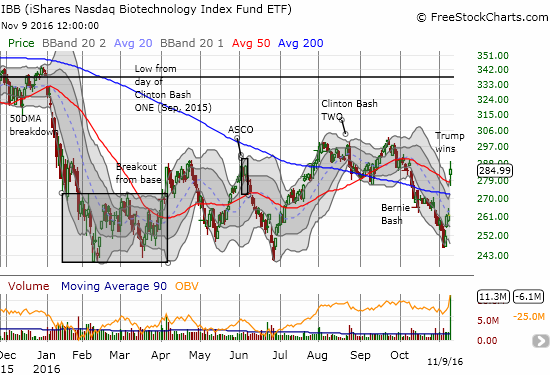

The iShares Nasdaq Biotechnology (IBB) suffered three important “bashes” starting in September, 2015 when Secretary of State Hillary Clinton promised to end price gouging by drug makers. Since then, a similar promise in August created a fresh top in IBB and a bash by Senator Bernie Sanders created a breakdown below 200-day moving average (DMA) support.

Source: FreeStockCharts.com

A Donald Trump victory in the U.S. Presidential election breathed new life into the sagging ETF. The chart above shows that IBB gapped above resistance at BOTH the 50 and 200-day moving averages (DMAs). IBB closed with a whopping 8.9% gain.

Perhaps most importantly IBB finally overcame a bash. The Bernie Bash is now in the rear view mirror. Assuming the 50DMA now holds as support, I foresee a quick test of Clinton Bash two around $300. Unless a triple top is in IBB’s future, a fresh rally should challenge the levels from the first Clinton Bash. This trade is one of many Trump-related trades now on my radar…

Full disclosure: no positions