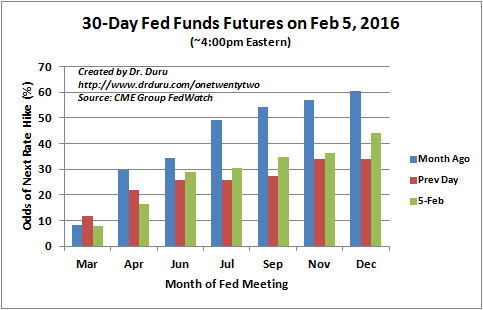

The U.S. jobs numbers for January, 2016 were good enough to send odds for the next rate hike from the U.S. Federal Reserve to jump across the scheduled meetings for 2016. Yet, the odds for December as the next month for a rate hike are still well under 50%.

Source: CME Group FedWatch

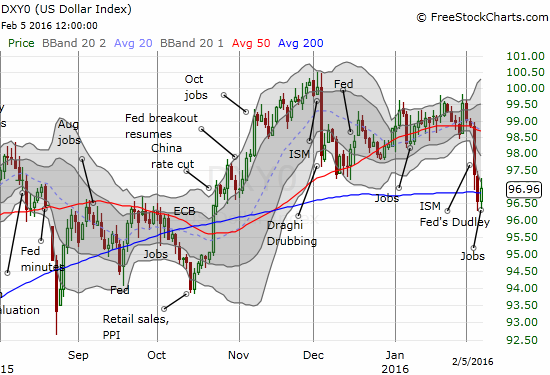

Although the odds still favor no rate hike for 2016, the rise across the remaining months was high enough to help the U.S. dollar index (DXY0) to maintain support at its 200-day moving average (DMA).

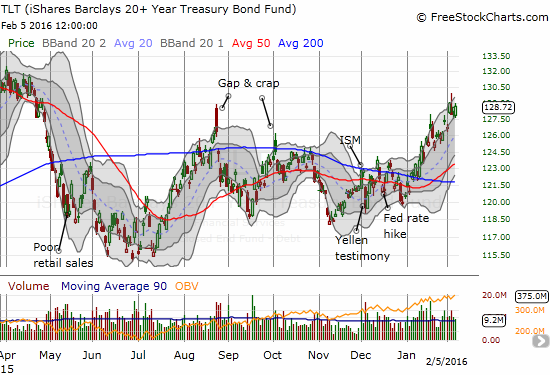

Still, the trend for the iShares 20+ Year Treasury Bond (TLT) remains definitely pointed upward (meaning long-term yields are going down).

The message from the markets is VERY clear. Yet, I still hear and read some pundits continue to parrot the Fed’s claim from December that we should expect four rate hikes in 2016. These claims help create lingering uncertainty about the Fed’s plans. Chair Janet Yellen gets an opportunity this week to provide some clarity.

Yellen speaks to Congress this week as part of the Fed’s Semiannual Monetary Policy Report to the Congress. Yellen appears before the House on February 10th and the Senate on the 11th. These appearances will indicate whether the Fed is going to concede to the market’s expectations as it prefers to do, or whether the Fed wants to try to guide markets back to a 2016 rate hike. Given the current odds, Yellen’s speech is not likely to weaken the dollar much further but she could strengthen it a lot.

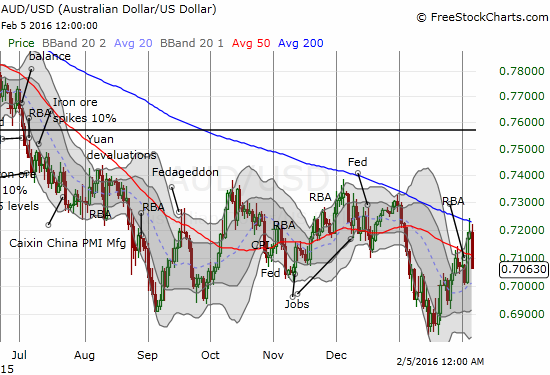

Despite the apparent asymmetric odds favoring a dollar rally, I reduced my net long U.S. dollar position. This change includes taking AUD/USD off my list of aggressive trades (going short in this case). Note I am still very much bearish the Australian dollar, but against the U.S. dollar I am suspecting an extended trading range is developing. AUD/USD is trending up from the most recent low but it definitely failed 200DMA resistance and broke through 50DMA support all in one day.

Source for charts: FreeStockCharts.com

Stay tuned and be careful out there!

Full disclosure: net long the U.S. dollar, net short the Australian dollar