(This is an excerpt from an article I originally published on Seeking Alpha on October 26, 2015. Click here to read the entire piece.)

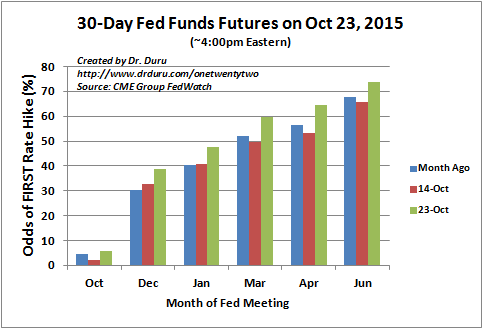

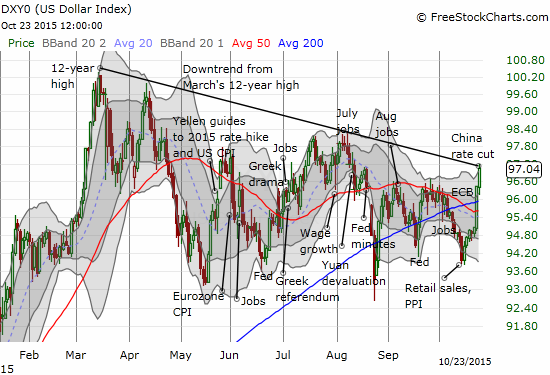

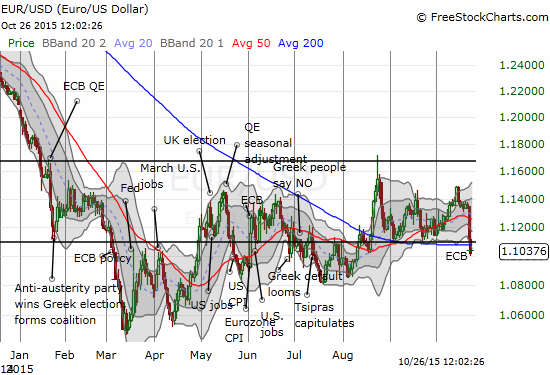

Almost two weeks ago, markets appeared ready to price in a first Fed rate cut way out into June, 2016 (essentially neverland). The U.S. dollar index (UUP) sat at one of its lowest closes in the middle of what has effectively become an extended trading range for 2015. Three central bank decisions later – the European Central Bank, the Bank of Canada, and the People’s Bank of China – the outlook has changed dramatically. The market is again committed to a March, 2016 rate hike, with the odds of a January rate hike leaping toward 50%. In line with this change, the U.S. dollar index has soared into a critical test of a downtrend that has stayed in place since March’s 12-year high.

Source: CME Group FedWatch

The theme swinging sentiment back in favor of the U.S. dollar is well summed up in the introductory statement from the European Central Bank (ECB) for its latest decision on monetary policy:

{snip}

Source: FreeStockCharts.com

{snip}

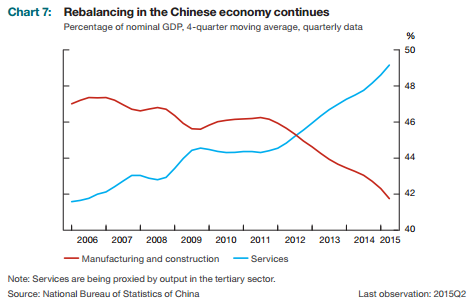

Finally, the People’s Bank of China’s sixth interest rate cut in a year essentially confirmed that economic conditions remain fragile in China if they are not outright weakening. The move is very consistent with the observations from other central banks that China’s economic transition is creating an environment of slower growth.

Source: Bank of Canada

These messages now converge upon the U.S. Federal Reserve’s meeting and decision on monetary policy this week. {snip}

Be careful out there!

Full disclosure: long and short several currencies versus the U.S. dollar

(This is an excerpt from an article I originally published on Seeking Alpha on October 26, 2015. Click here to read the entire piece.)