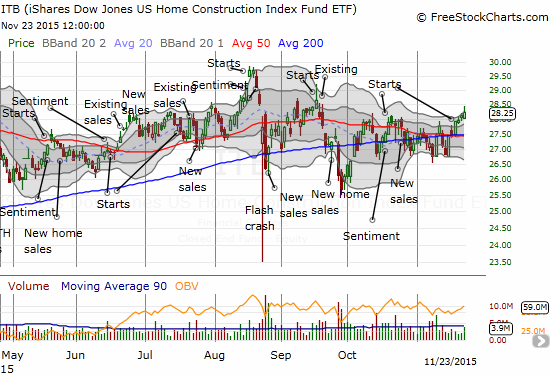

While I have been talking up warnings on the deterioration in the underlying technicals of the S&P 500 (SPY), I continue to like the relative performance of iShares US Home Construction (ITB).

Source: FreeStockCharts.com

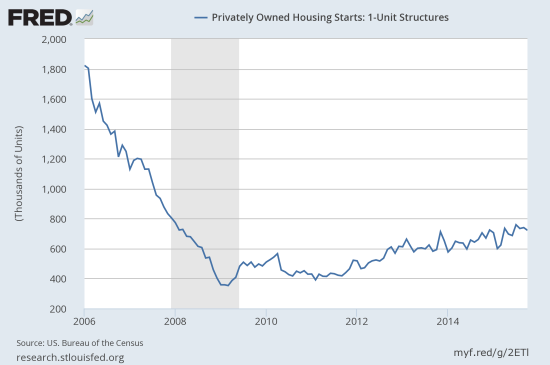

ITB is up 9.2% for the year while the S&P 500 is essentially flat year-to-date with a 0.3% gain. One of the reasons for this out-performance is the steady performance of economic output from homebuilders. Last week, the Census Bureau reported single-family housing starts that were down 2.4% from September, 2015 to October but up 2.4% year-over-year. These numbers keep housing starts well within the uptrend in place since the 2011 trough and the ever so slight breakout that occurred earlier this year.

Source: US. Bureau of the Census, Privately Owned Housing Starts: 1-Unit Structures [HOUST1F], retrieved from FRED, Federal Reserve Bank of St. Louis, November 23, 2015.

On a regional basis, the South stuck out a lot. The South was the ONLY region that suffered both month-over-month and year-over-year declines in single-family housing starts. I strongly suspect this represents declines in the Texas housing market. Publicly traded homebuilders have been consistent lately in talking about softer market conditions in Texas, especially in Houston. These declines in starts should foreshadow further weakening in Texas housing sales. I will be on even higher alert for Texas commentary in the next round of homebuilder earnings.

Be careful out there!

Full disclosure: long ITB call options