(This is an excerpt from an article I originally published on Seeking Alpha on March 15, 2015. Click here to read the entire piece.)

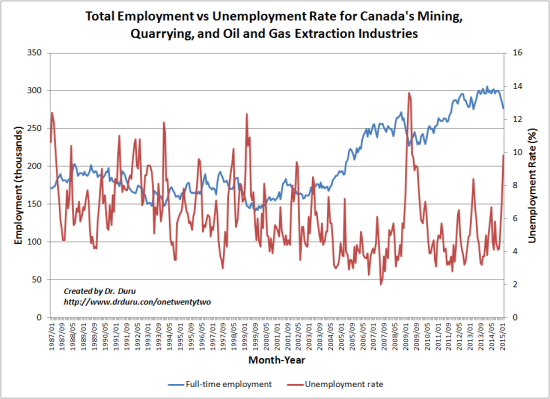

The retrenchment for employment in Canada’s mining, quarrying, and oil and gas extraction is well underway. Presumably, oil and gas are the primary drivers of the decline. The latest employment report from Canada shows a third consecutive monthly surge in the unemployment rate for this industry, from 4.2% in November to 5.4% in December to 6.8% in January to a whopping 9.8% in February. Over this period of time, total employment has fallen from 298,200 to 276,300.

Source: Statistics Canada

While the unemployment rate has historically been very volatile in this industry, including numerous spikes into double-digit territory in the 1990s, the decade long boom in overall employment is the unique background to today’s surge in unemployment. Unfortunately, the height of the boom implies that unemployment could rise even higher before total employment bottoms for this cycle. This is one half of the bad news from February’s labour force survey.

The second half comes from manufacturing. Canada reported its first drop in manufacturing employment since August, 2014. {snip}

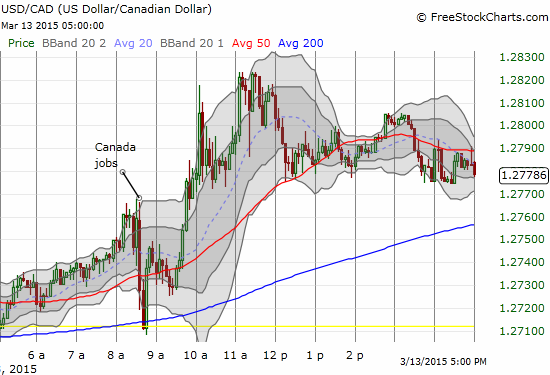

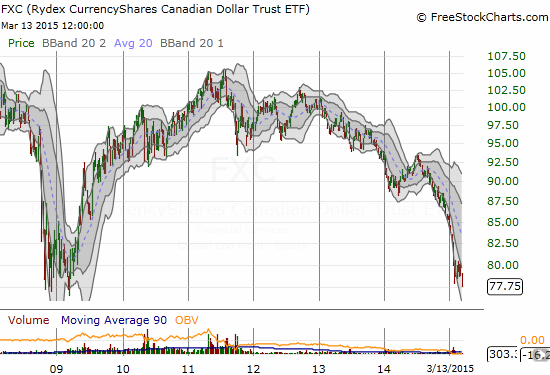

Source: FreeStockCharts.com

The overall jobs report was not too bad all things considered. Gains in educational services and construction helped offset losses in other sectors. {snip}

The underlying weakness in the report guarantees that the Bank of Canada will remain dovish. From the March 4th statement on monetary policy:

“The Bank continues to expect that most of the negative impact from lower oil prices will appear in the first half of 2015, although it may be even more front-loaded than projected in January. Nevertheless, data for 2014 as a whole suggest the anticipated rotation into stronger growth in non-energy exports and investment is well underway.”

{snip}

Be careful out there!

Full disclosure: no positions

(This is an excerpt from an article I originally published on Seeking Alpha on March 15, 2015. Click here to read the entire piece.)