(T2108 measures the percentage of stocks trading above their respective 40-day moving averages [DMAs]. It helps to identify extremes in market sentiment that are likely to reverse. To learn more about it, see my T2108 Resource Page. You can follow real-time T2108 commentary on twitter using the #T2108 hashtag. T2108-related trades and other trades are occasionally posted on twitter using the #120trade hashtag. T2107 measures the percentage of stocks trading above their respective 200DMAs)

T2108 Status: 39.8%

T2107 Status: 20.1%

VIX Status: 20.5

General (Short-term) Trading Call: bullish

Active T2108 periods: Day #4 over 20%, Day #3 over 30% (overperiod), Day #48 under 40% (underperiod), Day #52 below 50%, Day #67 under 60%, Day #408 under 70%

Commentary

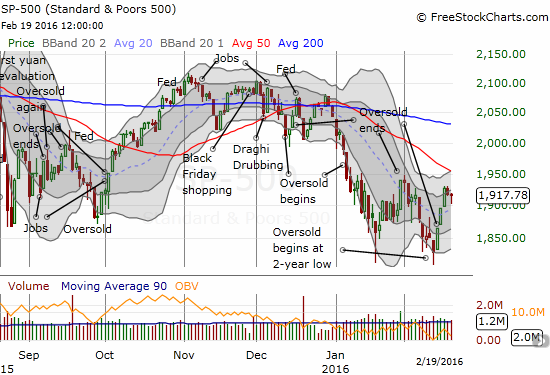

T2108, the percentage of stocks trading above their respective 40-day moving averages (DMAs), remained as steady as the S&P 500 (SPY) to close last week. T2108 was flat at 39.8%. Buyers picked the S&P 500 off its lows for the day to get a flat close and a strong week overall. T2107, the percentage of stocks trading above their respective 200DMAs, managed to close up in a small positive sign.

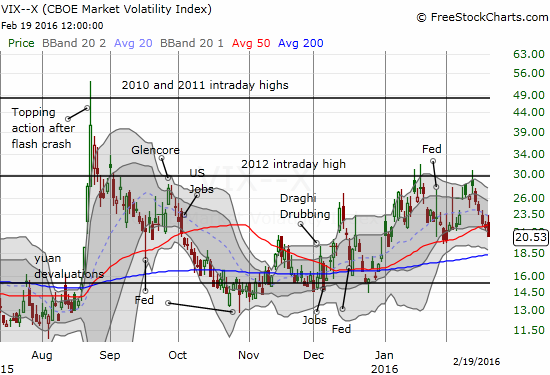

Interestingly, the volatility index made a much more dramatic move with a fade from highs that resulted in a definitive breakdown below its 50DMA. This move breaks the recent uptrend. This is a significant development that could support further market gains.

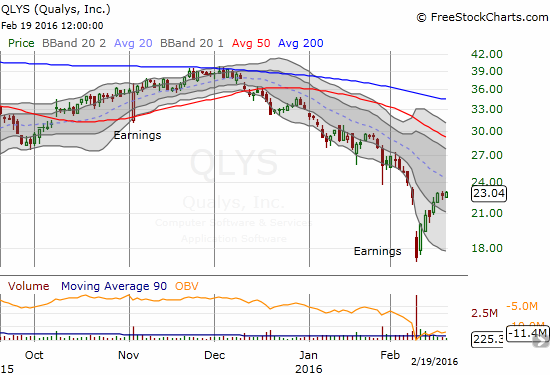

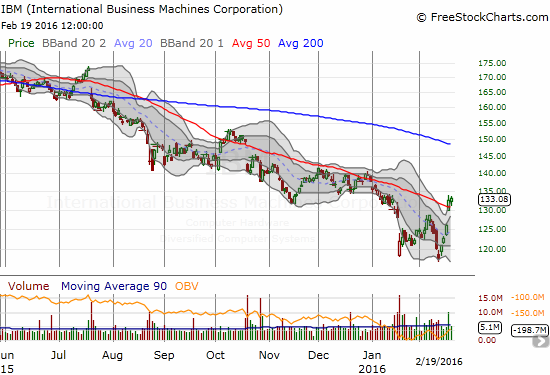

This week sets up well as a major test of the market’s ability to sustain post-oversold momentum. Here are some charts that have my attention going into this week. These are all the kinds of “recovery” stocks that get more and more interesting, the firmer the bounce from the S&P 500’s oversold conditions.

— – —

For readers interested in reviewing my trading rules for T2108, please see my post in the wake of the August Angst, “How To Profit From An EPIC Oversold Period“, and/or review my T2108 Resource Page.

Reference Charts (click for view of last 6 months from Stockcharts.com):

S&P 500 or SPY

U.S. Dollar Index (U.S. dollar)

EEM (iShares MSCI Emerging Markets)

VIX (volatility index)

VXX (iPath S&P 500 VIX Short-Term Futures ETN)

EWG (iShares MSCI Germany Index Fund)

CAT (Caterpillar).

IBB (iShares Nasdaq Biotechnology).

Daily T2108 vs the S&P 500

Black line: T2108 (measured on the right); Green line: S&P 500 (for comparative purposes)

Red line: T2108 Overbought (70%); Blue line: T2108 Oversold (20%)

Weekly T2108

*All charts created using freestockcharts.com unless otherwise stated

The charts above are the my LATEST updates independent of the date of this given T2108 post. For my latest T2108 post click here.

Related links:

The T2108 Resource Page

Expanded daily chart of T2108 versus the S&P 500

Expanded weekly chart of T2108

Be careful out there!

Full disclosure: long SSO call options, long SSO shares, long SVXY shares