(This is an excerpt from an article I originally published on Seeking Alpha on August 2, 2015. Click here to read the entire piece.)

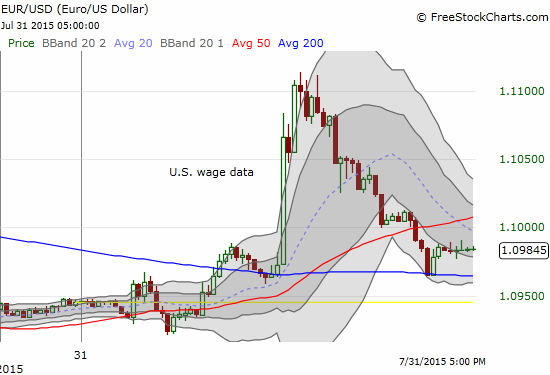

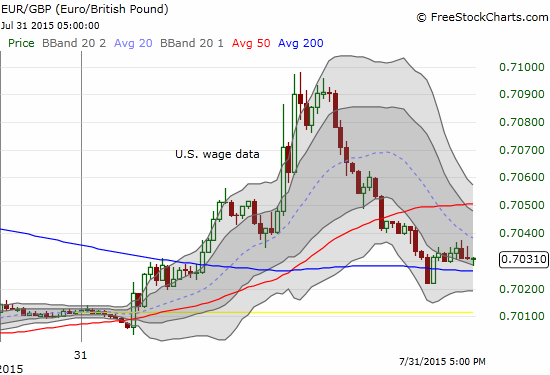

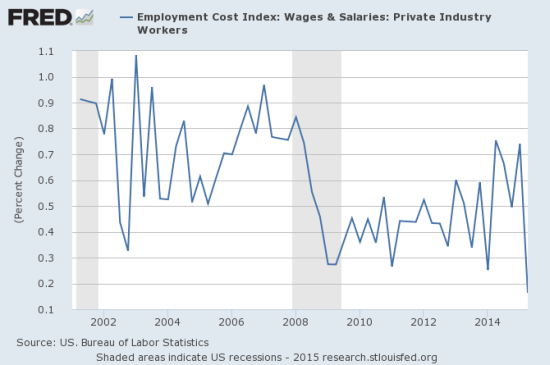

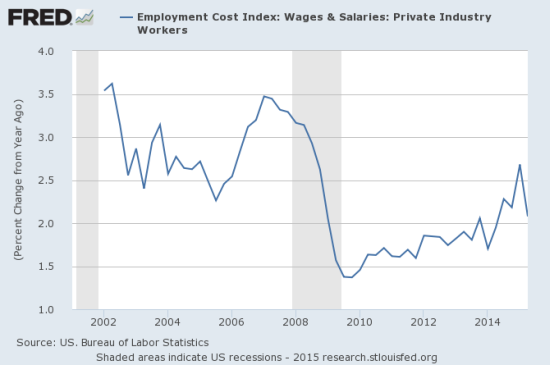

It seems odd to fear that wage growth is slumping in the U.S. with increasing momentum supporting minimum wage hikes across the country and through many industries. Yet, wage data on Friday, July 31, 2015 showing the slowest aggregate growth since at least 1982 sent the currency market into a spin for the day. The U.S. Federal Reserve has taught the currency market to stare at wage growth as an indicator that determines when rates will start their upward trek. Slowing wage growth presumably puts the Fed on ice.

{snip}

Source: The CME Group FedWatch

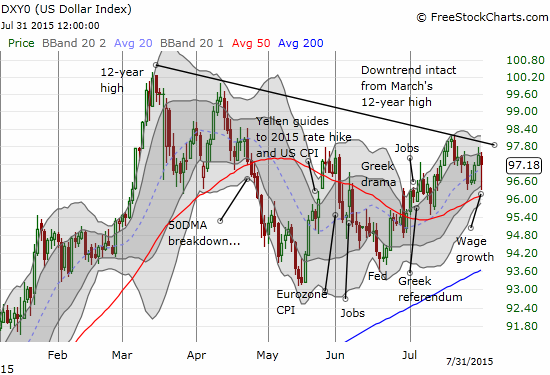

While the U.S. dollar index (UUP) took an early hit given these data, the index recovered into the close.

Source: FreeStockCharts.com

This kind of intraday volatility is likely to persist, perhaps even intensify, the closer we get to the presumed date for lift-off. It will create a lot more trading opportunities for those who are free to be flexible and not committed to any given rate hike assumption. {snip}

Perhaps amplifying the volatility are the numbers of analysts who are STILL counting down to a September rate hike… {snip}

Even more interesting is that despite the dollar’s intraday recovery, the narrative in media headlines for the day stuck with dollar weakness just because the index closed ever so slightly negative. It is the wrong narrative, especially when zooming in point-to-point from the release of the wage data to the close. {snip}

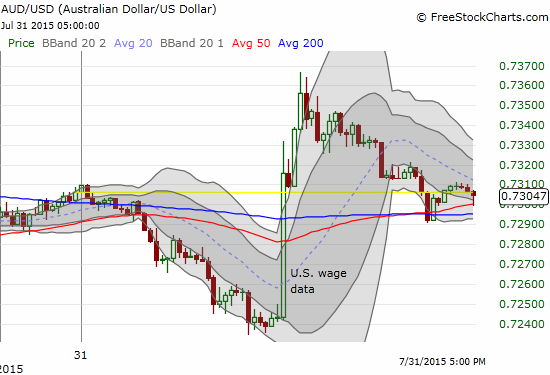

The response from the Australian dollar (FXA) was also of interest…{snip}

Source for currency charts: FreeStockCharts.com

So why all the confusion? I suspect that as cooler heads finished digging into the actual numbers and past the headlines, they found less reason for all the initial alarm.

{snip}

{snip}

Source for charts: US. Bureau of Labor Statistics, Employment Cost Index: Wages & Salaries: Private Industry Workers [ECIWAG], retrieved from FRED, Federal Reserve Bank of St. Louis, August 1, 2015.

Moreover, it turns out that the components of the Employment Cost Index (ECI) that caused the drop in wage growth may easily turn out to be temporary negatives. {snip}

Be careful out there!

Full disclosure: long and short various currencies against the U.S. dollar and the Australian dollar, long the British pound

(This is an excerpt from an article I originally published on Seeking Alpha on August 2, 2015. Click here to read the entire piece.)