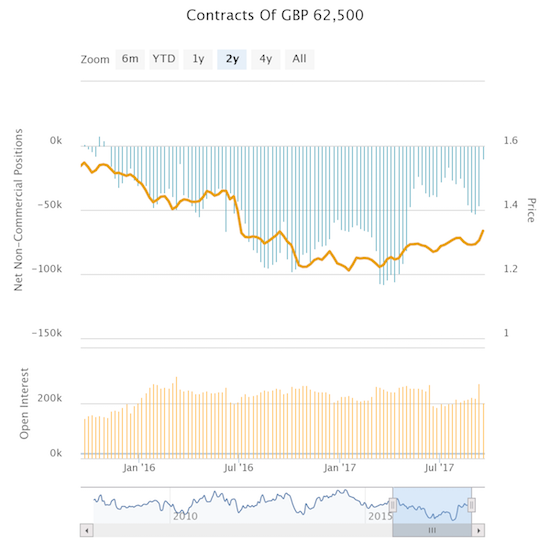

In one fell swoop, the Bank of England’s (BoE) hawkish posturing flushed shorts out of the British pound (FXB). The net short position of speculators has not been this low ever since the latest wave of currency bearishness began against the British pound.

Source: Oanda’s CFTC’s Commitments of Traders

This rapid closure of shorts helps explain the rapid burst of strength in the British pound in the wake of the BoE’s statement on monetary policy. While that week ended with another burst of strength, last week the pound failed to make much net incremental progress. This stasis means the coming week could prove pivotal in demonstrating whether the market is convinced that the BoE means business on future rate hikes. As I stated earlier, I am skeptical, but I have adjusted my trading strategy to the new momentum.

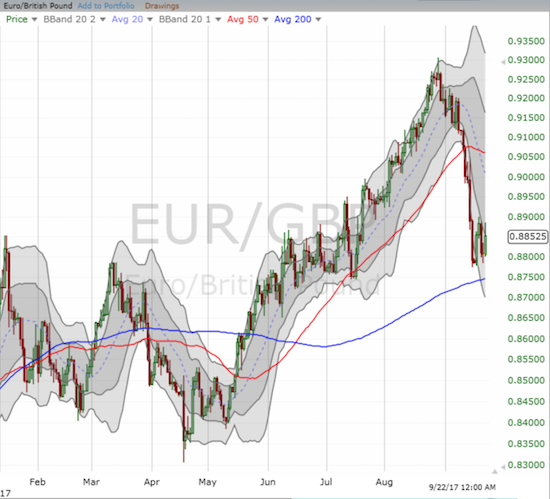

Source: FreeStockCharts.com

Be careful out there!

Full disclosure: long and short various currency pairs against the British pound

GBP like CAD, there can be a very quick 800 point move when short covering occurs. GBP Shorts were spooked after that move but I think they have started moving in again. The German election appears to be the catalyst for an overdue correction in the euro. I am starting to find Euro interesting as a buy again, but

NZD and sugar look interesting. I’ve taken a long position in both today. There could be some more blowback from the NZ election, but I don’t think it changes the medium term value of NZD.USD

What’s the catalyst for sugar? I am looking at a chart of the ETN SGG, and the technicals still look pretty bad.

EUR/USD broke down below its 50DMA, so I am a little less enthusiastic about the euro for the first time in a while. 🙂 In fact, I see hints that the U.S. dollar is in the early stages of a bigger relief rebound.

I haven’t traded sugar before but I took a position to get long softs as I had sold out of the others and it has been down 8% in 3 trading days so I figured a relief rally was overdue. But I was too early there. Should have stuck to bitcoin!

With currencies, I am not sure if there is much juice left in this dollar rally. Imputed odds are 70% now for fed hike in Dec. Don’t see it going much beyond 80% in the next month. Euro I am waiting for 1.167. Yen is already at a nice level above 113 so I bought some yen today. NZD, I may have been early. I think the election result weakness will get unwound in the next 3 weeks when a coalition forms in NZ.

Perhaps the dollar could rally on some different catalyst? What if economic data – minus hurricane effects – comes in even hotter? Odds for additional rate hikes could start soaring.

As long as SGG holds August low, you could still be good on sugar?

As always, good luck on NZD! I have nothing to offer there. 🙂

Hopefully the August low will hold for sugar in terms of my trade. Was definitely ill timed in terms of entry.

Dollar, very true, a rash of good data could bring strength. However, I think the other CB’s have cottoned on to the idea that they don’t want too much dollar strength again. So if prices started factoring in more fed hikes next year, the ECB would probably take the opportunity to fast track tapering QE or emitting something hawkish. So I think there is a good chance euro is range bound. Just what the bottom of the range is will be interesting. I am a buyer at 1.167. Even if there is a hot spot for inflationary data and the market prices in more rate hikes, I would expect the fed to walk back further rate expectations because they would not be hiking on short term data fluctuation.

I think Yellen had been indicating fairly clearly that Dec was likely so it was odd when the market was pricing Dec at only 30-40% last month. But 70% now is about right. It could go the other way and price in more hikes next year but that would be very, what would be the right word, from one extreme to another ? I guess it can’t be ruled out, but would be less

likely.

I *think* the ECB would prefer a much lower euro. So I am not expecting them to look at current weakness as an opportunity to hurry up with tapering. I agree the euro is rangebound at best given this 50DMA breakdown. The US dolarl index broke out above its 50DMA downtrend so it is definitely time to take a bottoming seriously!

Yes, quite true DD, the ECB want a lower Euro and 1.2 seems to be a limit for them. My reading is they will tolerate a higher euro for world macro stability. So I guess it depends on how China is going. It seems no one really wants new highs in the dollar though so that will be a headwind.

I suppose the other way of looking at the futures pricing is that the next rate hike (Dec) is now richly factored in. There is a risk of a dollar breakout but also risk data dissapoints in the next month and they wind back the hike expectations. The technicals are worth watching but I think they will grind around a range for a while. My base case scenario is minor dollar rally into rate hike Dec but sell on the news because if they do hike they will be out for a while if the data is not very robust. Or we may see a breakdown earlier if the data are not so good.

On a broader note I was thinking about what my goals are. Do you have any goals with your trading or investing ?

I think the most common pattern is a move in anticipation of a move and then a reversal of at least part of that move IF the Bank fails to forcefully communicate that more is on the way.

My goals for forex trading are just to keep getting better, cut losses sooner, and have well-defined theses for making entries.