(This is an excerpt from an article I originally published on Seeking Alpha on December 17, 2015. Click here to read the entire piece.)

The Federal Reserve could not have asked for a better response to its first rate hike in 9 years and first move off zero interest rates in 7 years. The Fed worked hard to guide the market to a December rate hike, the market responded, and the Fed delivered. The Fed demonstrated for the European Central Bank (ECB) how to properly manage market expectations. Where the ECB over-promised and under-delivered, the Fed followed through on a very simple calculus: guide the market’s expectations, monitor those expectations, and deliver according to those expectations. During the Q&A of the press conference, Yellen even lauded the execution of her crew at the Fed by noting she did not expect the market to have an immediate and strong reaction to a rate hike given her perception that market “structure” had already priced in a rate hike.

{snip}

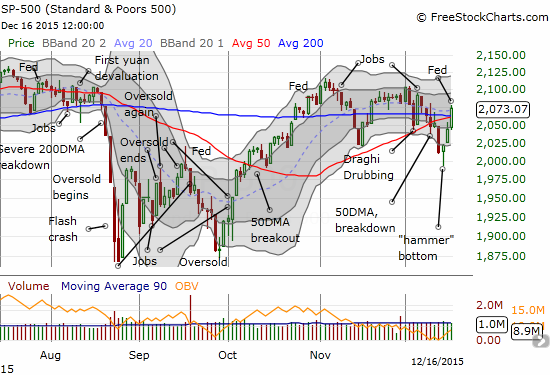

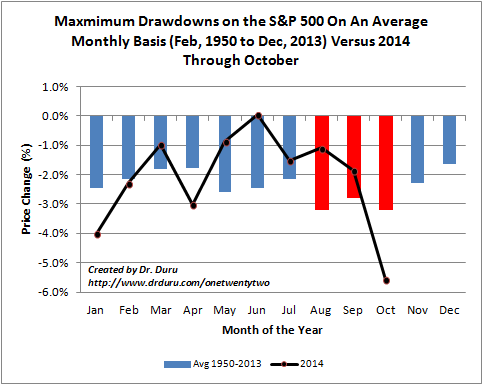

Only time will tell how the market follows through on these outcomes. The odds favor a bullish tone to end the month and the year. Last year, I wrote “The Numbers And Setup Behind This Year’s Potential Santa Claus Rally” to quantify the remarkable tendency for the S&P 500 to perform strongly in the second half of December no matter what happens in the first half. {snip}

{snip}

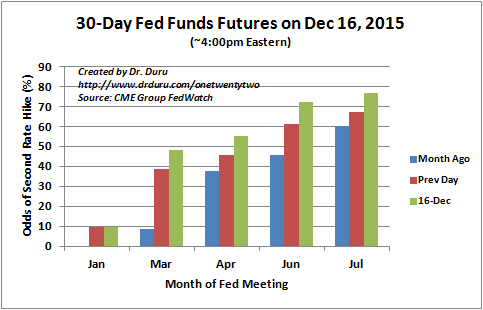

With the first rate hike out the way, it is now all bout the timing of the next rate hikes. The market has currently spaced out the second rate hike out to April.

Source: CME Group FedWatch

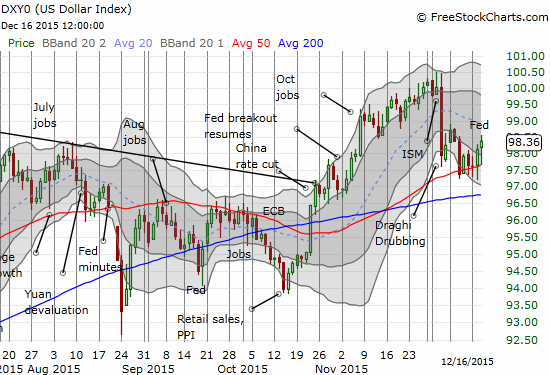

I am most interested in the implications for the U.S. dollar. {snip}

Given the market expects the next rate hike four months from now, I do not expect the dollar to rally like a rocket ship from current levels. {snip}

I still like going long the dollar against the euro. {snip}

Source: FreeStockCharts.com

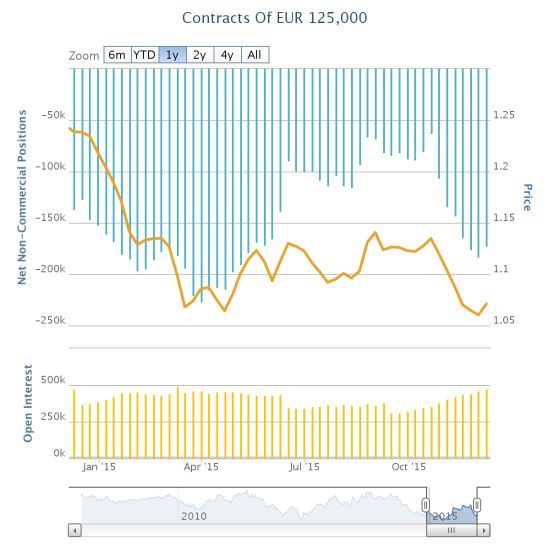

Shorts against the euro were surprisingly little deterred by the Draghi Drubbing. {snip}

Source: Oanda’s CFTC’s Commitments of Traders

Be careful out there!

Full disclosure: net long the U.S. dollar, net short the euro, long FXE call options

(This is an excerpt from an article I originally published on Seeking Alpha on December 17, 2015. Click here to read the entire piece.)