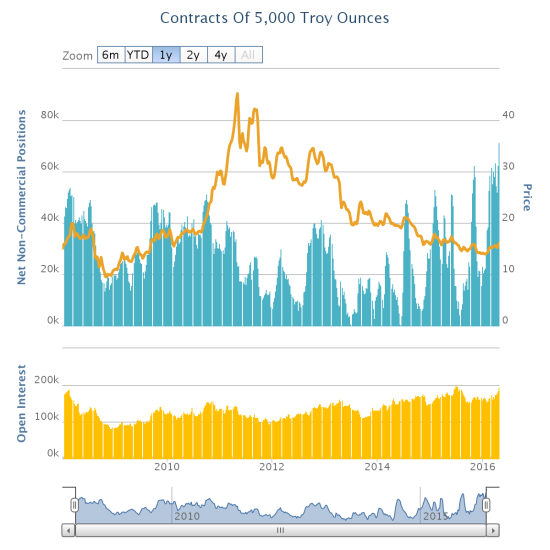

Last week’s report from the CFTC’s Commitments of Traders shows that speculators ramped up net longs on silver to levels unseen since at least 2008. I call this “maximum bullishness.”

Source: Oanda’s CFTC’s Commitments of Traders

Since June, 2014, the peaks in run-ups of net longs have generally trended higher and higher. Those buying sprees did not deliver lasting bottoms until the last trough last December and January. As iShares Silver Trust (SLV) began its latest rally in February, speculators quickly went to net 60K long contracts. Last week, they finally hit a new high of 71.4K net long contracts. That milestone was accompanied by a gap up and breakout of SLV.

Source: FreeStockCharts.com

Overall, sentiment looks strong and healthy for SLV where buying the dips makes a lot of sense. I continue to hold a core SLV position (and in miner Pan-American Silver (PAAS)) and occasionally trade in SLV call options. I sold the last call options into last week’s big move upward. I am now waiting for Wednesday’s Federal Reserve meeting before deciding what to do next. However, I am guessing if SLV fills its last gap up, I will treat the move as my next buying opportunity for a swing trade.

Be careful out there!

Full disclosure: long SLV and PAAS