(This is an excerpt from an article I originally published on Seeking Alpha on Feb 8, 2015. Click here to read the entire piece.)

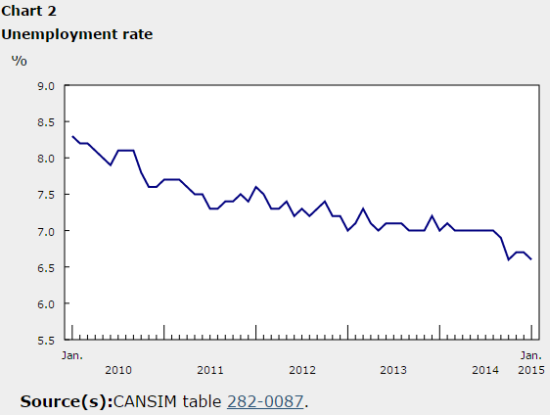

Canada has produced several strong economic reports over the past several months. For example, even with a 8.8% month-over-month drop in employment in the natural resources sector, January produced a net gain of 35,000 jobs over December, a gain of 0.2%. Year-over-year, natural resources employment fell 0.9% while overall employment gained 0.7% year-over-year. Unemployment fell from 6.7% to 6.6%.

Source: Statistics Canada

The Canadian dollar (FXC) was not able to register gains against the U.S. dollar on the heels of this report.

Source: FreeStockCharts.com

{snip}

The Canadian dollar lost on the day partly because the strong U.S. jobs report overshadowed Canada’s performance. However, a look below the headlines shows that Canada’s big job gain for January was a mixed bag. {snip} In other words, January was not a great month for people looking for full-time work with a Canadian company.

{snip}

Overall, the biggest take-away is that the natural resources sector shed a large percentage of jobs. The total employment level is even with January, 2014. Since the Bank of Canada cut its interest rate as a preemptive move to buffer the Canadian economy from the impact of falling oil prices, this jobs report seems to support the BoC’s decision.

Be careful out there!

Full disclosure: long USD/CAD

(This is an excerpt from an article I originally published on Seeking Alpha on Feb 8, 2015. Click here to read the entire piece.)