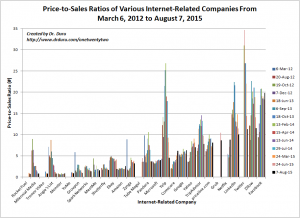

Almost a month before the latest earnings cycle, I chronicled the ascendancy of Facebook (FB) to the top valuation spot among the internet stocks I follow. Twitter (TWTR) lost the top spot thanks to a large post-earnings sell-off in April. Fast forward to the latest earnings cycle and internet-companies delivered even more disruptions. Rising above the dust, Facebook has further separated itself from the pack. The updated valuation chart below shows some major shifts:

- Netflix (NFLX) has soared from #9 to #5.

- Of the four companies ranked above NFLX in valuation, only Facebook survived earnings with a valuation increase. Indeed LinkedIn (LNKD), Twitter (TWTR), and Zillow (Z) all continue to suffer from major valuation compression.

- The “mid-tier” companies have experienced a mix of changes. Upside moves have been minimal. Yelp.com (YELP) and TripAdvisor (TRIP) continue to suffer large valuation compression.

- Ebay (EBAY) tumbled thanks to its spin-off of PayPal (PYPL).

- AOL fell off the list after being acquired by Verizon. Notably, this acquisition cost a price-to-sales ratio under 2. This was far cheaper than earlier acquisitions like Open Table and Trulia which occurred when the stocks were trading at price-to-sales ratios of 12 and 14, respectively. The final price on both sent these ratios close to 30.

As a reminder, I track price-to-sales as the valuation metric since several of these companies do not earn profits. Price-to-book is hard to interpret for companies whose major assets are people and software.

Click image for larger view…

Source for data: Yahoo!Finance

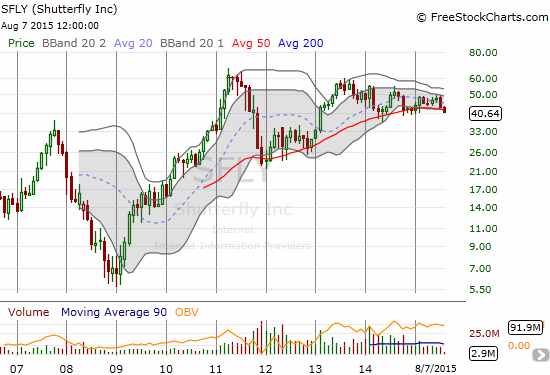

Of all the lower tier companies, say those with price-to-sales below 2, Shutterfly (SFLY) looks the most interesting to me. The monthly chart below shows the stock has been rangebound for the last 2 1/2 years. Like so many internet-related companies in this latest earnings round, SFLY sold off post-earnings. That sell-off marked a damaging breakdown below the 200-day moving average (DMA), and the stock has continued to sell-off ever since. SFLY is now essentially flat year-to-date and has lost 17% in three weeks. The headline results were good as SFLY beat on earnings and revenue for the prior quarter, guided in-line for earnings for the third quarter and FY2015, increased guidance for revenue in the third quarter, and provided in-line guidance for FY2015. Clearly, the market wanted even more.

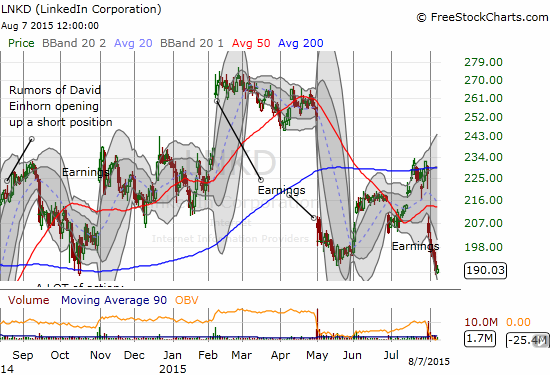

Speaking of facing a market wanting more, LinkedIn (LNKD) is the most disappointing stock on the list for me. From my related posts to StockTwits:

$GOOG and $NFLX set bad examples. Mkt went from internet euphoria to trigger sell all internet post-earnings. $LNKD overdone.

— Duru A (@DrDuru) Jul. 31 at 06:53 AM

$LNKD beat on Q2. Raised for Q3 and FY15. Stock should at least fill gap in due time.

— Duru A (@DrDuru) Jul. 31 at 06:55 AM

Based on my assessment, I added to my current call spread position with a speculative call option. It expired worthless last Friday. I still think LNKD will rebound at some point this quarter, perhaps going into October earnings. However, I am realizing I will have to stay patient, VERY patient. Until Friday, LNKD sold off every single day after earnings. The stock now trades just below its low for 2015, a level I thought would hold as a sustained bottom for a lot longer than it did.

Source for charts: FreeStockCharts.com

Speculating on where these stocks go as group from here, I hazard to guess that the days of double-digits P/S ratios are coming to an end. I am still undecided as to whether FB’s sky-high valuation can last in such a world. Given earlier acquisitions in the internet-space, P/S ratios around 10 get interesting for M&A if some bigger company convinces itself it can find revenue and profit-boosting synergies.

Finally, on trading strategies, my aggressively bullish approaches to Amazon.com (AMZN) and Netflix (NFLX) remain in place as I examine every dip for an opportunity to flip call options. NFLX is currently in the better position since it has managed to print gains since its first post-earnings close. These gains demonstrate buying interest has not completely exhausted itself. I have put Google (GOOG) back on the aggressive trading list after its stellar post-earnings performance. However, like AMZN, it is not in an ideal position given it has yet to add to its post-earnings gains.

Be careful out there!

Full disclosure: long call spread on LNKD and TWTR, long Z shares and puts, long YHOO, long P puts, short FB and long calls, long GOOG calls