(This is an excerpt from an article I originally published on Seeking Alpha on April 16, 2015. Click here to read the entire piece.)

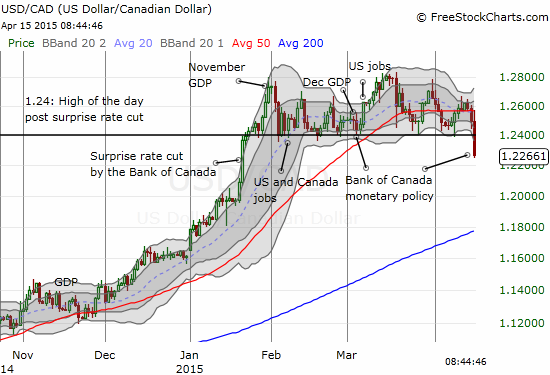

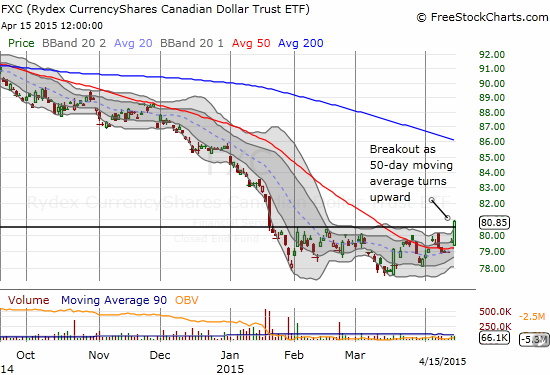

In the wake of the Bank of Canada’s latest announcement of monetary policy, the Canadian dollar (FXC) finally broke through an important line against the U.S. dollar. It is a line of support I have frequently referenced as representing the limit of my bearishness on the Canadian dollar. I also assume that many other market participants have watched this line just as carefully.

I had two reactions to the strong move – one longer-term, one short-term. Over the longer-term, CurrencyShares Canadian Dollar ETF (FXC) looks like it is breaking out of a nice base that forms a bottoming pattern. {snip}

The short-term trade is more technical and in-line with my assumption that the uptrend in the U.S. dollar index (UUP) is not over. The longer-term trade is based a lot more on fundamentals. In summary, the Bank of Canada expressed more optimism for the future, suggested that the negative impact from the oi price shock will likely end soon, and, most importantly, implied that Bank will not deliver a repeat of the surprise rate cut in January without some dramatic worsening of economic prospects.

{snip}

The key trick in managing trades and investments in the Canadian dollar versus the U.S. dollar is that Canada’s optimistic scenario is heavily relying on a resumption of strong economic numbers from the U.S. {snip}

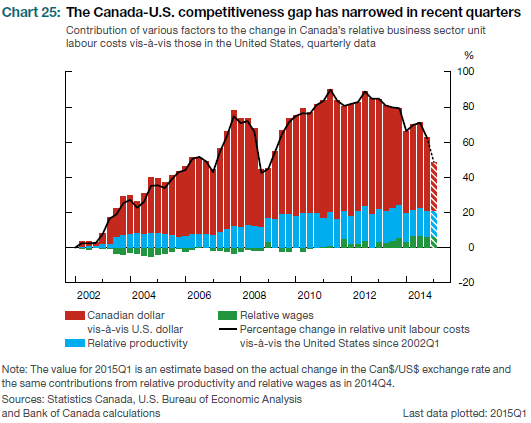

The chart below shows Canada’s increasing competitiveness versus the U.S. This competitiveness has a high degree of dependence on the exchange rate. At some point, increasing productivity will be required to tip the balance toward “allowing” the Canadian dollar to materially appreciate again.

Source: Bank of Canada Monetary Policy Report, April 15, 2015

{snip}

In other words, there is no scenario within the current band of confidence where the Bank will consider a rate cut. The Bank will also not rush into reversing the last rate cut. It is also important to note that the Bank of Canada considers the current depreciation a “temporary factor.” If they are correct, we should not expect much more weakness in the Canadian dollar from here. {snip}

During the Q&A session, Senior Deputy Governor Carolyn Wilkins claimed that the housing market in Canada is experiencing a soft landing that is consistent with a balanced market.

The Q&A session also provided more clarity on the the Bank’s expectations for the emergence of strength in the economy. Poloz explained that prior to the rate cut, the Bank studied (sounded like regressions) which sectors of the economy are most sensitive to interest rates. The non-energy exports which are expected to lead the recovery from the oil price shock represent about half of all non-energy exports. The export-oriented portion of GDP is growing twice as fast as the domestic-oriented part of GDP. {snip}

Clearly, the Bank of Canada is looking to sustain this economic momentum through low interest rates and a relatively weak Canadian dollar. So, my expectations for the currency are bullish, but my enthusiasm is contained for now.

{snip}

Source for charts: FreeStockCharts.com

Be careful out there!

Full disclosure: long USD/CAD (short-term), long FXC (long-term)

(This is an excerpt from an article I originally published on Seeking Alpha on April 16, 2015. Click here to read the entire piece.)