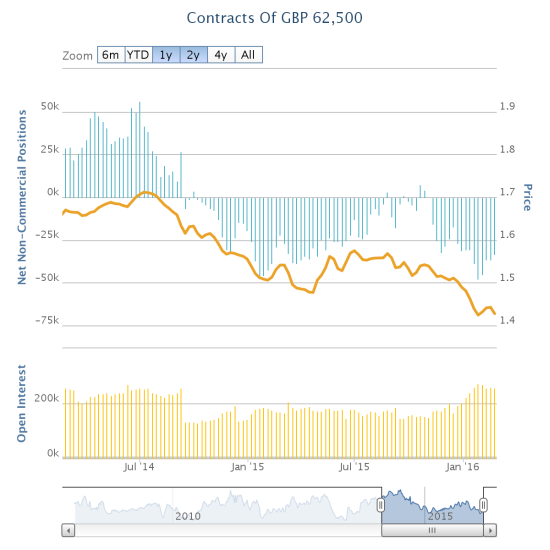

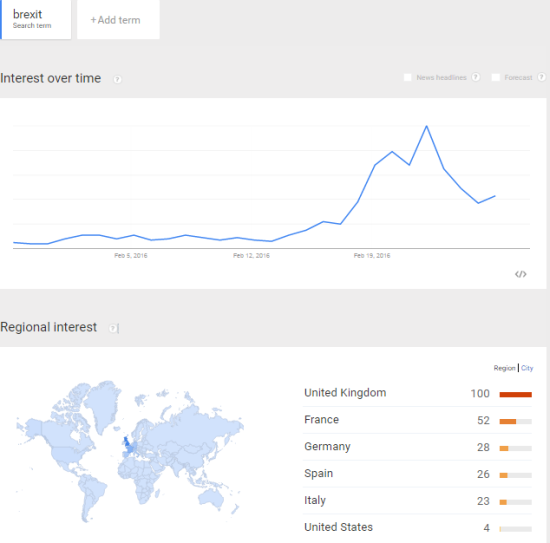

As I wrote in “Forget The Yuan – The Devaluation Of The British Pound Is Breathtaking,” I was eager to see how speculators would respond to the setting of a date for a referendum on “Brexit” and the subsequent stated support for Breixt by London’s Mayor. These vents heightened the stakes for Breixt; they sent traders first rushing into the pound and then rushing out of the pound with even more force for two days. If speculators responded with a surge in net shorts, I was going to assume a continuation in the pace of the current downtrend. If speculators responded with a continued retreat, I was going to assume that the losses in the British pound (FXB) would abate consistent with the cooling in Google Trends interest in Brexit. The vote is in. Speculators continued their retreat from the recent peak in net shorts. The current level is a 6-week low.

Source: Oanda’s CFTC’s Commitments of Traders

I am a bit surprised that the response was so muted. I expected a significant response one way or the other. Given this mild response, I will assume for now that the pace of losses for the British pound will continue to abate in line with the cooling in interest in Brexit.

Source: Google Trends

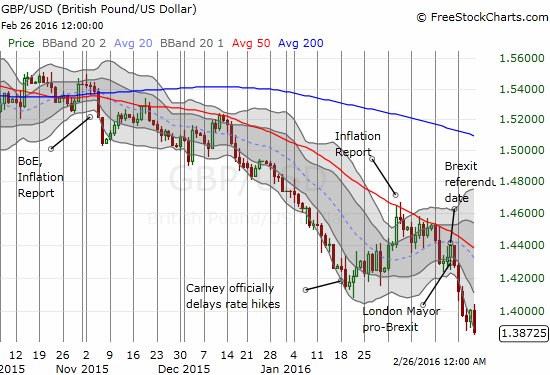

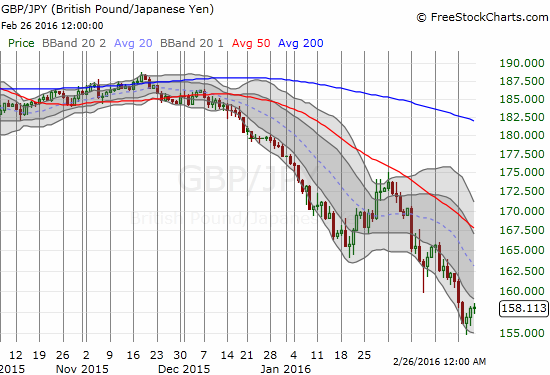

The forex picture for the British pound was mixed on the week. From Sunday to Tuesday, the pound definitely weakened across the board as the fall-out cascaded from the Mayor of London coming out in favor of leaving the European Union (EU). After that point, the pound strengthened against the Japanese yen (FXY) while it continued to slip against the U.S. dollar (DXY0). The U.S. dollar index strengthened most notably on Friday on the heels of a strong GDP.

Source: FreeStockCharts.com

The battle of words through op-eds on the Daily Telegraph continued. This time Prime Minister David Cameron wrote to convince voters to embrace the EU given a vote for Brexit would plunge the UK into uncertainty and pariah status on the world stage.

“…when the people campaigning for ‘out’ are asked to set out a vision outside the European Union, they become extremely vague. It’s simply not good enough to assert everything will be all right when jobs and our country’s future are at stake. That’s why today I want to set out some of the specific questions those who would leave the European Union must answer. They don’t owe it to me; they owe it to us all, because at the moment what they are offering is a leap in the dark…

There is no doubt in my mind that the only certainty of exit is uncertainty; that leaving Europe is fraught with risk. Risk to our economy, because the dislocation could put pressure on the pound, on interest rates and on growth. Risk to our cooperation on crime and security matters. And risk to our reputation as a strong country at the heart of the world’s most important institutions. With so many gaps in the “out” case, the decision is clearly one between the great unknown and a greater Britain. A vote to leave is the gamble of the century. And it would be our children’s futures on the table if we were to roll the dice.”

I am now waiting for the moment when currency traders realize the peril the European Union faces upon Brexit…and accordingly price the euro (FXE) down.

Be careful out there!

Full disclosure: net short the British pound and euro