(This is an excerpt from an article I originally published on Seeking Alpha on August 17, 2015. Click here to read the entire piece.)

After regional homebuilder LGI Homes (LGIH) produced stellar earnings results earlier this month, I had high hopes for Century Communities (CCS) as well. CCS’s results for its second quarter were good, but not LGIH-level good. The performance in Texas delivered the most stark contrast. Whereas LGIH demonstrated outstanding sales strength in its core Texas market, CCS was more subdued on its Texas business. {snip}

{snip}

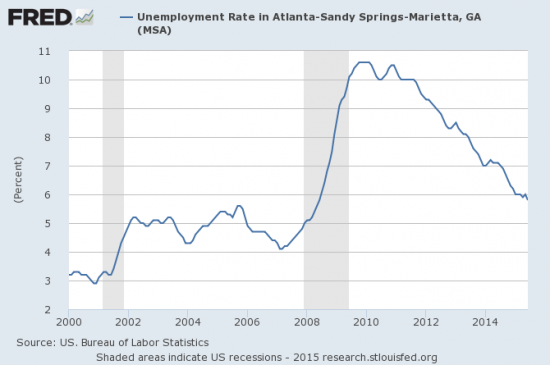

The big surprise (for me) in the results from CCS is the increasing concentration of the company’s business in Atlanta. {snip}

Source: US. Bureau of Labor Statistics, Unemployment Rate in Atlanta-Sandy Springs-Marietta, GA (MSA) [ATLA013UR], retrieved from FRED, Federal Reserve Bank of St. Louis, August 16, 2015.

The concentration of building in Atlanta means CCS is all about Atlanta now in addition to its (original) core business in Colorado. For comparison and reference, here is the unemployment rate for the state of Colorado:

Source: US. Bureau of Labor Statistics, Unemployment Rate in Colorado [COUR], retrieved from FRED, Federal Reserve Bank of St. Louis, August 17, 2015.

In other words, from the lens of upside potential, Atlanta probably has more room for improvement than Colorado. {snip}

Increased guidance was the best news coming from CCS. {snip}

This guidance of course includes very bullish expectations for the Atlanta market. The guidance also builds upon second quarter results with impressive year-over-year growth (bolstered by acquisition activity):

{snip}

Source: FreeStockCharts.com

Be careful out there!

Full disclosure: Long CCS

(This is an excerpt from an article I originally published on Seeking Alpha on August 17, 2015. Click here to read the entire piece.)