(This is an excerpt from an article I originally published on Seeking Alpha on October 11, 2016. Click here to read the entire piece.)

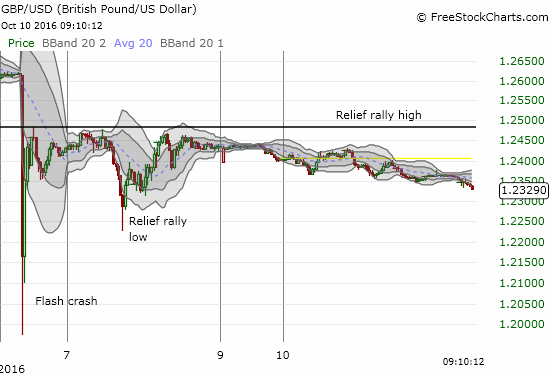

The panic in the British pound (FXB) became unmistakable last week as the currency experienced a flash crash. {snip}

The presumed driver of the rush to sell soon after the close of U.S. trading October 6th while liquidity was surely poor was commentary from French President Francois Hollande insisting that the EU posture firmly against the UK over Brexit. {snip}

Whatever the specific catalyst, traders were clearly on edge after UK Prime Minister Theresa May started the last trading week by rolling out the calendar for Article 50, the trigger for UK’s exit from the European Union. {snip}

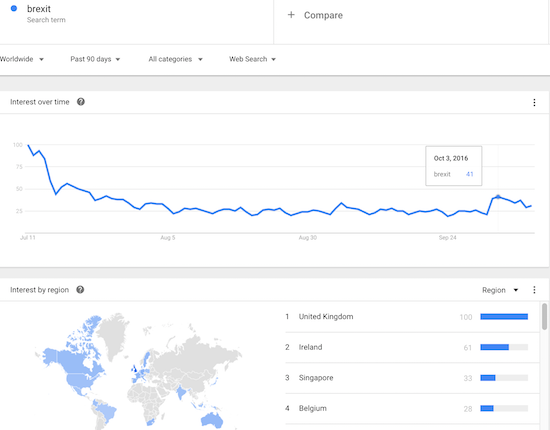

Source: Google Trends

{snip} Reuters briefly reported on leaked government documents, reportedly seen by the Financial Times, that supposedly estimate a 66 billion pound per year loss to the UK economy on Brexit and a cratering of GDP by 9.5%. {snip}

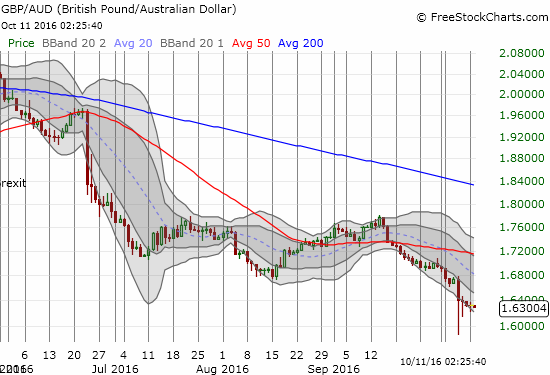

The bulk of the article referenced analysis from Princeton University professor Ashoka Mody, the IMF’s former deputy-director for Europe. He emphatically claimed that the British pound was 20% to 25% over-valued prior to Brexit. Mody views a march to a “fair value” of $1.10 on GBP/USD is providing a welcome rebalancing to the UK economy…

{snip}

The inability of a second month of strong post-Brexit economic news is case in point demonstrating the anchor tied around the pound’s ankles. {snip}

So while the British pound burns, the UK economy heats up.

Source for charts: FreeStockCharts.com

Be careful out there!

Full disclosure: long FXB and net long the British pound (but not likely for much longer for either one!)

(This is an excerpt from an article I originally published on Seeking Alpha on October 11, 2016. Click here to read the entire piece.)