The following data cover the latest from the CFTC’s Commitment of Traders as reported by Oanda from the week of Monday, March 21, 2016. From Oanada:

“The Commitments of Traders (COT) is a report issued by the Commodity Futures Trading Commission (CFTC). It aggregates the holdings of participants in the U.S. futures markets (primarily based in Chicago and New York), where commodities, metals, and currencies are bought and sold. The COT is released every Friday at 3:30 Eastern Time, and reflects the commitments of traders for the prior Tuesday.”

In this edition of “Forex Critical”, I focus on notable changes in the currency positioning of non-commercial traders, also known as speculators. While speculators do not necessarily drive market action, they can provide good proxies for the market sentiment that DOES drive currency moves. Wherever meaningful, my snapshots of currency charts show U.S. dollar currency pairs to provide a common point of reference and a direct comparable to the charts provided by Oanda (the yellow line in the positioning charts). These charts come from FreeStockCharts.com. I provide Oanda’s embeded tool at the end of this post for your convenience.

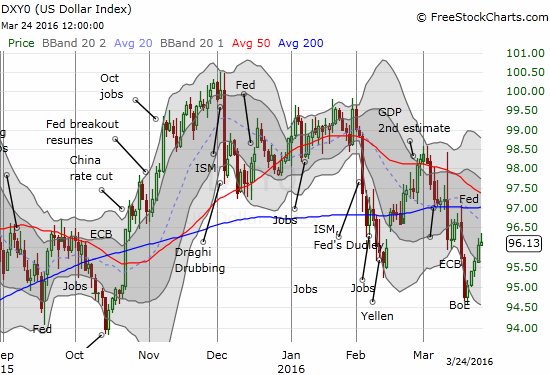

The U.S. dollar index

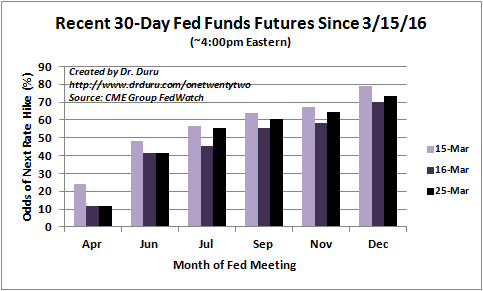

For context, the U.S. dollar index (DXY0) has been recovering since a huge 2-day post-Fed loss. The index reversed half its loss in a little over three days. Perhaps within 2 or 3 days, all losses will get reversed. Expectations on rate hikes are a likely driver. After the Fed’s March announcement, expectations for the next rate hike dropped from July to September. Those expectations are now back to July.

The British pound

Perhaps the previous week’s plunge in net short interest on the British pound (FXB) was a random blip. THIS week, speculators are suddenly back in the game betting against the British pound. They clearly seized upon the previous week’s surge in the pound off the Bank of England’s (BOE’s) statement on monetary policy as an occasion to refresh shorts at a better price. This quick shift and re-shift reminded me to avoid over-extrapolating one week moves. The bias for speculators remains heavily against the British pound.

The above chart suggests that the 50-day moving average remains an important level of resistance for GBP/USD. The previous two breakouts look like false breakouts. Overall, the British pound looks like it is settling into a range right around or just below the plunge where London’s mayor publicly sided with the “Leave” side of the Brexit referendum drama. I have adjusted my trading on the pound accordingly.

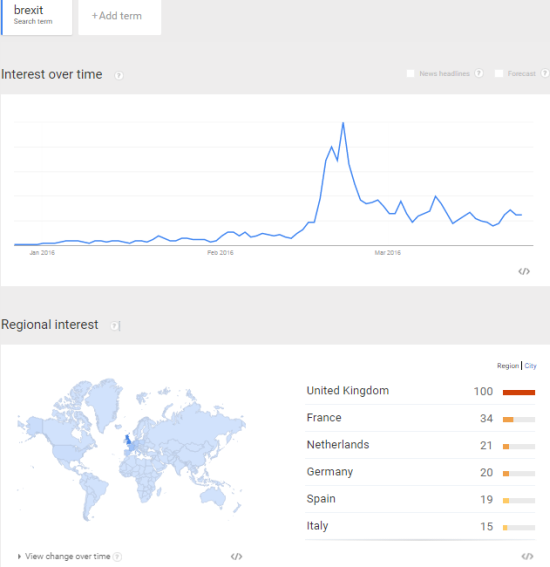

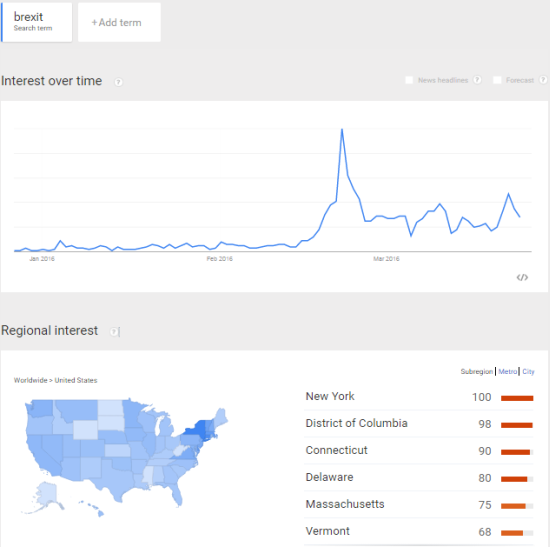

Google Trends shows that search interest – a proxy for market sentiment – has stopped dropping from the highs of the referendum decision. Sentiment is stabilizing within a range, and I imagine will remain this way until the referendum approaches. Since the U.S. does not crack the top 6 of countries interested in Brexit, I created a separate view of the U.S. New York and Washington D.C. are far ahead of other states in their interest in Brexit. In general the Northeast dominates Brexit interest within the U.S. I was a little surprised that California could not beat out the former British colonies of Connecticut, Delaware, Massachusetts, or even Vermont! Maybe there is a historical connection going on here. Going further down the list of states (not shown in the snapshot below), Google Trends shows New Jersey, New Hampshire, Virginia, and Maryland (an index of 50).

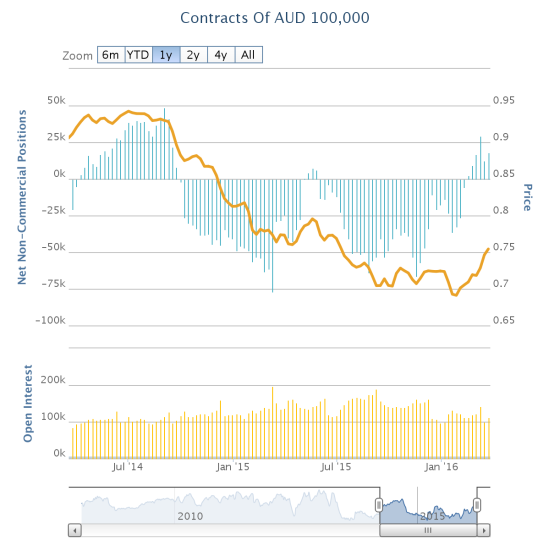

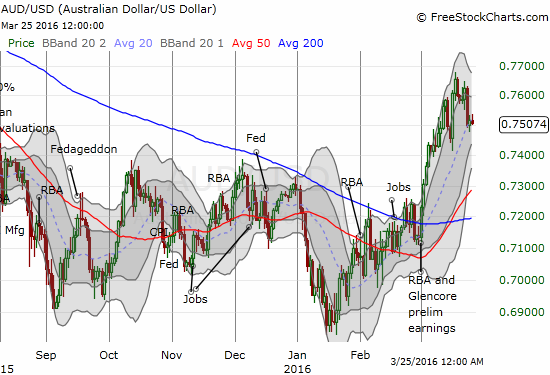

The Australian dollar

Like the British pound, the Australian dollar (FXA) looks like it has bounced back to previous sentiment. I had interpreted the previous week’s drop in net longs as potentially signalling the end to the Australian dollar’s run-up. The Aussie’s momentum has definitely slowed a bit since then, but speculators are still firmly bullish relative to all the bearishness since October, 2014. This positioning bodes well for bullishness in financial markets.

Like speculators, I positioned myself net long on the Australian dollar for the first time in a VERY long time. I am NOT yet comfortable with this shift given my stubborn bearishness on iron ore. However, I am not going to argue with the market at this juncture.

Be careful out there!

Full disclosure: net short the British pound, net long the Australian dollar