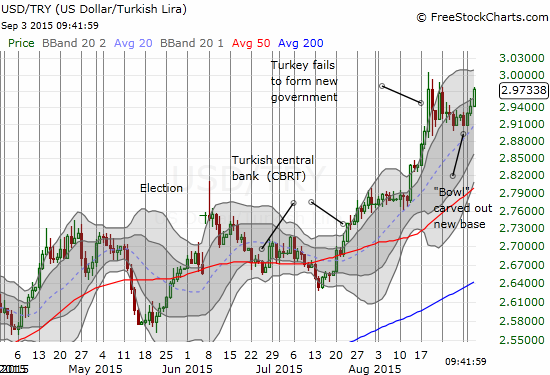

The trade on the blow-off top on USD/TRY, the U.S. dollar versus the Turkish lira, turned out to be short-lived. Now, the lira looks poised for a lot more weakness. USD/TRY never cracked the low of the day from the blow-off top, and now it is starting into a new uptrend.

Source: FreeStockCharts.com

Last week, the Turkish central bank raised its reserve ratio in an attempt to stabilize the Turkish lira. The bank applies this reserve ratio on the short-term currency borrowings of lenders. The bank then hopes it will encourage these lenders to do more long-term borrowing which presumably helps to reduce volatility in the lira. The first big test may come later this month when the U.S. Federal Reserve announces its decision on monetary policy on September 17, 2015. While the odds of a September hike are very low (27.4% at the time of writing), the anticipation remains high for this meeting based on the chatter and headlines I see. No matter the decision, the market will likely react sharply as it wrestles with a mix of trepidation, disappointment, and relief. Any moves that are dollar-positive are likely to hurt the currencies of emerging markets the most…like the Turkish lira.

I am likely going to reposition myself long USD/TRY after Friday’s U.S. jobs report (September 4, 2015). I am hoping for a dip to buy and then ride the lira lower into the anticipation of the Fed meeting (and fears of China).

Be careful out there!

Full disclosure: no positions