this purpose, and should do more.”

Be careful out there!

Full disclosure: long and short positions on all mentioned currencies

Sell the hike I suppose. Amazing they hiked but it was well leaked/forecasted. Hard to find any trends to play in forex currently.

What I find really interesting currently is bitcoin. The terminal value in say 5 years is likely to be zero. Sizing a short is very difficult though. I went short 2 bitcoins today at $7000 USD. How much should I allow to buffer out volatility. Should I set a stoploss at say $8000. Or should I set no stoploss as the terminal value is likely 0. But then if I set no stoploss I would have to put aside in margin the maximum it could go to which some people say is 500k or something ridiculous. But the. The probability of being stopped out is higher if I set a stoploss. It is very volatile though and pure sentiment trading. Fascinating stuff. Have a look into it if you haven’t.

Took a loss on the bitcoin short. I had been long a few weeks ago and it is definately easier being long on the right side of this parabolic trend. At some stage though, it will be a very good long term short. I’ll have to have a long think about the conditions under which a short would be compelling. Selling blow offs in a parabolic trend probably not very practical.

Imagine this though, say bitcoin goes to 100k. Being short a couple of bitcoins could be very rewarding. But how to know when it has topped out. I suspect it will be an early indicator of liquidity reducing so maybe a better short than Tesla or Nasdaq in the early stages of a deleveraging cycle. Excess liquidity went to Dotcom in the late 90’s and it appears to be going to crypto recently.

This could be one to keep a close eye on but to be ultra slow in shorting. It may well get way more overdone than supposed or what I imagine. I will have to think of some rules to apply to myself, a checklist before I can consider shorting bitcoin again – like clear topping out in global liquidity, other correlated markets indicating reducing liquidity, clear topping pattern.

I would say if terminal value is zero in 5 years, you should size your position to enable you to hang in there long enough. You can see from past volatility that this thing soars to crazy heights, crashes, and repeats.

I don’t see how Bitcoin can be valued beyond what the current flavor or momentum of the day says. There is no way to think through just how expensive Bitcoin is. It does not serve a critical purpose yet; that is, we can still do without it. On the flip side, new crypto currencies can be created out of thin air…meaning they are just like fiat money but with the downside of zero backing from any store of value. Good luck on trading this one. I have to stay out of this battleground!

It’s a bubble DD. No point overthinking it. In fact, it sounds like you know more than I do about Bitcoin and 10X more than the average bitcoin investor. Not sure about why you are averse to trading it though, because it is very tradable and in play.

Someone told me once, if you hear something is in a bubble, the first thing you should do is go buy it. So I did that with Bitcoin. Then I sold too early and shorted way too early. Participation in a bubble with ratcheting stoploss is probably lower risk than trying to pick a top.

That’s a great insight. I think the lesson to buy a bubble the first time you hear about it is because if you are even semi-involved in markets, you are not likely the last person to learn about it.

I have listened to several extended podcasts about bitcoin. So I know a lot about what it is. What I don’t know is the trading behavior or patterns or the specific mechanics of doing so. I have my hands so full right now, I am just very averse to adding yet one more thing to juggle and worry about managing.

Yes, quite true. It takes a few months to get the feel of a market and if you have enough already, no point in adding another unless you have time or find it particularly interesting.