(This is an excerpt from an article I originally published on Seeking Alpha on December 10, 2015. Click here to read the entire piece.)

On December 10th, the Australin Bureau of Statistics (ABS) reported Australia’s jobs data for November, 2015. The results were in-line with existing trends:

{snip}

Adjusted for seasonality, the unemployment rate decreased from 5.9% to 5.8%. The participation rate ticked up 0.3 participation points, but total number of hours decreased slightly by 0.8%.

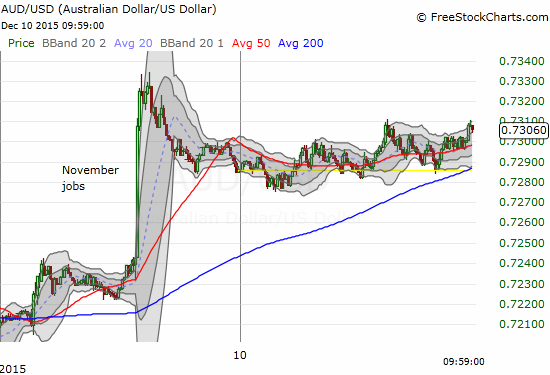

The reaction in the currency market was surprisingly strong. The Australian dollar (FXA) jumped up sharply.

Source: FreeStockCharts.com

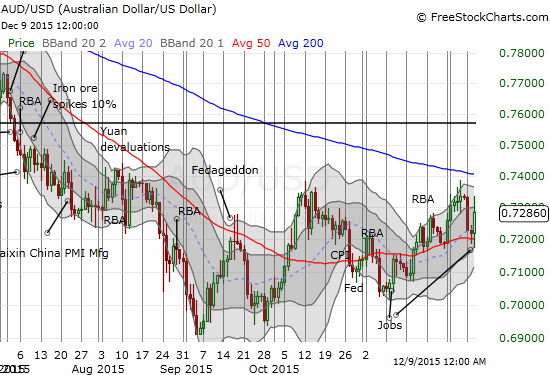

This kind of move demonstrates the market’s underlying jitters and current tendency to fire off quick trigger reactions. This particular move looks like shorts getting out the way. The scale and scope of the news did not suggest a new, strong catalyst for the currency. {snip}

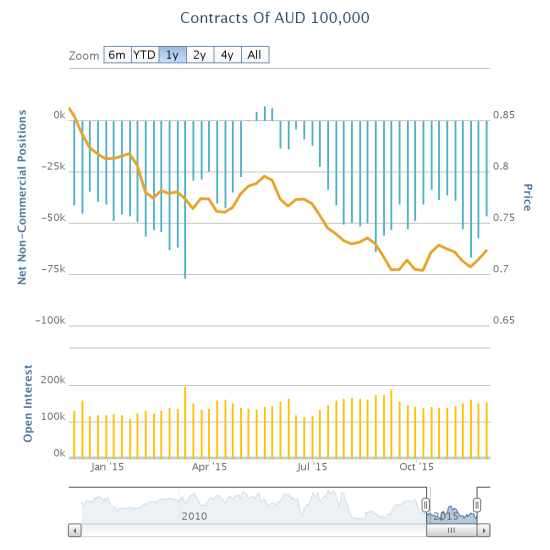

In recent weeks, the net short interest of speculators has trended downward. So, it makes sense that only a very bad report could generate more selling of the Australian dollar. Going forward, the Australian dollar likely has more upside than downside risk for the very short-term.

Source: Oanda’s CFTC’s Commitments of Traders

{snip} Indeed, an analyst from Goldman Sachs Asset Management recently made a case for playing the Australian dollar long versus the U.S. dollar to 0.75 before turning around and shorting it again. In other words, the short-term technicals favor more short-covering and a continued drift higher. However, over some horizon perhaps starting in January, the fundamentals, including an increasingly dovish Reserve Bank of Australia (RBA) should start to weigh again. {snip}

Be careful out there!

Full disclosure: net short the Australian dollar

(This is an excerpt from an article I originally published on Seeking Alpha on December 10, 2015. Click here to read the entire piece.)