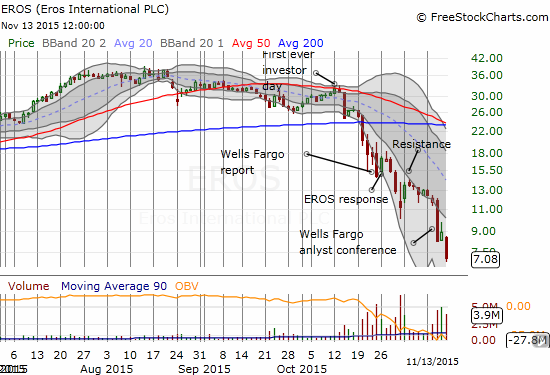

Eros International (EROS) faced the public and once again failed to deliver reassurance. EROS management attended the Wells Fargo Technology, Media & Telecom Conference on November 11, 2016, and the stock promptly plunged. By the end of the day, the carnage totaled to a 26% loss. On the 13th, the selling resumed. I guess EROS was over-optimistic that Wells Fargo would deliver good fortune this time around.

Source: FreeStockCharts.com

After watching the stock plunge all over again, the company clearly felt compelled to release yet another press release…even though it seems these pronouncements are just shouts in the wind. From November 12th:

“On November 11, 2015 the management team attended the Wells Fargo Technology, Media & Telecom Conference in New York, where it did not disclose any new information to the market and only reinforced its business fundamentals. No statement was provided concerning the Alpha Exposure article dated November 10, 2015 which made further baseless allegations about the Company’s core business, its content library and film slate.”

From what I can surmise, EROS has still not addressed head-on one of the biggest concerns that launched the selling: the surprisingly rapid and large revenue growth from the United Arab Emirates (UAE). The failure to do so has left the company vulnerable and exposed to additional charges of fraud. The press release – strangely titled “Eros Says Content is at the Core of Their Business and Baseless and Misleading Allegations Don’t Change Their Fundamentals” – goes on to reiterate its confidence in the strength of its film library. Here is one key defense:

“As part of the NYSE IPO process in November 2013, the Company’s entire film library, and not just the new release slate tables, went through full due diligence in which each and every agreement was vetted. This same process was repeated for the follow-on equity offering in July 2014. Every year when the Company files its Form 20F, the Company and its auditors review the entire slate for that particular year…

…The Company has been very clear and transparent with analysts and investors on the categorization of films. Conclusions drawn purely based on Indian box office reports are grossly misleading. Such reports are compiled using informal informational sources that are not as reliable as Rentrak internationally, only include theatrically released Hindi films in India and no non-theatrical Hindi films and entirely exclude regional language films, thereby creating a distorted picture.”

The above chart of course demonstrates that the press release failed to accomplish its mission for now.

With EROS dropping toward my low single digit target in the worst case scenario, I have made additional adjustments in my positioning for a binary outcome.

$EROS confirmed upper resistance. Closed out 1st puts as part of "binary" trade strategy: http://stks.co/g3R5Y

— Duru A (@DrDuru) Nov. 11 at 11:15 AM

On November 11th, I made my first trade by locking in profits on my November 20th $12.50 puts. With expiration approaching, I decided it was a good time to close them out under the “don’t be a greedy short” concept. Obviously with hindsight that sale was early – I could have even held for another day (the chart above is a snapshot at the time I sold the puts). Realizing that EROS’s binary outcome looked more likely to be heading toward zero than recovery, I used Nov 12th’s small bounce to add back in put options: December 18th $7.50s. Keeping the hedge, I added a single call option for December 18th $10. For the upside part of the trade, I have moved to call options over shares because of the increasing likelihood of EROS approaching zero. I want to commit a lot less money to the upside part of the binary trade while still exposing my position to upside potential. Finally, with EROS plunging to $7, I sold all my November 20th $10 put options. Frankly, these were put options I thought would expire worthless!

Going forward, I will use any rallies in EROS to load up on a fresh batch of put options (unless of course the rally occurs on a solidly positive catalyst). With securities lawyers circling in on EROS, the company is running out of time to produce a winning story. The next, and perhaps final, catalyst will come the next time EROS has to report earnings. The current tentative date appears to be November 18th. This date comes from briefing.com; I find it extremely hard to get basic press release announcements at EROS’s main corporate website.

Be careful out there!

Full disclosure: on EROS, long shares, short call options, long put options