“Earlier this month, it is reported in the local Macau media that the Director delays to Macau and mainland China that the central government is going to help support Macau’s economy. And these comments followed similar statements from Macau’s Chief Executive last month. I think no real specifics were given. So my question to you Steve is this: How do you interpret these comments; what specific measures can or will be introduced based on your dealings with those sets of government officials or do you think these statements were more generic and/or meant to send the signals to turn mainland Chinese, so maybe for the lack of better words, know but [ph] that go into Macau? And then I have a follow-up.” – Joe Greff of JP Morgan from Seeking Alpha transcript of Wynn Resorts (WYNN) Q3 Earnings Call, October 15, 2015.

This question of government support for casinos in Macau was surely on the mind of many. Speculation about Chinese support helped pick WYNN off the floor and ignited a massive 50% rally into earnings. The reality came up very short. WYNN gapped down after earnings but buyers stepped right in and almost closed the gap at the end of the trading day. The stock has drifted downward the last two days and faces an important test of the post-earnings low.

Source: FreeStockCharts.com

CEO Steve Wynn’s response to this question reads like a near tirade. He was clearly very angry and frustrated. Here are some key clips:

“…The table cap is the single most counterintuitive and irrational decision that was ever made. Here we are spending billions of dollars creating non-gaming facilities and then arbitrarily so much as well you should only have this many tables. No jurisdiction ever has imposed such — that kind of logic on us.

And what it’s done is turned our human resource planning inside out and upside down. And you could tell by the tone of my voice, the extent of my frustration on this point; my frustration on behalf of our colleagues that Melco, who made commitments for 400 tables. Why on earth they have to deal with half as many is beyond my — anything that I can understand in a 45 years of experience I’ve had. It isn’t good for Macau…

If you wanted to undermine and scuttle the viability of that industry, you put in table caps. And you could tell I am a tremendous critic of that decision because I don’t understand it in terms of anything in my 45 years of experience that explains it. And to see the predicament the local people find themselves in because they made covenant, agreements, is dazzling to me. And I’ve complaint to the government about this and tried to understand what the rationale was for this thinking. And I’ve never gotten a reasonable answer…

But these are problems that when you say that there has been the government has made general statements about supporting us or supporting the people of Macau, I think it’s time for them to put their actions where the rhetoric is but the rhetoric won’t solve the problem.”

Given this fresh uncertainty about government support for Macau, I am very surprised WYNN is not already a lot lower.

I reached back to fill in the details of the post-earnings move I described in an earlier post because of an even more important display of the Chinese government stepping away from propping up industry. At the time of writing news recently broke that Sinosteel will default on an interest payment on a sizable bond. From Bloomberg:

“Sinosteel Co. failed to pay interest due Tuesday on 2 billion yuan ($315 million) of 5.3 percent notes maturing in 2017 after saying it will extend the deadline as it plans to add a unit’s stock as collateral. That came after the National Development and Reform Commission planned to meet noteholders and ask them not to exercise a redemption option on Tuesday to force full repayment, people familiar with the matter said last week.”

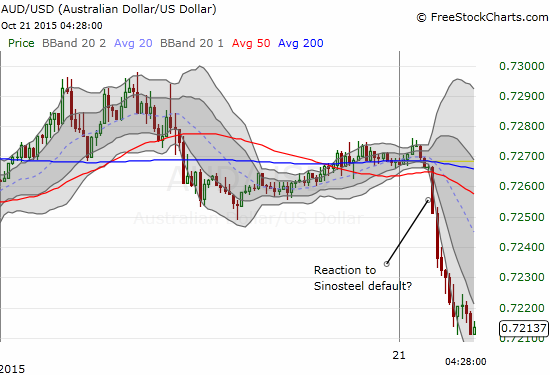

Sinosteel is a trading house that also owns steel mills and has joint ventures in iron ore. It is a large importer of iron ore. I believe there were hopes in the market that the Chinese government would step in and pay the interest on behalf of Sinosteel. Australian Mining earlier erroneously reported that the Chinese government had indeed come to the rescue. I am not sure whether folks in the U.S. will care about this news given SInosteel has been in trouble for a year. However, the news seemed big enough to at least send the Australian dollar lower for the moment.

Source: FreeStockCharts.com

I think Bloomberg rightfully points out that lack of government action now materially increases the risk of default in other struggling companies in weak industries. If this is true, then many assumptions about Chinese customers and business will need to ratchet down further. I am alert for the usual suspect China-related plays to take hits mainly in industrial sectors. One key test may be coming on the morning of October 22nd when Caterpillar (CAT) reports earnings…

Be careful out there!

Full disclosure: net short the Australian dollar, short CAT