(This is an excerpt from an article I originally published on Seeking Alpha on June 26, 2016. Click here to read the entire piece.)

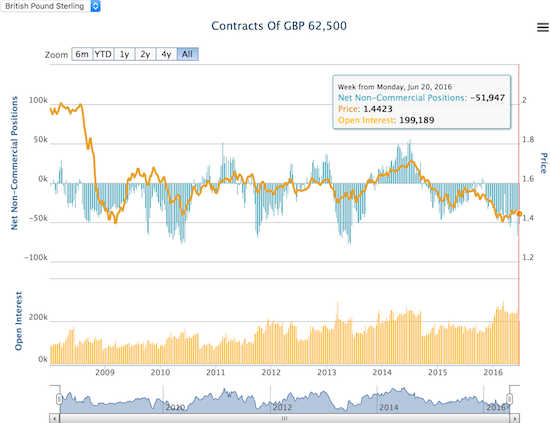

The British pound (FXB) suffered a historic plunge in the wake of Brexit’s victory, the beginning of the UK’s divorce from the European Union (EU). While headlines have been full of shock and expressions of surprise, speculators apparently were little surprised. {snip}

Source: Oanda’s CFTC Commitment of Traders

The collapse in the British pound did not happen at once. The fall was a cascade… {snip}

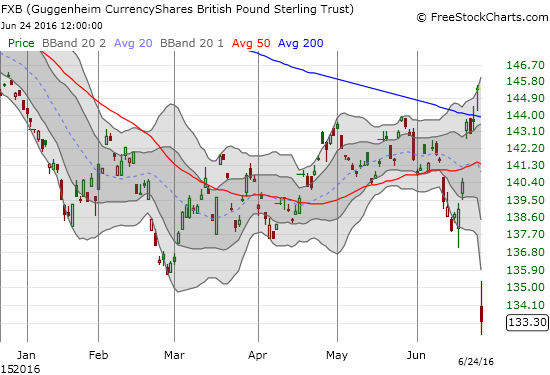

Source: FreeStockCharts.com

Live Brexit results: https://t.co/CGLRFEa36c $GBPUSD $GBPJPY "Larger than expected turnouts for Leave in Newcastle, Sunderland"

— Dr. Duru (@DrDuru) June 23, 2016

The news that something unexpected had happened in the voting results was the first clue that something was amiss. {snip}

This selling process is the anatomy of a bottom for the British pound. At its worst, the British pound hit levels last seen in the 1980s – that move covers a LOT of post troubles. However, the currency managed to bounce back to close right around the lows of the financial crisis. {snip}

It SEEMS most of the selling pressure has flushed out. {snip}

Click image for larger view…

Source: FXCM.com

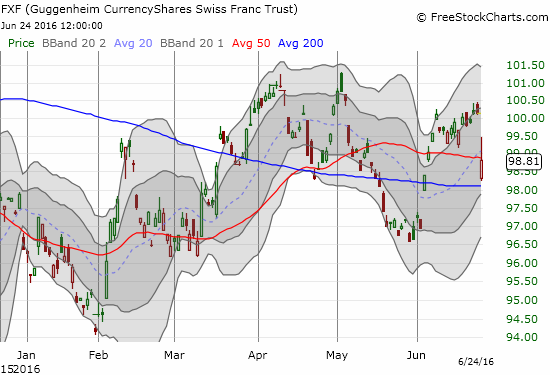

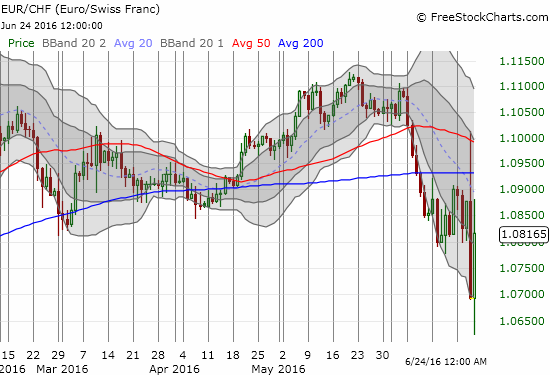

{snip} There are several ways to see how the Swiss franc failed to provide an adequate hedge against the plunge in the British pound. First, there are the ETFs…{snip}

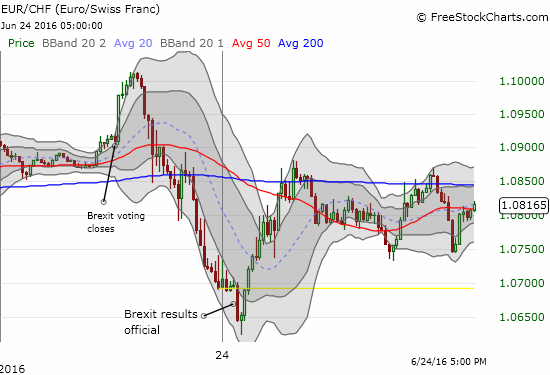

{snip} The Swiss franc also failed as a net hedge given EUR/CHF closed right at the lows of the recent trading range. The 15-minute chart shows that the Swiss franc’s strength was as swift as the British pound’s losses but the franc’s was relatively small.

If the Swiss franc was indeed supposed to provide an effective hedge, perhaps its relatively poor performance as a hedge is one more hint that the British pound’s worst losses are already behind it. Time should soon tell…

Full disclosure: net short the euro and the pound

(This is an excerpt from an article I originally published on Seeking Alpha on June 26, 2016. Click here to read the entire piece.)