(This is an excerpt from an article I originally published on Seeking Alpha on December 13, 2015. Click here to read the entire piece.)

Almost a month ago, analysts from KBW described a seasonal trade on home builders. {snip}

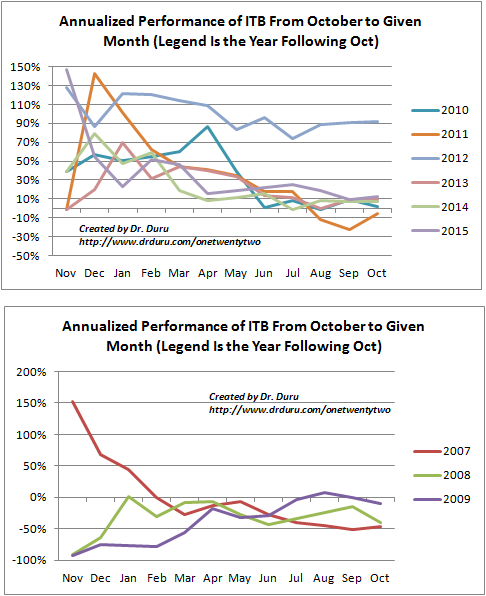

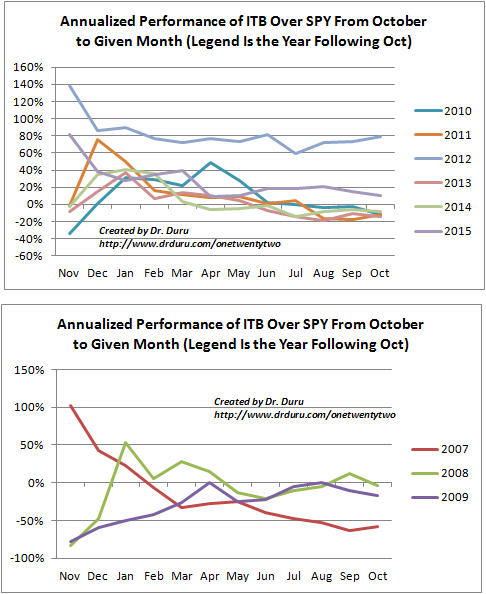

I took a slightly different perspective on this seasonality to make the pattern stand out and understand its performance when it fails. I calculated a compound, annualized return starting from the last trading day of October to the last day of subsequent months. {snip}

Source for prices: Yahoo Finance

It is clear that the maximum absolute and relative returns on ITB are generally realized by February or March starting from the end of October. However, a trading rule that exits positions after performance reaches a certain threshold regardless of month may be even more effective than a strict calendar-based rule. {snip}

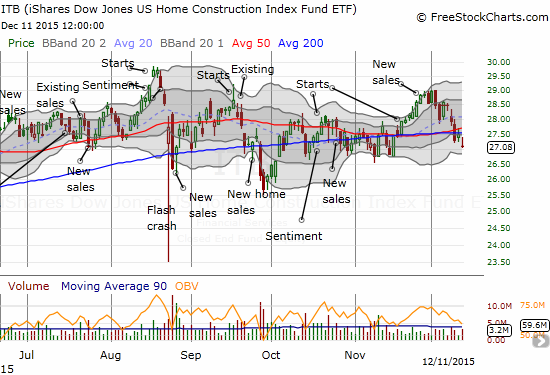

This year’s seasonal trade may face a monetary policy which for the first time in 9 years will not be moving in favor of housing. {snip}

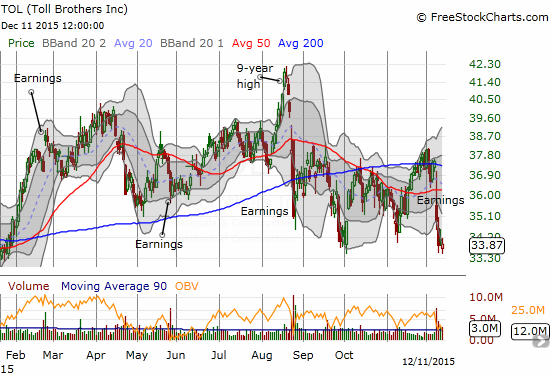

Earnings reports from home builders are an ever present wildcard impacting the seasonal trade. {snip}

Fortunately, TOL did not take down the whole sector. {snip}

Source: FreeStockCharts.com

TOL did not offer any specific guesses about the 2016 Spring selling season. However, it is quite clear that management is as bullish as ever about future prospects. {snip}

Be careful out there!

Full disclosure: long ITB call options

(This is an excerpt from an article I originally published on Seeking Alpha on December 13, 2015. Click here to read the entire piece.)