I keep looking for reasons to believe in a bottom for commodities. Recently, the big washout of sellers in commodity giant Glencore looked like such a signal. Upon closer examination, I decided that the bottom is more likely temporary than sustainable.

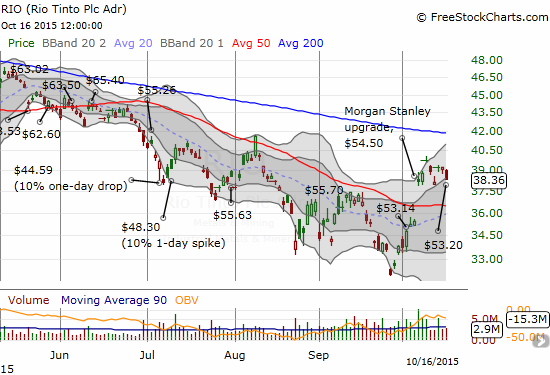

The latest signal was the third quarter (2015) production report from Rio Tinto (RIO) released on October 16th. CNBC ran the teaser headline “Does Rio’s iron ore boost signal a turn for commodities?” to suggest that something significant had happened. Upon closer examination, there was not much new to see. The stock market responded accordingly. RIO dropped 2.2% on lower than average volume. (Prices overlayed on the chart are approximate spot iron ore prices at the given date).

Source: FreeStockCharts.com

The focus of excitement was a shipment level that outstripped production:

“Anglo-Australian miner Rio Tinto posted Friday a 17 percent rise in third-quarter iron ore shipments, selling more of the raw material than they were able produce, a result that some investors are taking as a sign that conditions for the commodity market might be looking up.”

On the surface, this looks like encouraging news. However, the second quarter production report also indicated a gap between shipments and production. RIO currently trades around the same levels from the July 16th report. Sure, the 6.0% gap of 91.3M tonnes shipped versus 86.1M tonnes produced is larger than the second quarter’s gap of 2.1% (81.4M tonnes versus 79.7M tonnes), but overall shipments are right in-line with RIO’s projection of 340M tonnes for the year. In other words, NEW news would be a report of production scheduled to go higher than expectations because of excess demand. Even better would be a response in prices driven by the gap.

Instead, iron ore finished the week down 4% – the largest weekly loss since July. Moreover, Shanghai rebar futures remain extremely weak. Reuters reported that these futures are at their lowest level since the launch of the market in 2009. Chinese over-production is likely contributing to the weakness. Low prices have barely put a dent in production: output has only fallen 2% from January to August.

This story of persistent over-supply has dogged iron ore (and steel) for well over a year now. Producers are still more concerned about cash flow than prices. Without an abatement of oversupply, there is still no reason to believe a sustained bottom has occurred. This reality was the message of a market that failed to get excited about RIO’s latest production report.

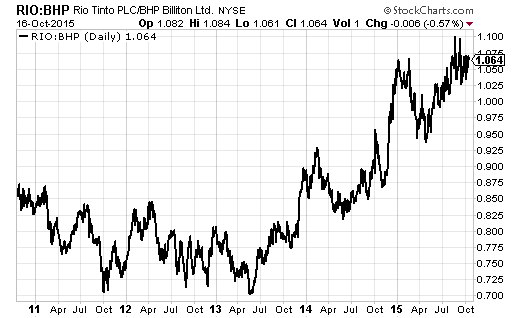

For trading purposes, I still prefer a hedged approach with RIO as the bullish side of the trade. Iron ore competitor BHP Biliton remains relatively weak compared to RIO.

Source: Stockcharts.com

Be careful out there!

Full disclosure: long RIO call options

Hi Duru, I hope you have been well. I am looking to reload AU shorts around 0.75 to 0.76 in October. I think there really needs to be production cuts to the majors in ore and mid tiers like fmg going under before we see a bottom in ore

I am STILL short the Australian dollar. So I am all in with ya on that. 🙂