(This is an excerpt from an article I originally published on Seeking Alpha on August 27, 2015. Click here to read the entire piece.)

When I wrote “A Time To Sell Some Housing Stocks,” I could not have come close to imagining its timeliness. The current market sell-off since then has been so deep and rapid that I have accelerated my plans to put cash back to work.

The first candidate is iShares US Home Construction (ITB). I missed the big plunge on Monday, August 24th as I was busy chasing down other opportunities. I did not hesitate to start loading up the next day when ITB fell to a new low for the current selling cycle.

Source: FreeStockCharts.com

{snip}

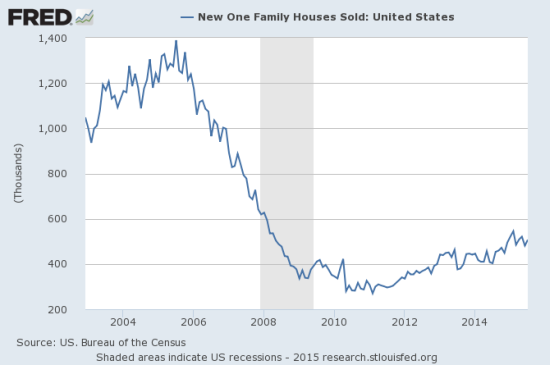

I found some level of comfort in my earlier than anticipated repurchase of ITB from the new home sales data. {snip}

Source: US. Bureau of the Census, New One Family Houses Sold: United States [HSN1F], retrieved from FRED, Federal Reserve Bank of St. Louis, August 27, 2015.

Year-over-year and monthly sales were strong across three out of four regions. {snip}

The most interesting part of the report came from the distribution of sales across price ranges. The June report showed a surprising relative surge of sales in the $200,000 to $299,000 range to 40% of all homes. This share dropped all the way to 32% in the July report which puts the share back within the 30 to 35% range that has held for quite some time. {snip}

Note well that I did not buy ITB here because I am certain a final bottom is now in the rear view mirror. The stock market seems sure to exhibit a lot more volatility in coming weeks and perhaps months. {snip}

Be careful out there!

Full disclosure: long call options on ITB

(This is an excerpt from an article I originally published on Seeking Alpha on August 27, 2015. Click here to read the entire piece.)