Last week, I updated the data on the Apple (AAPL) pre-earnings trade in a piece called “The Apple Pre-Earnings Trade: October, 2015 Edition – An Important Juncture.” I concluded that the main trade for AAPL going into earnings October 27, 2015 is to fade the 7-day average daily price change. Not including today (the 27th), the 7-day average daily price change is 0.6%; the 14-day is 0.3%. Thus, the bias for AAPL’s 1-day post-earnings reaction is bearish. It will take a huge amount of selling today to flip the 7-day average negative.

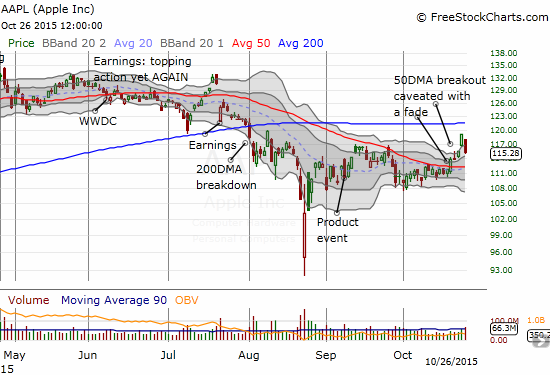

The chart below shows the recent price action. AAPL was doing just fine until a huge 3.2% loss on the 26th that completely reversed a similarly impressive gap up the previous day.

Source: FreeStockCharts.com

The bearish trading call comes with a few caveats.

First of all, I do not think an AAPL-specific catalyst drove AAPL on Friday. Instead, very bullish responses to earnings reports from Alphabet (GOOG), Microsoft (MSFT), and Amazon.com (AMZN) probably generated some sympathy buying. The selling on Monday was almost just as mysterious except I caught wind on a news radio program that a supplier of Apple reported poor results that suggested Apple iPhone sales could be weak. I finally found a mention in a piece on Seeking Alpha: “Apple down 3% as chip supplier plunges following Q3 report.” Here is a main quote:

“RBC’s Amit Daryanani (Outperform rating, $150 target on Apple) observes Dialog’s Q3 revenue missed a $354M consensus, and that its Q4 guidance is below a $475M consensus. He thinks the numbers are negative for Apple “given our discussions with [Dialog] management, which suggest ASPs are up ~4-5% (implying AAPL units being flat to down 2% in Dec-qtr).” He qualifies the remarks by noting inventory and supply chain dynamics can affect the relationship between Dialog’s sales to Apple and Apple’s own sales.”

Dialog Semiconductor provides power management chips for the iPhone and iPad. AAPL is the company’s largest customer. The poor earnings sent the stock down 18.4% in trading in Germany.

So, this news SEEMS to support the bearish bias going into earnings. However, it is VERY possible that market sellers have satisfied themselves with Monday’s big 1-day loss. Moreover, the most recent earnings news is coming in good from China and a strong rally continues for many China-related names. At the time of writing, Alibaba Group Holding Limited (BABA) is opening up 8% post-earnings. Baidu (BIDU) is up 26% from recent lows. So, given China appears to be the big wildcard for AAPL, I have sympathy for those who believe Tim Cook’s early bullish assessment on China sales continued into the second half of the quarter.

Regardless, to keep the trade simple, I am sticking with the technicals and the correlations and trading for post-earnings downside. I rate the odds of success on this one at around 60%. In other words, this is NOT an aggressive trade – just a few put options or even a put spread. I currently have a call option that I bought near the close on the 26th that I am hoping to flip ahead of today’s close on resumption of the rally in AAPL going into this week. It is possible I decide to keep it and turn this into a hedged play with a bearish bias.

(As a reminder, this trade is about the ONE DAY price change after Apple reports earnings. It says little to nothing about the sustained response to Apple’s earnings. For example, in the past, post-earnings dips made for excellent buying opportunities in AAPL).

Be careful out there!

Full disclosure: long AAPL call option